In the White House conference room, U.S. lawmakers fiercely debated how to "Make America Great Again".

Their collective gaze eventually turned to Yiwu, China.

Because - it's just too cheap! Americans are buying too much!

At the center of discussion: cancelling the T86 duty-free policy.

This policy exempts goods under $800 from tariffs, serving as a fast track for billions of Chinese products to enter the U.S. market.

Against the backdrop of U.S. efforts to revitalize domestic manufacturing, this policy seemed long overdue for cancellation. However, in February this year, the U.S. abruptly halted T86 implementation before reversing course and extending it again.

Clearly, T86 impacts not only Chinese businesses but also U.S. consumers' cost of living.

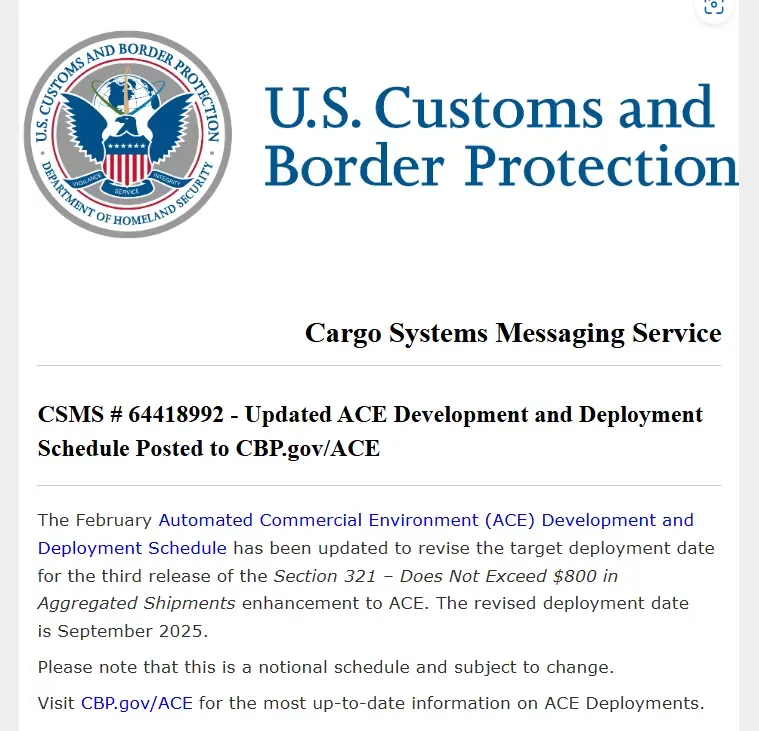

On March 17, the U.S. Customs and Border Protection (CBP) issued a notice giving sellers a "stay of execution".

This notice shattered widespread expectations that T86 would end in April:

CBP's Automated Commercial Environment (ACE) system will complete functional upgrades by September 2025, focusing on enhanced oversight of low-value shipments.

Source: U.S. CBP

While officials emphasize these changes are purely technical and unrelated to T86 policy, in today's tense international climate, any new restrictions carry significant weight.

T86 has become a critical barometer reflecting global sellers' hopes and anxieties, balancing between opportunity and risk. This article provides analysis on T86 and sustainable strategies.

Why T86? Why Scrap It?

Rooted in the legal principle "De Minimis Non Curat Lex" (the law does not concern itself with trifles), the low-value duty exemption dates back to the Great Depression era.

In 1930, when Americans fought over restaurant scraps, imposing tariffs on basic goods would have exacerbated suffering.

The Tariff Act of 1930 responded by exempting low-value imports - a lifeline for struggling families.

Initially limited in scope, the policy gained momentum in 2016 when the Obama administration raised the exemption threshold from $200 to $800 (equivalent to ¥54,000 at the time).

For context, the iPhone 7 launched at $548 that year.

From simple clothing to large-scale smart home appliances, all may "pass for free", and a large number of Chinese merchants have entered a high-speed growth mode.

