Alibaba & MAGA: Global Sellers Strategies Beyond Tariffs

Love him or hate him, US President Donald Trump has inadvertently become a "brand ambassador" for Chinese commerce. His aggressive tariff policies haven’t curbed imports—instead, they’ve spotlighted China’s unbeatable value proposition. As American consumers realize their everyday goods—clothing, electronics, even luxury accessories—are overwhelmingly "Made in China" and astonishingly affordable, a wave of curiosity has swept across the Atlantic.

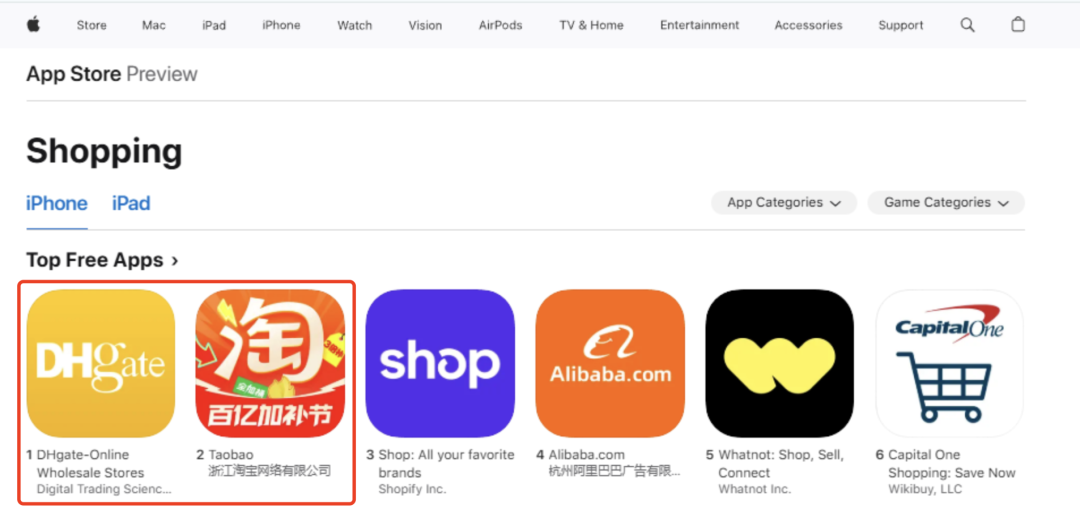

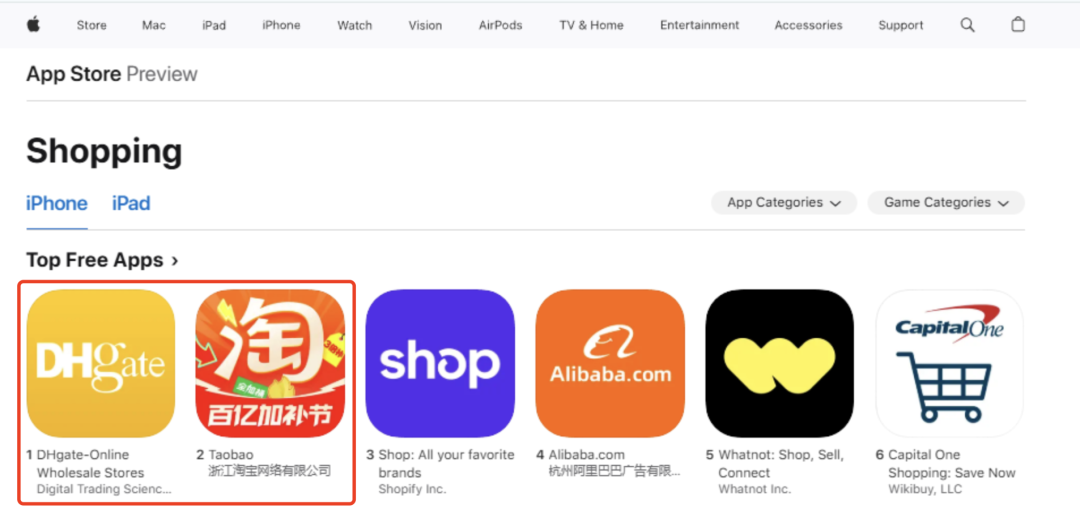

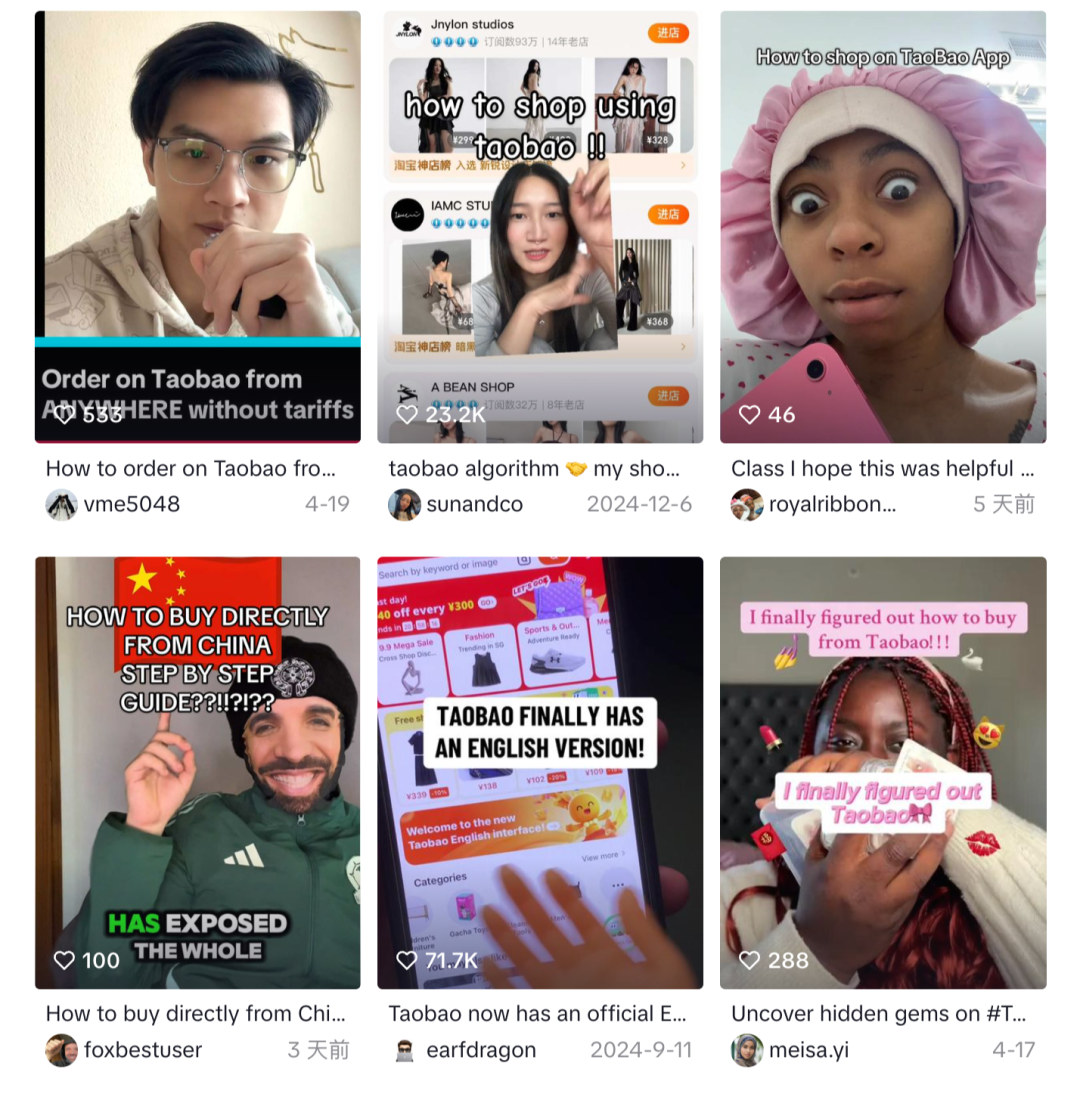

Platforms like DHgate and Taobao now dominate the US App Store charts, with foreigners scrambling to learn "How to shop on Taobao" in overnight tutorials. The irony? Trump’s "MAGA" (Make America Great Again) might as well stand for "Make Alibaba Great Again".

