2025.3.24 GoodsFox Daily E-commerce News: U.S. Inflation Cools, but Trade Tensions Loom

- Bamboo Fiber Boxer Briefs Capture Global Middle-Aged Market

- Apple Faces Class-Action Lawsuit Over Delayed AI Features

- U.S. Inflation Cools, but Trade Tensions Loom

- TEMU Mandates Platform Shipping Labels, Raising Logistics Costs

- EU Probes Chinese E-Bikes for False Vietnamese Origin Claims

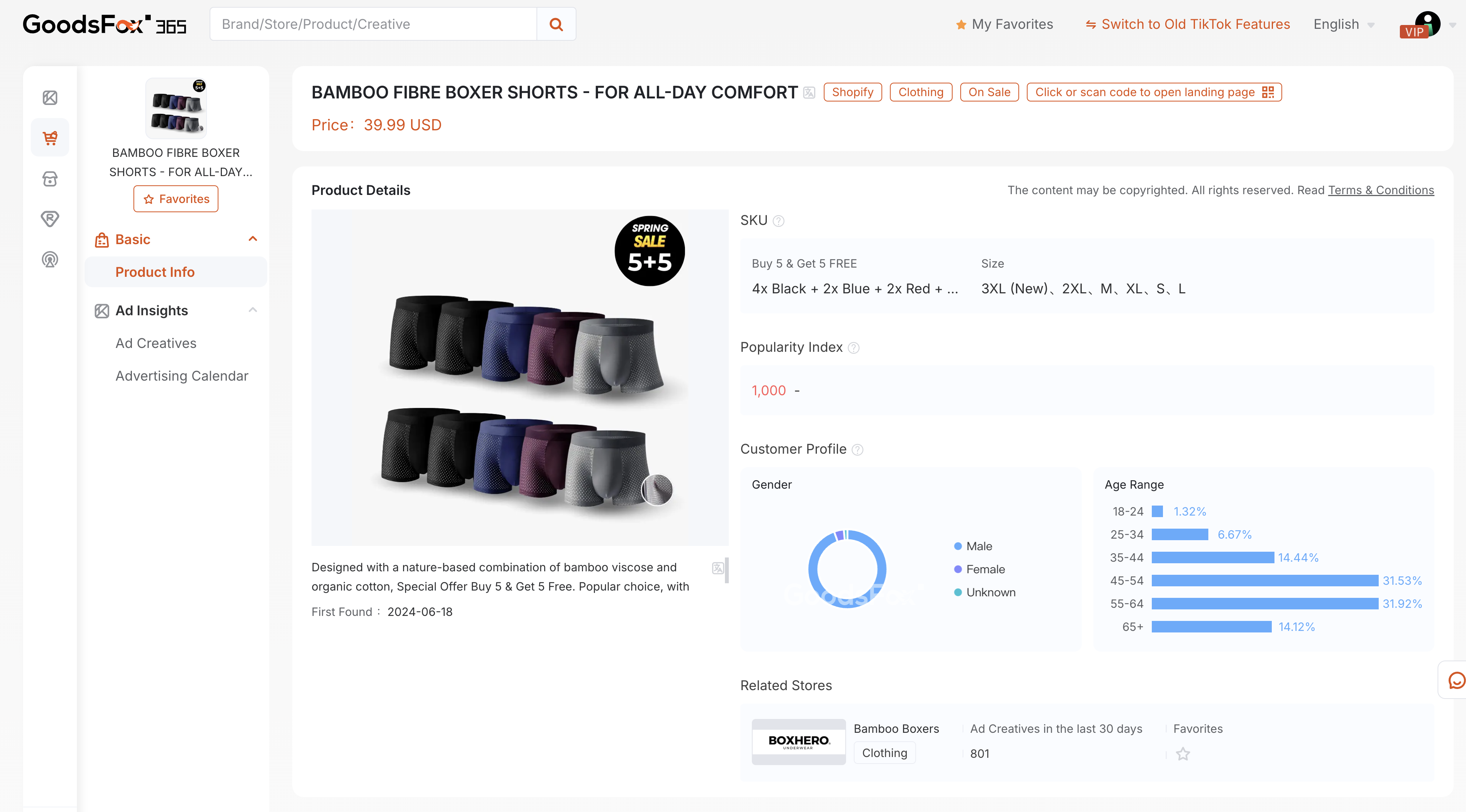

1. Bamboo Fiber Boxer Briefs Capture Global Middle-Aged Market

GoodsFox data reveals that cross-border e-commerce brand Boxhero’s bamboo fiber men’s boxer briefs are gaining traction in Western and emerging markets. Priced at $39.99, these eco-friendly underwear—made from bamboo viscose and organic cotton—target middle-to-high-income consumers aged 45-64, who account for over 63% of buyers. In the past week, Boxhero launched 500+ new ad creatives (up 155.5% month-over-month), focusing on the U.S., U.K., Philippines, and South Africa.

The antibacterial and breathable properties of bamboo fiber align with global health trends, offering a case study in "sustainability + silver economy" marketing. This bestseller is thriving on Amazon and independent sites, with Southeast Asia showing strong growth potential.

Source: GoodsFox

2. Apple Faces Class-Action Lawsuit Over Delayed AI Features

Plaintiffs claim Apple misled consumers by promoting "revolutionary AI capabilities" for iOS 18 and iPhone 16 in 2024 ads, despite delaying core features until 2025. Apple is confronting a class-action lawsuit alleging false advertising related to its postponed Apple Intelligence features. Law firm Clarkson argues buyers were sold devices with "incomplete or missing" AI functionalities. Apple has yet to respond.

3. U.S. Inflation Cools, but Trade Tensions Loom

U.S. consumer prices rose 2.8% year-over-year in February, down from 3% in January. Core inflation (excluding food/energy) hit 3.1%, the lowest since April 2021. While this marks the first slowdown since September, economists warn that Trump-era tariffs on imports from China, Europe, and others could keep prices elevated through 2025.

4. TEMU Mandates Platform Shipping Labels, Raising Logistics Costs

TEMU’s U.S. site now requires semi-managed/standard stores using USPS to adopt platform-generated shipping labels or face delisting. Though TEMU offer 0.6–0.8 subsidies per order, sellers report overseas warehouse fees ($4+) and rising last-mile costs. Hidden penalties for delays or fake shipments remain a concern. Sellers must adjust workflows via the Seller Center SOP immediately.

5. EU Probes Chinese E-Bikes for False Vietnamese Origin Claims

The EU is investigating Chinese e-bike exporters falsely declaring Vietnamese origin to evade anti-dumping duties and VAT. European Anti-Fraud Office (OLAF) estimates 1.2 million in fraud. In 2023,China supplied 43.1% of EU e-bike imports,about 891.7M dollars. With plans to impose 36% tariffs on Chinese EVs by August 2024, Vietnam’s Ministry of Industry urges exporters to ensure compliance amid tightened scrutiny.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/