This created opportunities spanning from $9.9 AI earbuds flooding U.S. markets to $19.9 customizable T-shirts.

Chinese manufacturers demonstrated unparalleled innovation and productivity.

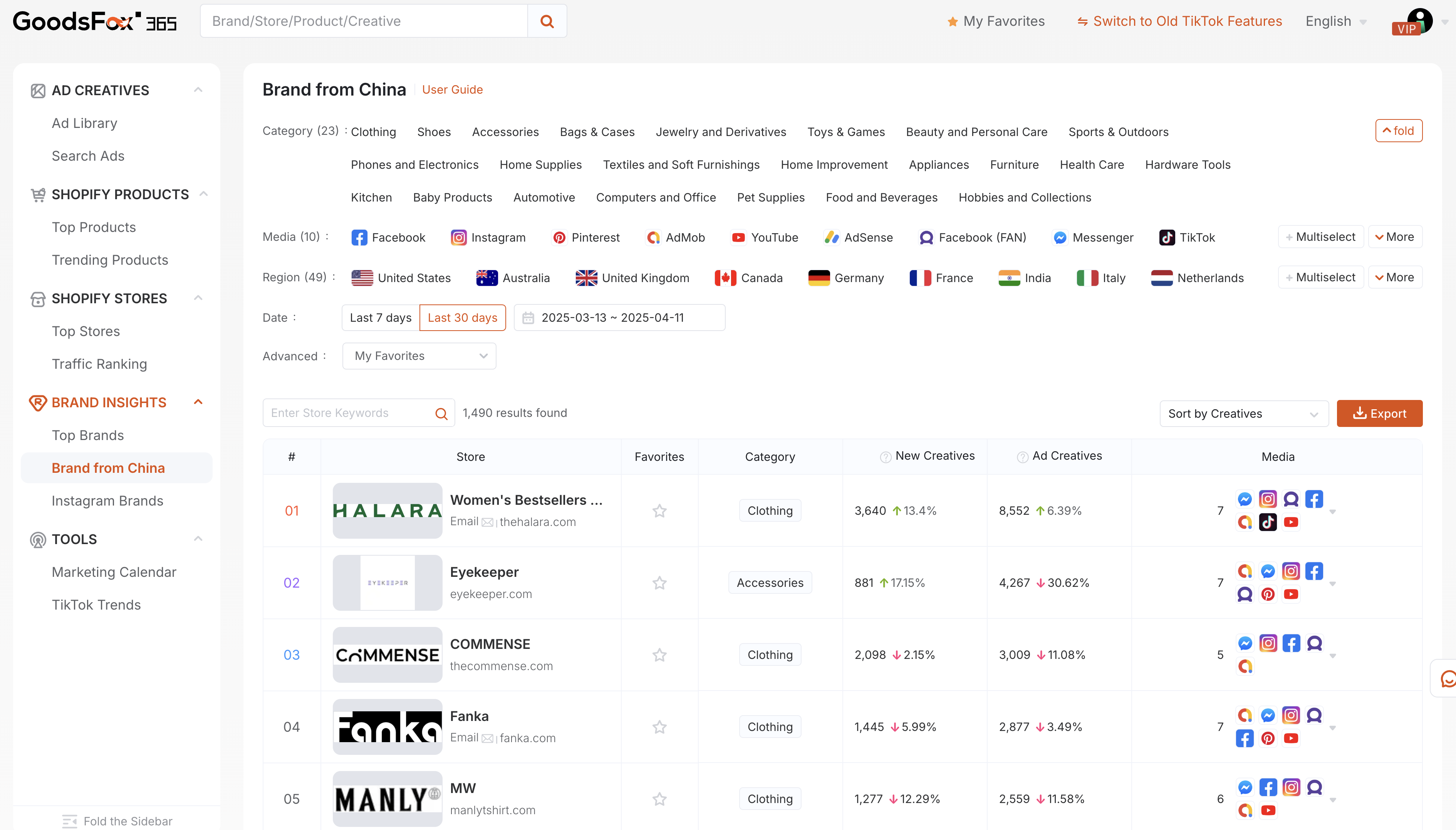

Source:GoodsFox

However, U.S. policymakers began viewing this success with increasing concern.