Source: apps.apple.com

Amid this frenzy, global sellers face critical questions:

- Can exporters pivot successfully from international to domestic markets?

- As platforms surge overseas, can logistics, compliance, and brand-building keep pace?

- When tariffs rise and consumer sentiment fluctuates, what strategies ensure long-term survival?

TikTok has become ground zero for a new retail rebellion. Dozens of accounts claiming to be OEM factories for brands like Lululemon and Louis Vuitton have gone viral, showcasing $5 yoga pants (vs. $100 retail) and $1,000 "premium replicas" of $38,000 luxury bags. The message? "Cut the middleman—buy direct from the factory that makes your favorite brands."

Source: mcds-menu

This trend isn’t just noise:

- #ChineseFactory has 29.9K TikTok videos and 27.3K Instagram posts, with views surging 250% weekly.

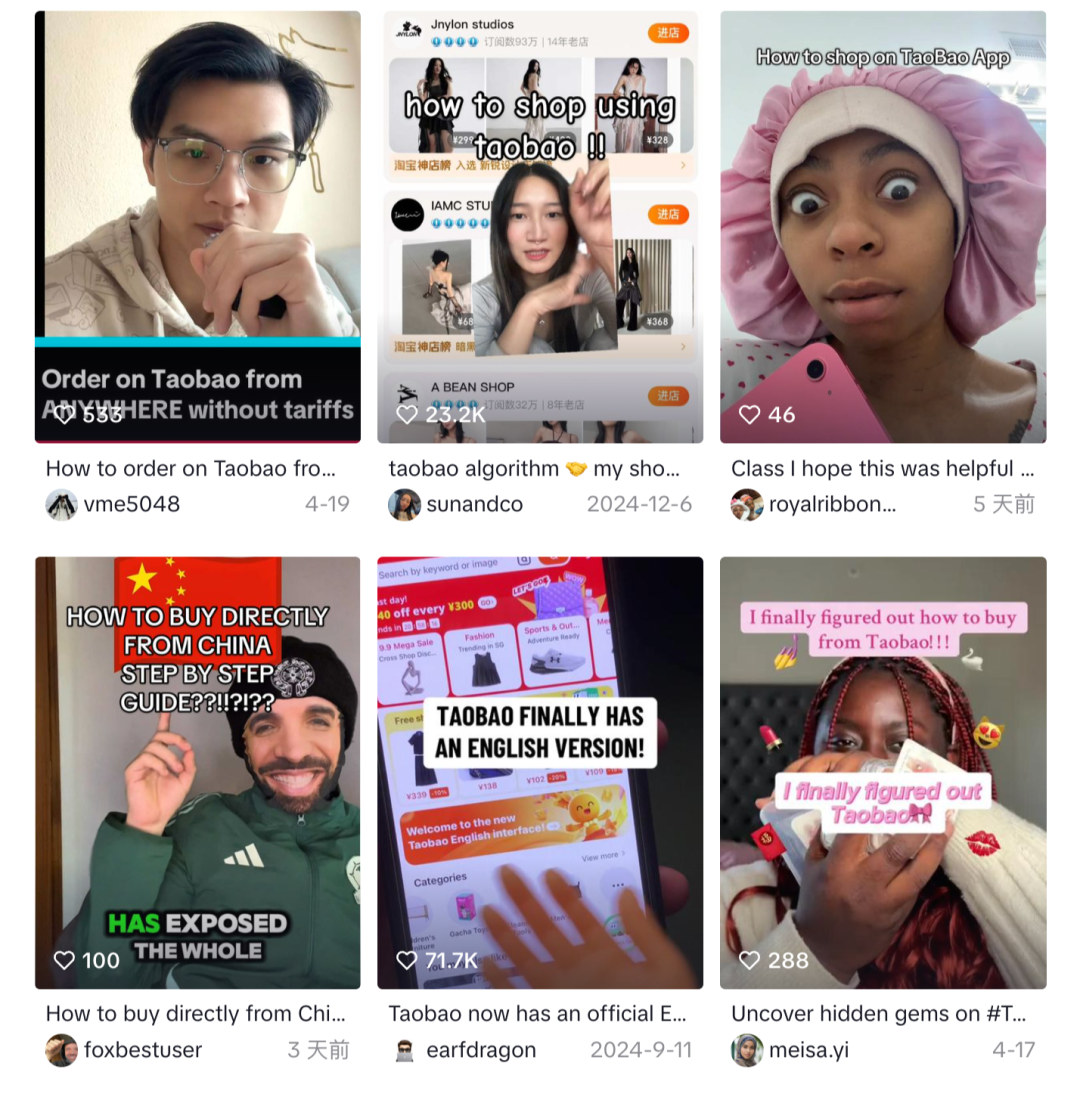

- Taobao’s international search terms like "How to use Taobao in English" have spiked, driving the app to top download charts in the US.

Source: TikTok

But caution prevails. Many "factory" claims are questionable:

- Legitimate OEMs often violate non-compete agreements by selling branded knockoffs. Hermès recently deleted a viral TikTok accusing it of markups, reiterating its "100% French craftsmanship" ethos.

Source: TikTok@wangsen9998

- The US plans to eliminate the $800 de minimis tax exemption for Chinese goods in May, eroding the "cheap direct mail" advantage overnight.

Low prices attract attention, but they rarely build resilience. Hong Kong’s South China Morning Post reported that when US tariffs on Chinese goods hit 104%, container exports plummeted from 40-50 daily to just 6. Even today:

