The corner of a room is often where fitness equipment goes to die.

Treadmills become clothing racks, and fitness mirrors collect dust. The saying goes, if you can succeed in the fitness business, you can succeed anywhere.

Selling a product is just the start. The real challenge is to keep users coming back and paying for more.

Globally, three strategies stand out: content subscriptions, AI-powered hardware, and vertical specialization.

Content Subscriptions: The Digital Pivot

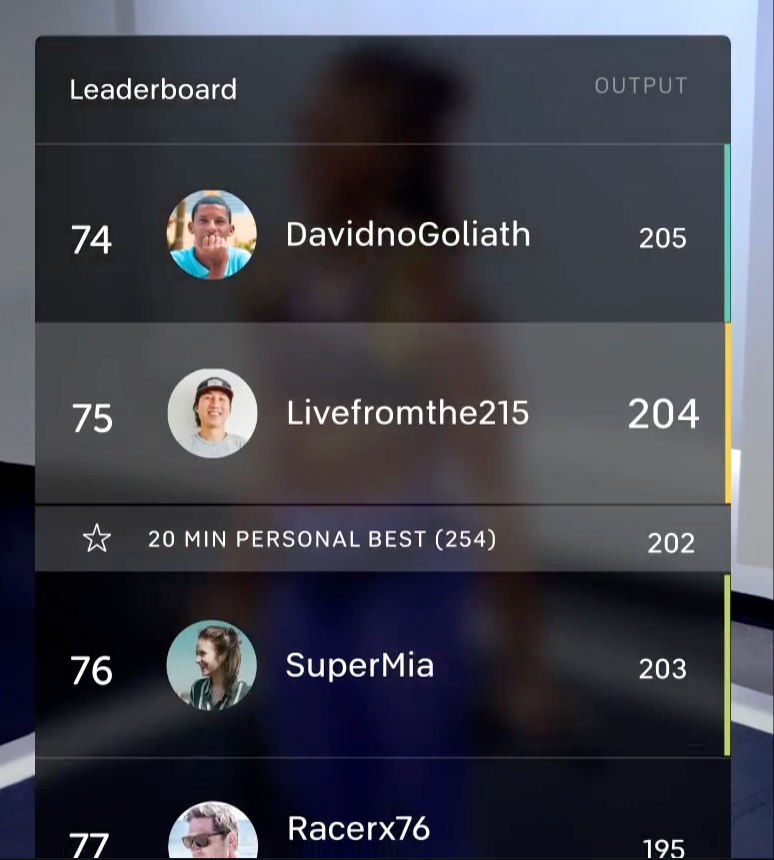

A few years ago, Peloton was a darling of the American tech scene.

Its connected spin bikes offered live classes and real-time leaderboards. "Social home fitness" was hailed as the future.

Source: Peloton

At the same time, China was experiencing a similar craze. The "Liu Genghong Girl" trend swept across Douyin, Bilibili, and Xiaohongshu. Fitness became a free emotional outlet for people staying at home.

Source:RedNote@刘畊宏

These trends, though seemingly different, share a common business model: subscriptions.

Peloton commercialized through content subscription and social mechanism, setting a benchmark for the global fitness industry. Liu Genghong's sustained activity on social media keeps fans engaged. His subsequent monetization through product endorsements is a form of "soft subscription."

The subscription model is particularly effective in fitness, as most people struggle to maintain long-term consistency. This is why many top Chinese gyms have failed, losing their gamble against human nature.

The cycle is familiar: a new gym opens, sells out annual memberships, but as equipment ages, membership prices drop. A new competitor opens next door, and the cycle repeats. Gyms try to sell multi-year or lifetime memberships, but consumers are wary of such long-term commitments.

A subscription model, however, offers a low barrier to entry and quick decisions. It generates steady revenue, even from users who forget to cancel their plans.

Peloton's Q3 2025 financial report proves this model works. Subscriptions generate a high gross margin (67%) and an average monthly free cash flow of $19.8 million.

Ads from Peloton. Source:GoodsFox

The core subscription business produces enough cash flow to cover operating costs.

However, fitness equipment is a low-frequency, high-cost consumer product with a long lifecycle. Peloton must now figure out how to attract new users and extend the long-term value of its subscribers as hardware sales slow down.

