2025.4.10 GoodsFox Daily E-commerce News: US Raises Tariffs on Chinese Goods to 125%, 75 Nations Get 90-Day Reprieve

- U.S. Sneaker Prices Could Soar 50% Amid Tariff Surge

- China Retaliates with 84% Tariffs on U.S. Imports

- US Raises Tariffs on Chinese Goods to 125%, 75 Nations Get 90-Day Reprieve

- SHEIN Doubles Down on China-Based Supply Chain

- Amazon Haul Shifts to U.S. Domestic Inventory Amid Tariff Pressures

1. U.S. Sneaker Prices Could Soar 50% Amid Tariff Surge

Footwear Distributors and Retailers Association (FDRA) CEO Matt Priest warned of drastic price hikes under the new tariffs. A $150 sneaker could jump to $230 (+53%), while domestically produced alternatives might cost $300–$400—tripling prices for consumers . Priest attributed the surge to "punitive tariffs" that disrupt Asia-centric manufacturing networks, urging policymakers to prioritize supply chain stability over political posturing.

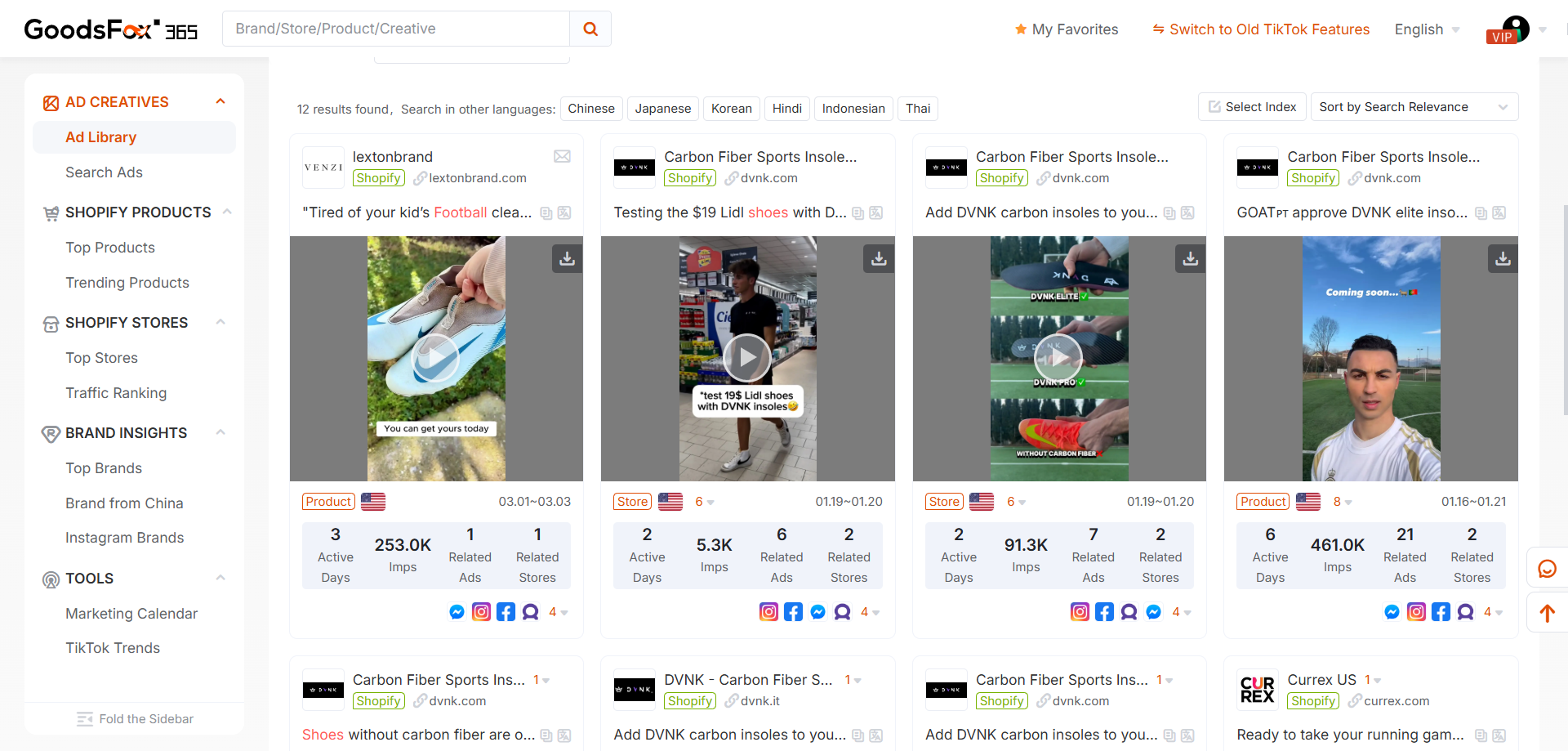

Source: GoodsFox

2. China Retaliates with 84% Tariffs on U.S. Imports

In a swift response to the U.S. tariff hike, China raised its retaliatory tariffs on American goods to 84%, effective April 10 . The move targets agricultural products, machinery, and vehicles, mirroring the U.S. "reciprocal tariffs" framework . Chinese officials emphasized the measures were "necessary to safeguard national interests" amid escalating trade tensions.

3.US Raises Tariffs on Chinese Goods to 125%, 75 Nations Get 90-Day Reprieve

The U.S. announced immediate 125% tariffs on Chinese imports, while granting 90-day tariff suspensions with 10% reductions to 75 nations that engaged in negotiations without retaliation . This move, unveiled by Trump on social media, aims to pressure China over trade imbalances while temporarily easing tensions with other partners. The abrupt policy shift has sent shockwaves through global supply chains, particularly in electronics, textiles, and machinery sectors.

4. SHEIN Doubles Down on China-Based Supply Chain

Amid rumors of "supply chain relocation," Guangzhou’s commerce bureau confirmed SHEIN is expanding its China-centric operations, with Q1 exports from Guangzhou growing year-over-year 9. The fast-fashion giant now supports millions of domestic jobs across manufacturing, logistics, and cross-border e-commerce, while leveraging its "platformization strategy" to empower 300+ Chinese industrial clusters to enter global markets

5. Amazon Haul Shifts to U.S. Domestic Inventory Amid Tariff Pressures

Amazon’s budget platform, Amazon Haul, is phasing out its reliance on Chinese direct-shipment models. With the U.S. set to eliminate the $800 low-value shipment exemption (LVCE) on May 2, Haul is pivoting to U.S.-based inventory for apparel and accessories 12. While this shields short-term pricing, long-term viability hinges on balancing cost efficiency with localized logistics—a challenge shared by Temu and SHEIN in the U.S. market.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/