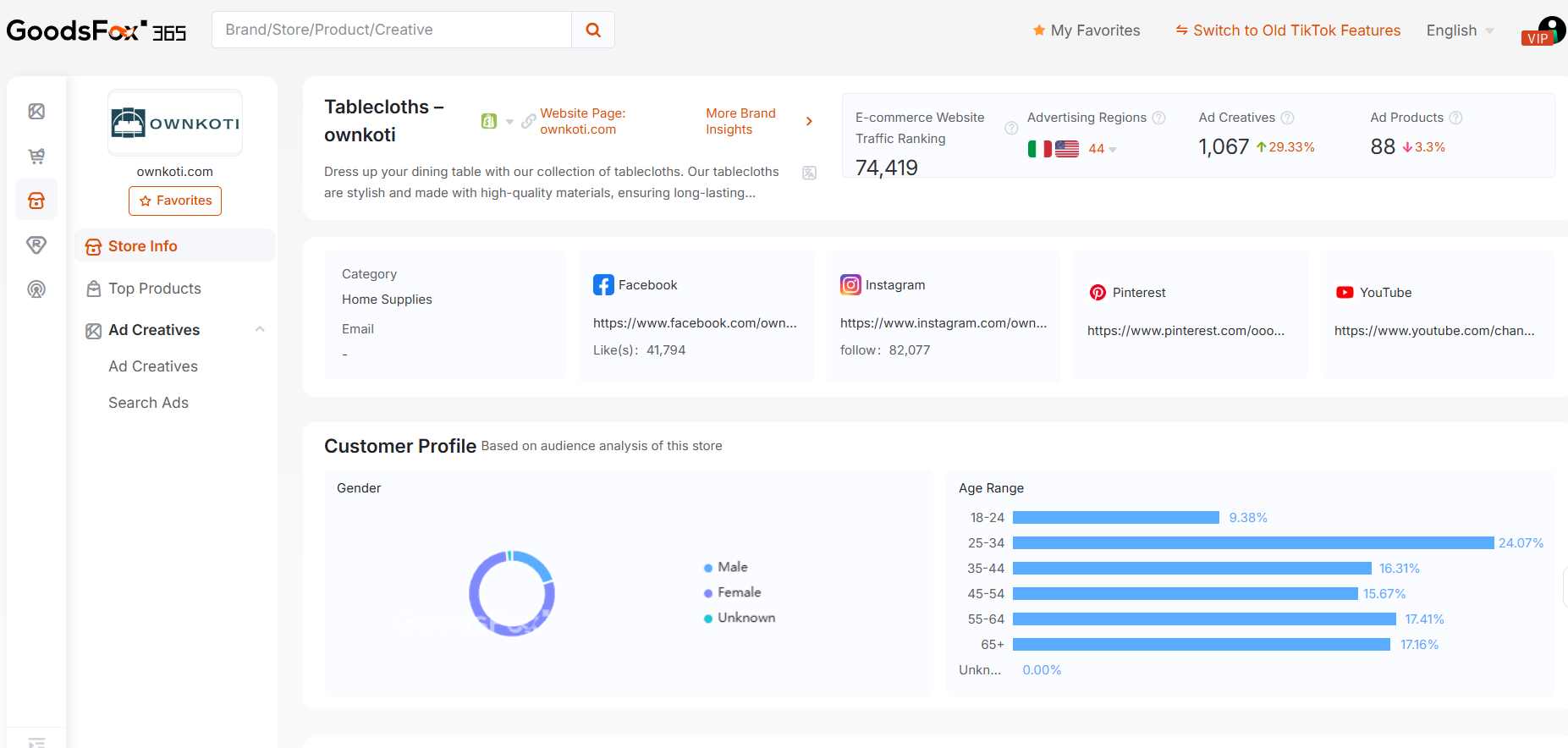

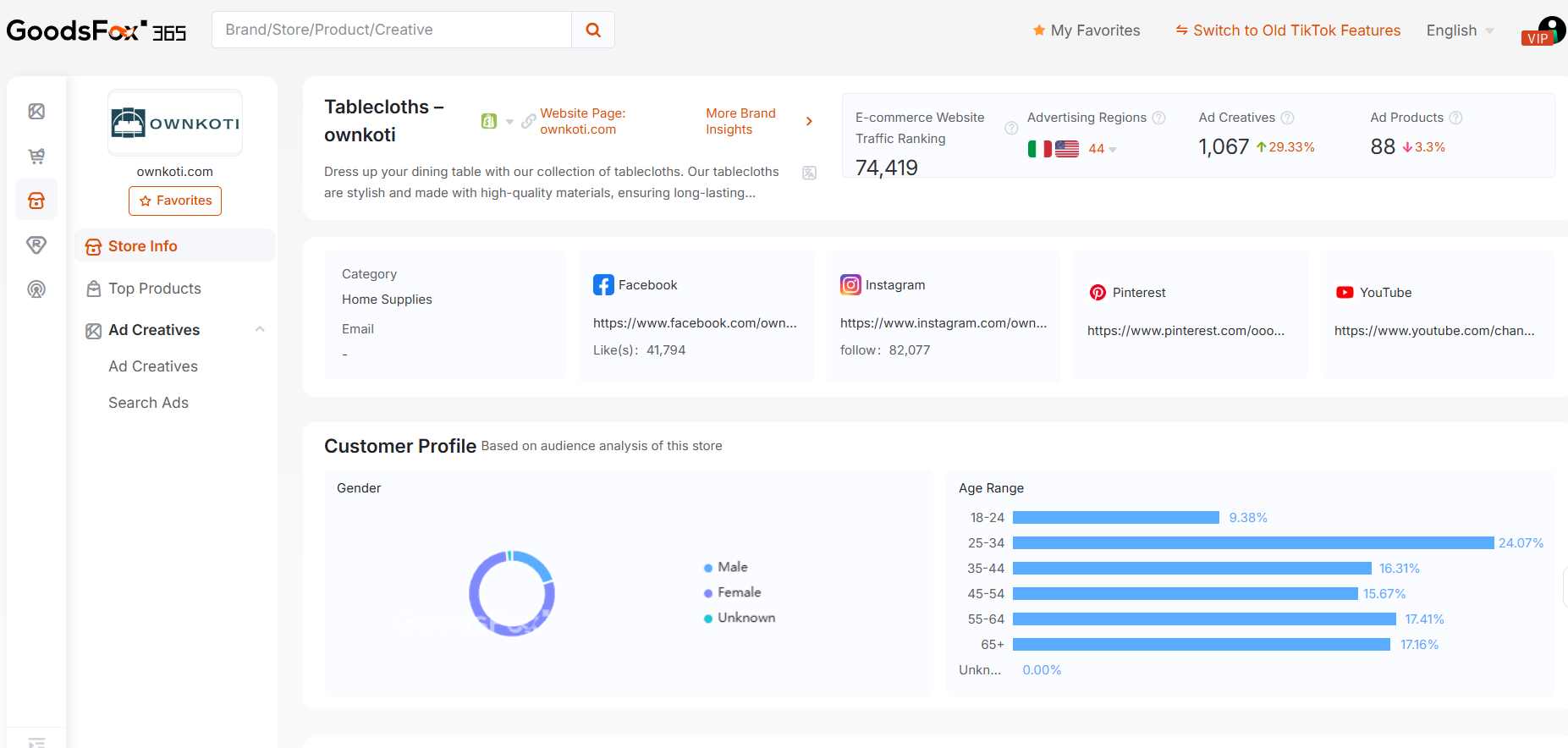

- GoodsFox data shows a 10-40% drop in Chinese brand ad spend in the US over the past 30 days, despite peak sales seasons.