AI + Hardware: A New Frontier

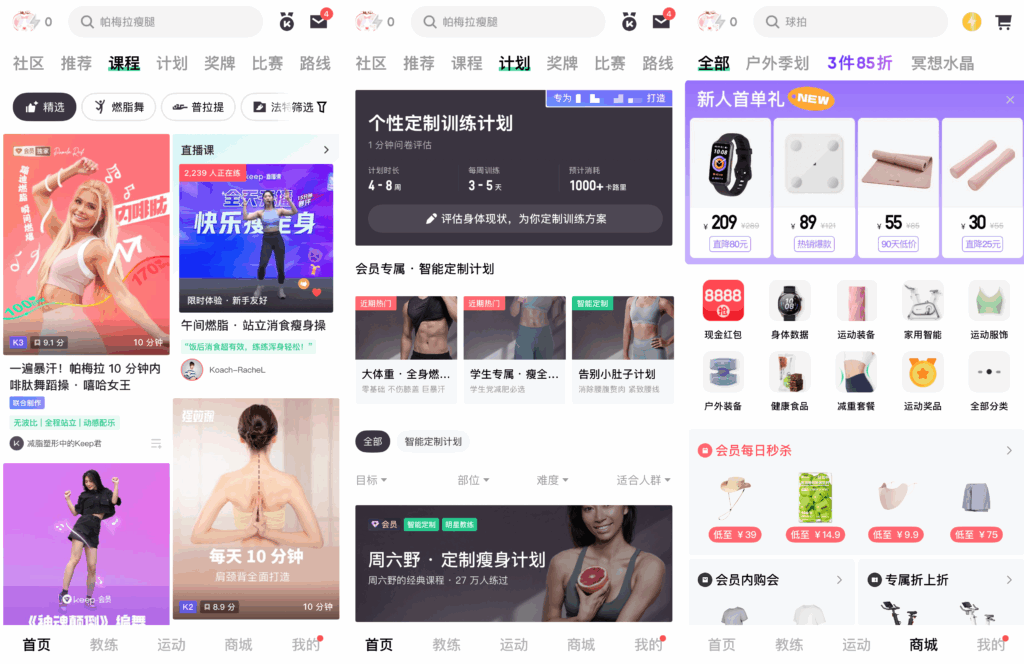

Keep is a leading fitness content platform in China.

It tried a Peloton-like path with content subscriptions and a community-driven business model. Its free app, rich courses, and community check-in system helped it attract early users.

Source:Keep

However, a key issue emerged: low willingness to pay in the Chinese market.

The courses offered by popular trainers on Keep were also available for free on platforms like Bilibili and Douyin. The "professional" and "scarce" nature of the content did not translate into sustainable paid subscriptions.

As a result, Keep made a practical pivot to hardware.

Today, its main revenue comes from its branded sports products. The platform creates a training loop by integrating its app with wearables and smart equipment. This enables a seamless process of recommendations, feedback, and tracking.

Keep's attempt to expand internationally with its "Keep Trainer" app failed, as it struggled to adapt to overseas markets and was quickly replaced on mainstream charts.