During his first term, former President Trump repeatedly targeted Chinese supply chains, including potential T86 adjustments.

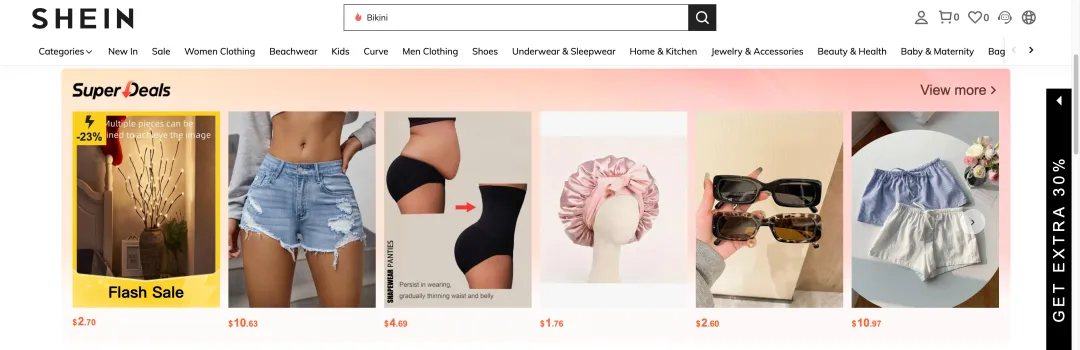

These plans were delayed by the COVID-19, allowing platforms like SHEIN and Temu to dominate U.S. markets with ultra-low prices. Even Amazon, after decades of rebranding as a premium platform, was forced to launch "Amazon Haul" to compete.

Source:SHEIN

Now, with Trump's return to power, the first move was signing an executive order to end duty exemptions. As the deadline approaches, sellers face uncertainty:

- Some adopt a "business-as-usual" approach, accustomed to policy volatility

- Others are accelerating contingency planning

Reprieve’s Delay, The End’s Align

The CBP announcement provided temporary relief.

Key changes include:

- Mandatory "Estimated Time of Arrival" declarations

- System alerts for single-recipient daily purchases exceeding $800

- Stricter compliance reviews for duty-free shipments

These adjustments signal:

- Short-term delays in T86 cancellation

- Long-term tightening of low-value exemptions

Cross - Border Dreams, What’s the Scheme?

In late March, major logistics providers suspended U.S.-bound shipments, with many implementing "wait-and-see" policies.

Even Amazon issued a "Global Trade Policy Update" alerting sellers to potential delays.

In these uncertain times, sellers should act swiftly to evaluate alternative customs clearance strategies—such as adopting overseas warehouse models—or leverage multi-channel staggered shipments to minimize tax liabilities and mitigate delivery delays.

For recently delayed orders, prioritize transparent communication with customers to maintain trust and provide reassurance. For severely impacted SKUs, consider pausing restocking temporarily to avoid excess inventory risks.

Looking ahead, expect stricter enforcement of duty-free thresholds for low-value shipments.

Against this backdrop of regulatory flux, cross-border merchants must reassess their long-term U.S. market strategy.

Strategic Recommendations:

-

Market Diversification

Expand presence in Southeast Asia, Europe, Middle East and other regions to reduce dependency. -

Brand Development

Invest in branding and product differentiation to offset margin pressures. -

Localization

Establish overseas warehouses, explore U.S. distribution partnerships, or consider domestic incorporation - as seen in Indonesia where local operations mitigate regulatory risks.

Final Thoughts:

As regulatory tides shift, survival will depend on adaptability. The era of low-margin arbitrage is ending - those who build resilient, localized business models will weather the storm.