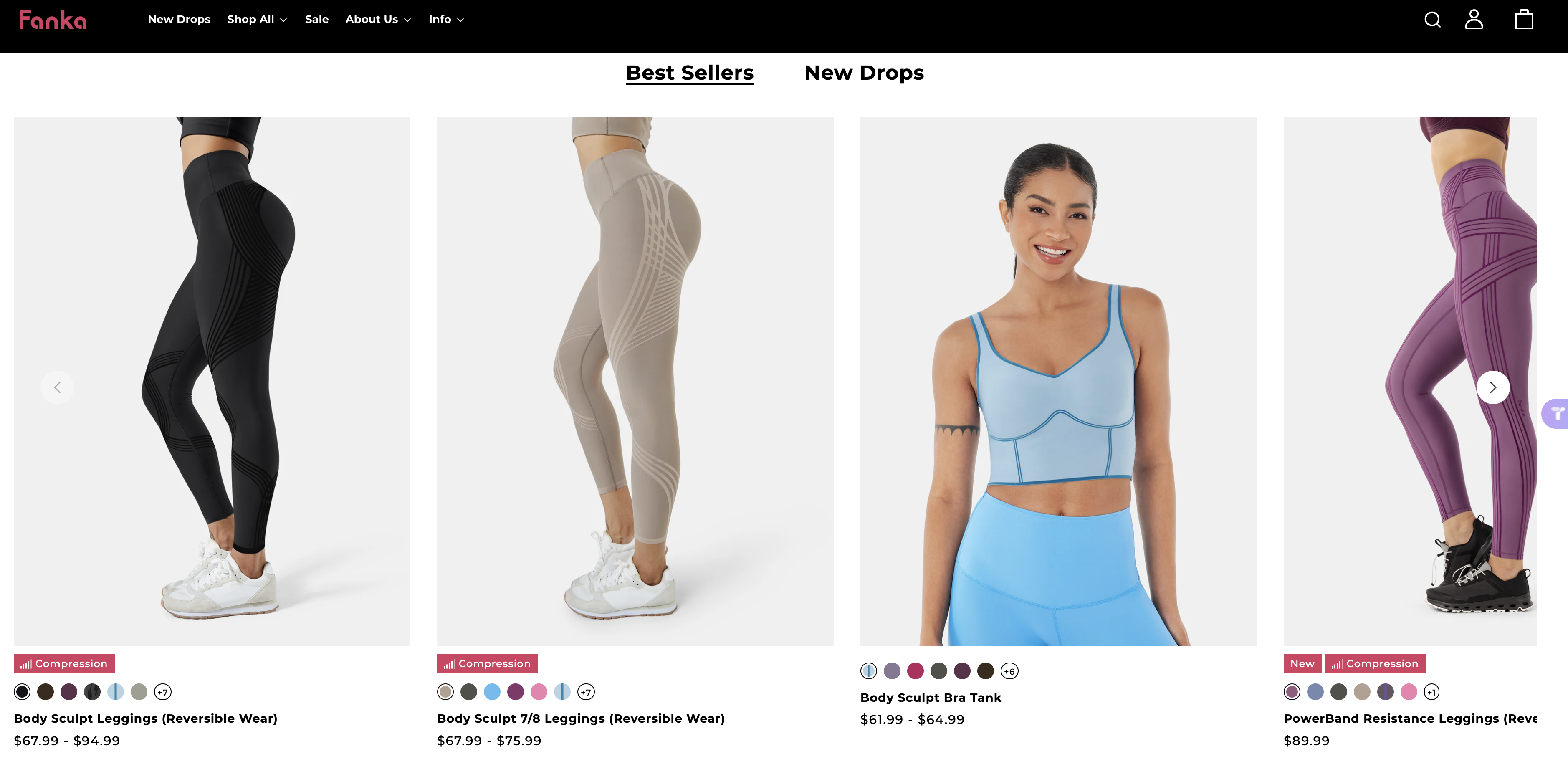

Contrast this with brands that prioritize value over cost:

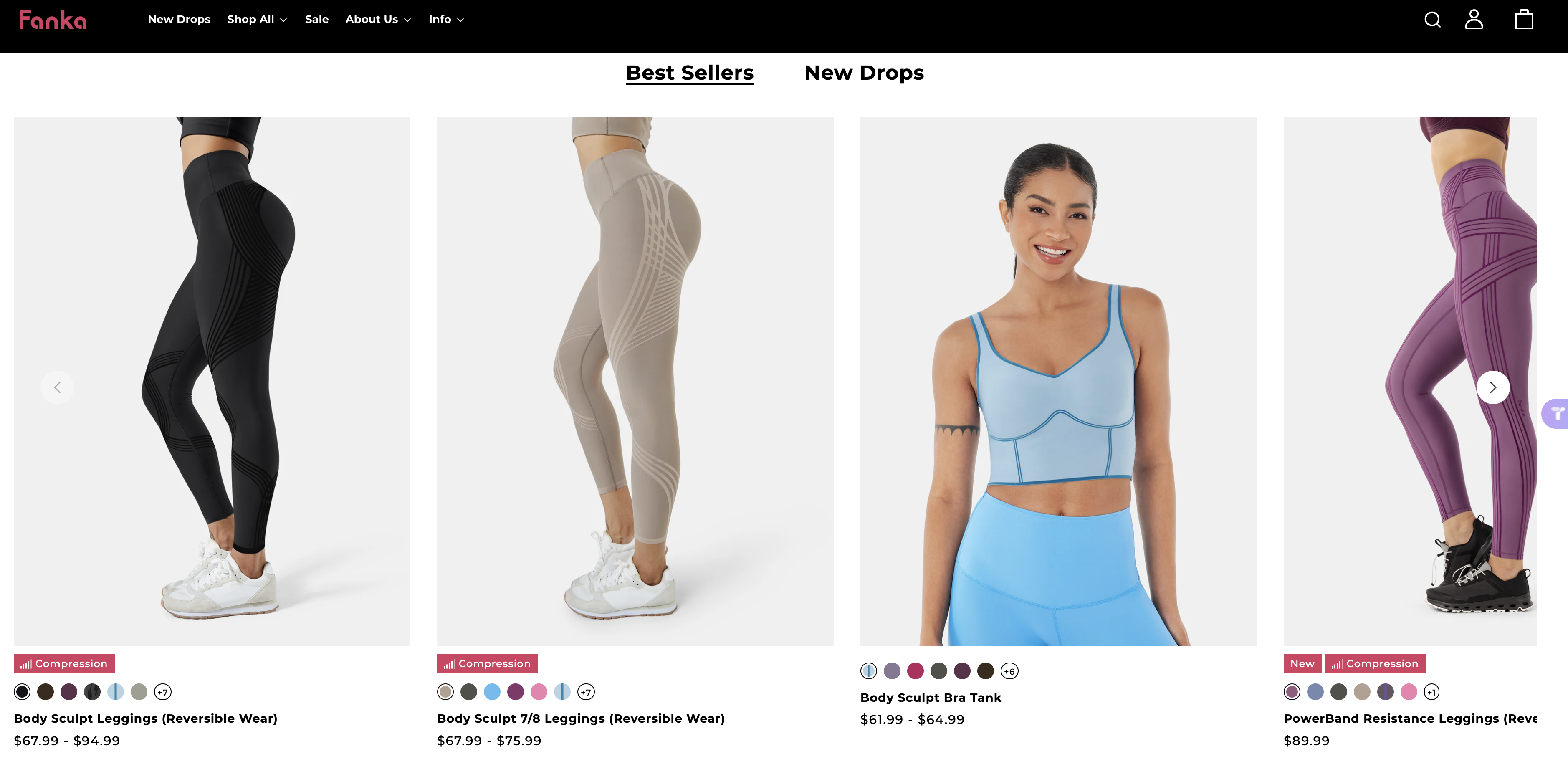

- Fanka sells yoga pants for $67.99–$94.99 in the US, maintaining healthy margins to fund overseas warehouses.

Source: Fanka

- OWNKOTI prices a lightweight quilt at $125 (excluding shipping), leveraging brand equity to absorb tariff shocks.

Source: www.goodsfox.com

Their secret? Moving beyond "manufacturer" to "storyteller." Luxury brands sell not products, but narratives—status, heritage, exclusivity. Global sellers must ask: "What unique value do we offer beyond a factory price tag?"

Taobao’s sudden overseas fame mirrors rednote's short-lived hype cycle a year prior. While #Taobao now has 300K+ TikTok videos, algorithmic suppression shows only 4 visible posts—a reminder that platform favoritism can vanish overnight.

For sellers, the challenges are tangible:

- Logistics Shock: A $10 product might incur $100+ in international shipping, leading to order cancellations.

- Compliance Complexity: Customs delays, duty calculations, and return logistics overwhelm small businesses.

As overseas headwinds grow, many are eyeing China’s domestic market. Platforms like Alibaba, Douyin (TikTok China), and Tencent offer "export-to-domestic" programs—traffic subsidies, commission waivers, and matchmaking services. But adaptation is non-negotiable:

- Product Reengineering: US women’s clothing with 15+ sizes must shrink to S/M/L for Chinese consumers; aesthetics and functionality need localization.

- Operational Speed: Domestic e-commerce operates at warp speed—same-day delivery, 24/7 live streaming, and real-time ad optimization, a stark contrast to overseas markets’ 10-30 day delivery tolerance.