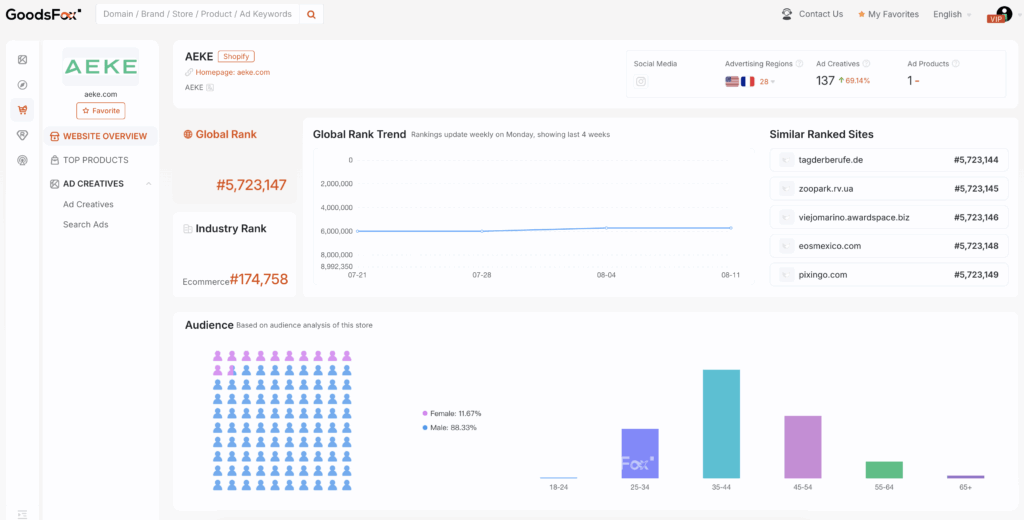

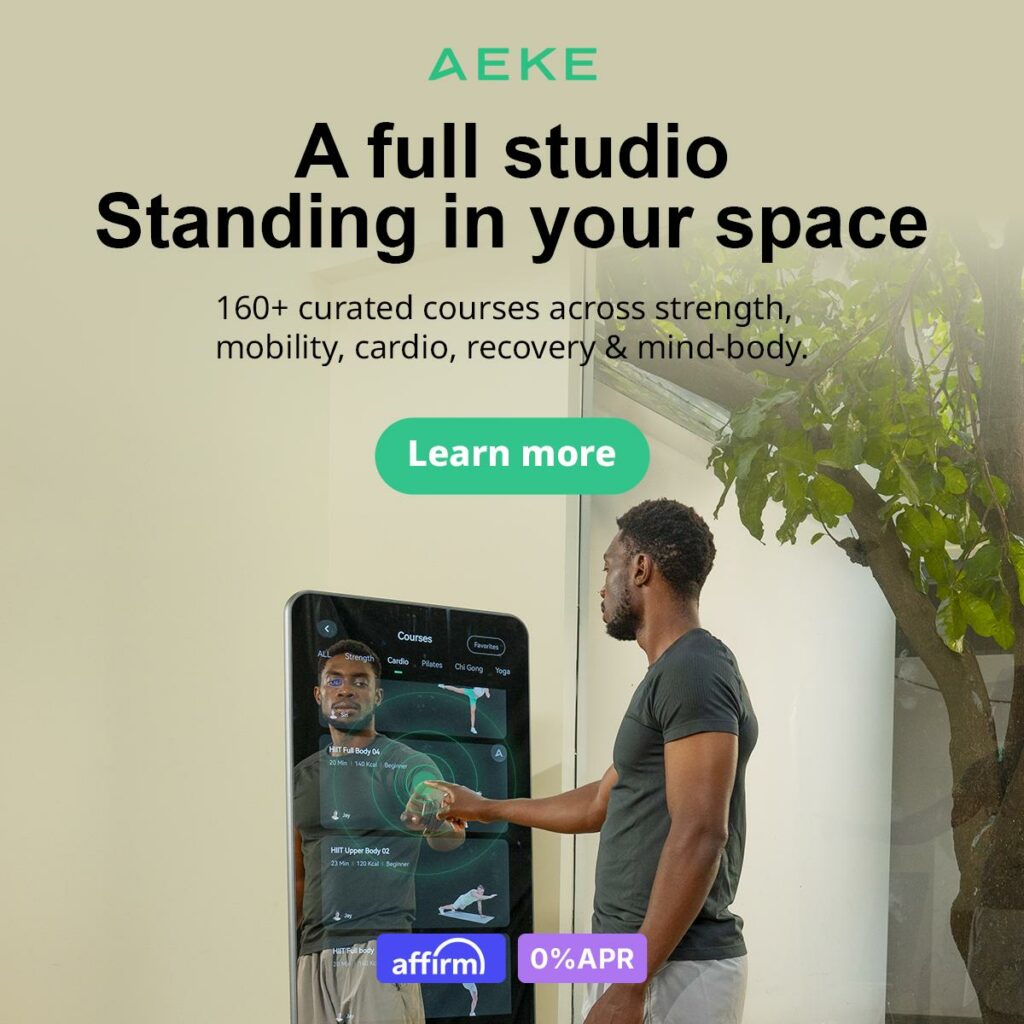

Another player, the Chinese brand AEKE, took a different approach by embedding personalized training directly into its hardware.

Source:GoodsFox

It sells AI-powered fitness mirrors that offer interactive training without the need for an additional subscription. This is made possible by AI technology. The product uses a camera and visual recognition to capture user posture and movement.

Combined with infrared depth sensing, it provides real-time analysis and feedback. The mirror serves as a display screen for videos and an interactive hardware for personalized guidance.

Ads from aeke.com. Source:GoodsFox

This model has seen initial success in overseas markets.

