2025.3.6 GoodsFox Daily E-commerce News:

- Paper Art Brand My Mind's Eye Tops Global DTC Page View Ranking

- Australia’s Social Media Ban Sparks Debate, YouTube Exemption Questioned

- ByteDance’s Short Drama App Melolo Shines in Southeast Asia

- Government Report: Boost High-Level Openness, Stabilize Trade and Investment

- Amazon’s Low-Cost Store Haul to Compete with Temu in Europe

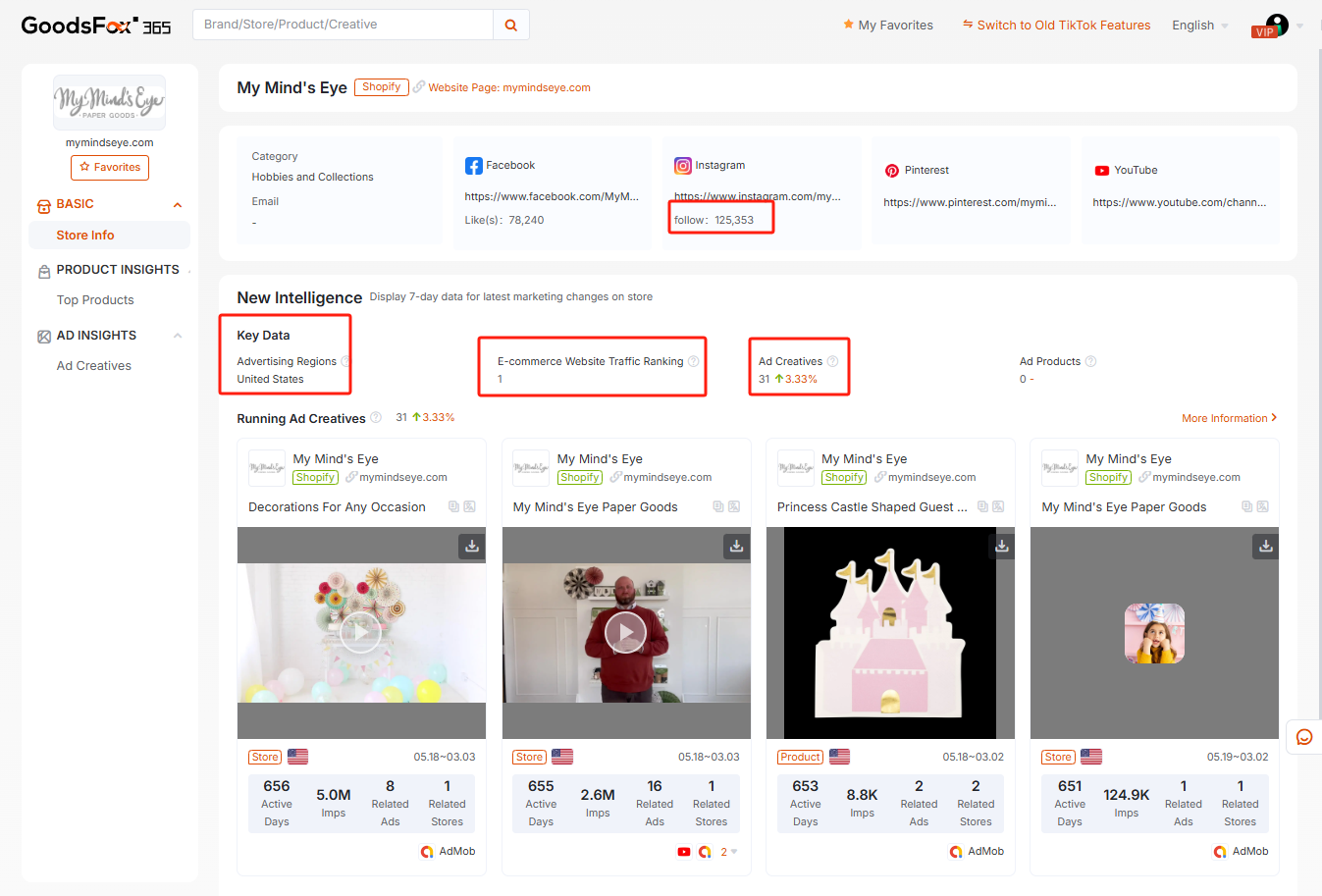

1. Paper Art Brand My Mind's Eye Tops Global DTC Page View Ranking

Source: GoodsFox

2. Australia’s Social Media Ban Sparks Debate, YouTube Exemption Questioned

Last November, Australia banned social media for users under 16, but YouTube was exempted. Meta, TikTok, and Snapchat challenged this, arguing it gives YouTube an unfair edge and weakens child safety efforts. The government defends YouTube’s educational value, distinguishing it from core social platforms. Yet, studies highlight harmful content on YouTube, especially with Shorts gaining traction. Broader debates question the ban’s necessity and impact. Experts disagree on social media’s harms versus benefits, and some research backing the law has been debunked. With elections nearing, the ban’s future is uncertain. Australia may pioneer a global test case for age restrictions, with YouTube’s exemption likely under review.

3. ByteDance’s Short Drama App Melolo Shines in Southeast Asia

Since its overseas launch late last year, ByteDance’s short drama app Melolo has excelled in Southeast Asia. By February 2025, it hit 1.32 million global downloads, 99% from Southeast Asia, with Indonesia at 58.85%. Compared to rival FreeReels by Kunlun Wanwei, Melolo’s downloads are just 20% of FreeReels’ total and absent from the U.S. market. Its ad strategy leans conservative, focusing on Instagram and Facebook. Content-wise, Melolo relies heavily on dubbed dramas, with few local productions, limiting user connection. Still, ByteDance’s brand power, tech expertise, and ecosystem give Melolo strong growth potential, despite challenges.

4. Government Report: Boost High-Level Openness, Stabilize Trade and Investment

China aims to stabilize foreign trade with robust policies. It will help firms secure orders and expand markets. Enhanced financial services like financing, settlements, and Forex will support businesses. Export credit insurance will grow in scope, while overseas exhibitions get more backing. Cross-border e-commerce will thrive with better logistics and overseas warehouses. New trade zones, intermediate goods trade, and diverse markets are priorities. Integrated domestic and foreign trade will address certification and channel issues. Service trade innovation will boost traditional strengths, encourage exports, and import quality services. Green and digital trade will drive growth, with new offshore trade models emerging. Major expos like CIIE, Canton Fair, and CIFTIS will elevate standards. Smart customs and easier clearance will enhance global cooperation.

5. Amazon’s Low-Cost Store Haul to Compete with Temu in Europe

Amazon plans to launch Amazon Haul, a low-cost store, in Europe by 2025. Job postings for software engineers and product managers signal preparations for global and Mexico rollouts. With a solid European user base and logistics, Amazon faces Temu, whose monthly active users surpass Amazon’s by 38% and prices undercut by 40%. GoodsFox tracks these e-commerce trends, empowering DTC brands to stay competitive.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/