- Content Mastery: In Douyin’s algorithm-driven ecosystem, success hinges on creating "scroll-stopping" content—videos that blend product utility with emotional storytelling to trigger impulse buys.

- Diversify Origins: Set up regional warehouses (e.g., EU, US) to bypass tariff hotspots.

- Local Sourcing: Partner with overseas manufacturers for high-tariff categories.

- Global Storytelling: Craft narratives that resonate across cultures—sustainability, convenience, or self-expression (e.g., Fanka’s "sculpting technology" vs. ZASUWA’s "confidence-first" messaging).

- Platform Nuance: Tailor content to each channel’s strengths—UGC for TikTok, influencer collabs for Instagram, SEO-driven blogs for Amazon.

- Premium Positioning: Even budget brands can build loyalty through consistent quality (e.g., Halara’s "Lululemon alternative" positioning).

- Community Building: Engage buyers via newsletters, forums, or exclusive events to turn transactions into relationships.

The current wave of "China fever" in global retail is both opportunity and test. While tariffs and platform algorithms create turbulence, the sellers who thrive will be those who:

- Move beyond short-term price wars to build defensible brand value.

- Master the dual challenges of overseas expansion and domestic adaptation.

- Recognize that in e-commerce, survival isn’t just about riding tides—it’s about building ships that withstand storms.

Whether betting on Europe, doubling down on the US, or embracing China’s domestic market, the lesson is clear: cheap gets attention, but value earns loyalty.

Click to explore GoodsFox global market intelligence and unlock 3 days of free access.