AEKE has completed several crowdfunding rounds on platforms like Kickstarter and Indiegogo. Its initial launch project alone generated nearly 10 million RMB in pre-sales and is expanding into North America, Europe, and the Middle East.

For early-stage brands, using crowdfunding to validate a product before localizing is a more practical strategy than aggressive channel or ad spending.

However, AEKE is still small and its future depends on further market validation.

Ads from aeke.com. Source:GoodsFox

It faces the typical challenges of high-priced fitness mirrors: user engagement often drops, and the device is abandoned if a routine is broken. To extend user lifecycles and reduce the risk of a short lifespan and low repurchases, AEKE's AI model and service must be smart and continuously evolving.

Heavy Operations: The Delivery-Focused Approach

Beyond the narratives of content and AI, a business is about integrating channels and controlling the supply chain.

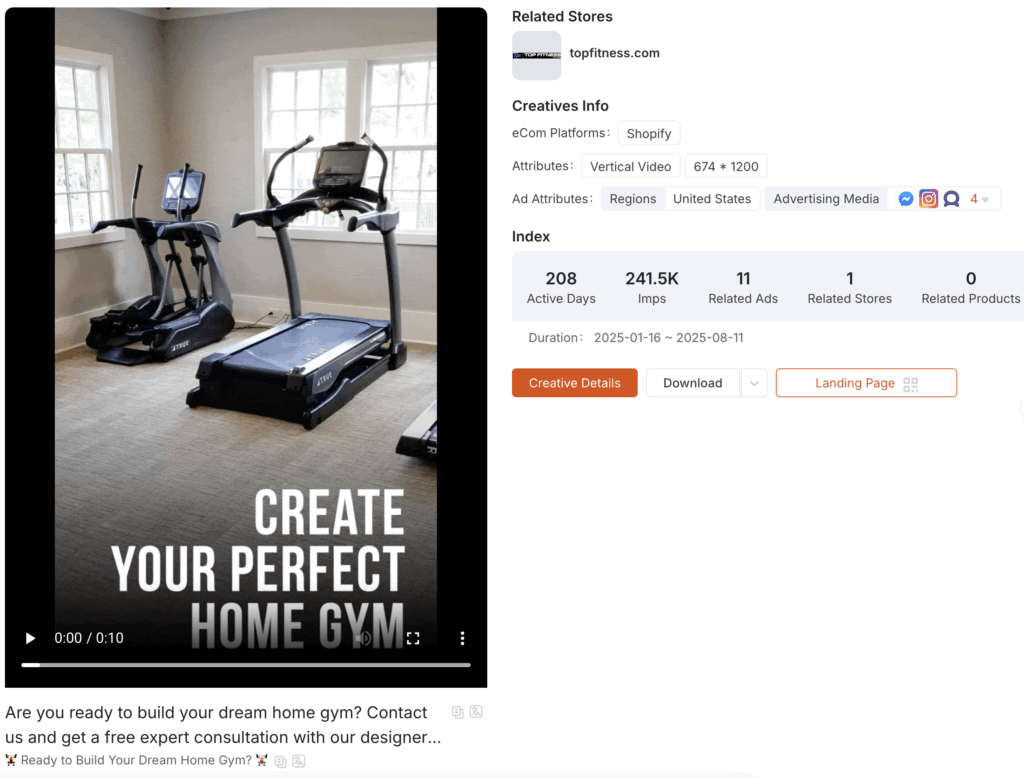

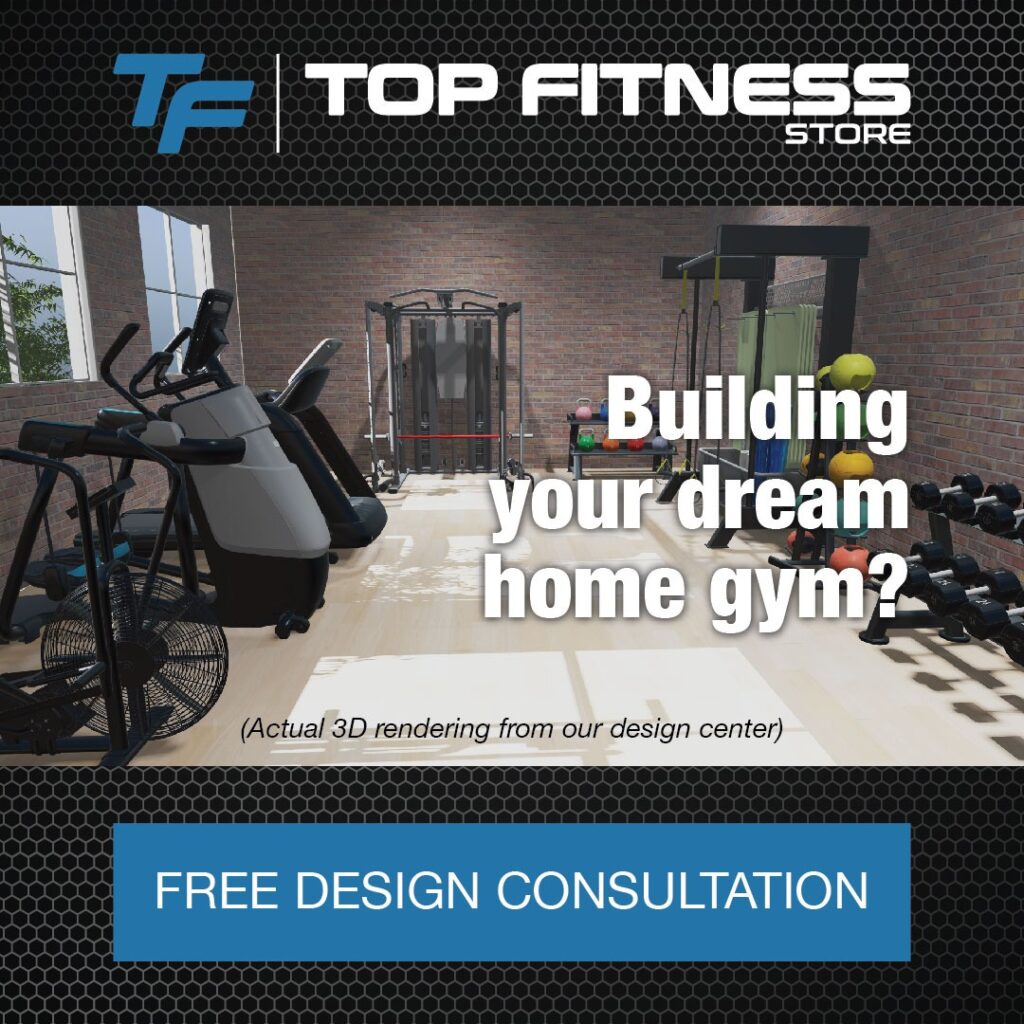

TopFitness is a great example of this: selling equipment and providing full-service delivery.

The company serves two main customer segments:

- B2C Consumers: Offering high-end home fitness equipment.

Ads from topfitness.com. Source:GoodsFox

- B2B Clients: Providing customized fitness spaces for apartments, offices, hotels, and gyms. This includes everything from product selection and planning to installation and maintenance.

Source:topfitness.com

The company expanded during the pandemic's home fitness boom. However, with the market cooling, it faced inventory pressure and price wars.

