-

StayShop US Face Cream Sells Out on TikTok USA!

-

HATALKIN Car Charger Becomes a New TikTok U.S. Hit!

-

Ozon launches Ozon Fashion, a new platform.

-

TikTok Shop Updates New Shop Inspection Period Rules

-

Shopee Brazil will collect import tax from buyers from August this year.

1. 15,833 daily sales! StayShop US face cream sells out on TikTok US!

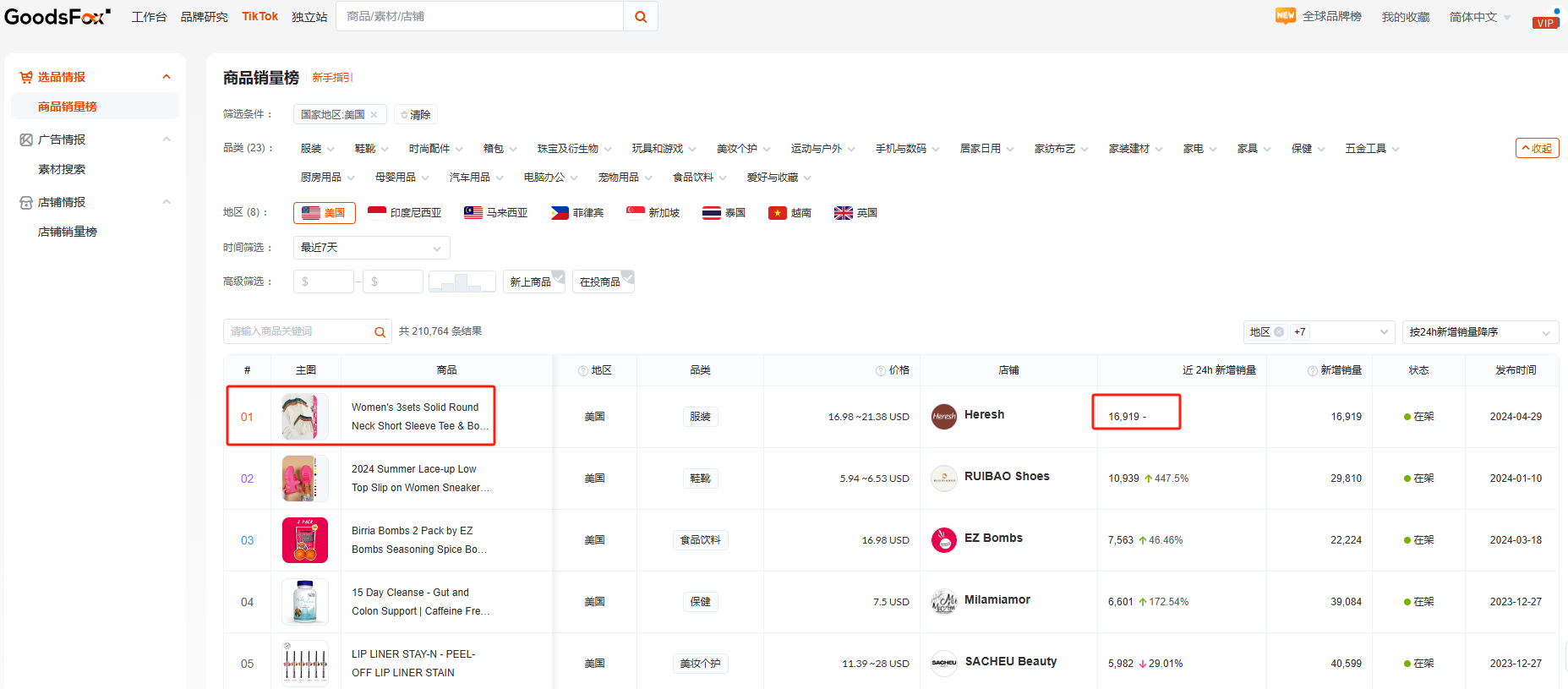

Source: GoodsFox

The StayShop US Face Cream, a skincare set that provides intensive care for day and night skin, recently sold out on TikTok US. According to GoodsFox, the product sold 15,833 units per day on July 8 on TikTok US.

2. 15,396 daily sales! HATALKIN car charger is the newest TikTok U.S. hit!

Source: GoodsFox

The HATALKIN car charger, a retractable car charger for fast charging, has become a new breakout item for TikTok US. According to GoodsFox data, in the TikTok U.S. region, the daily sales of the product reached 15,396 on July 8th.

3.Ozon launched a new platform Ozon Fashion

Ozon has launched a new platform, Ozon Fashion, to which it has relocated its apparel, footwear, accessories, and jewelry categories, expanding into a comprehensive platform that covers all fashion items while retaining its original verified brands.

4.TikTok Shop Updates Rules for New Store Inspection Periods

On July 10 this year, TikTok Shop will adjust the U.S. cross-border new store inspection period rules: shorten the inspection period to at least 30 days, and reduce the number of transactions required to 500 single, while raising the store business responsibility poor evaluation rate standard to 0.4% or less. The new rules cancel the early graduation channel, and add a 60-day observation period.

5.Shopee Brazil station this year, August will start to buyers to collect import tax

From August this year, the Brazilian government will impose a 20% import tax on orders imported into Brazil with a value of up to $50: for orders with a purchase amount of ≤ $50, buyers are required to pay 20% of the import tax and 17% of the Goods and Services Circulation Tax (ICMS); for orders with a purchase amount of > $50, buyers are required to pay 60% of the import tax and 17% of the Goods and Services Circulation Tax ( For orders >$50, buyers are required to pay 60% import duty and 17% ICMS, with a $20 discount on the import duty portion.