To counteract this, TopFitness expanded its channels (official website, e-commerce platforms, offline stores) and introduced new products. They also offered flexible financing options like "leasing" and "installment plans" to extend the customer's decision and usage cycle.

TopFitness's real competitive advantage lies in its B2B "space delivery" business. It offers a one-stop solution for B2B clients with budgets but lacking fitness expertise, such as real estate developers and wellness centers.

topfitness.com

However, this path also faces challenges. B2B demand is limited, with long sales cycles, strong bargaining power from clients, and a lengthy, intensive service chain, which places extremely high demands on the team.

TopFitness's next breakthrough may lie in extending its "space delivery" capability to smaller markets by developing standardized product packages to improve efficiency and profitability per person and per square meter.

The Future of Fitness

Every entry point into the fitness market has been tried, and all have their challenges.

Peloton, Keep, AEKE, and TopFitness represent different choices based on different stages and backgrounds.

Peloton's success proves the subscription model works but requires continuous user acquisition and retention.

Keep's challenge is to find a new value proposition in a saturated market.

AEKE's breakthrough is turning hardware into a companion system that binds user behavior.

TopFitness’s success is built on providing comprehensive space solutions.

Ultimately, fitness is not just about content or hardware. It is about a long-term commitment to the user's journey. The brand that provides the most reliable and trustworthy long-term solution will be the one that retains its users.