E-commerce was tough this year. But it got even tougher.

Before operations resumed, the US market faced two major shocks.

First, the duty‐free era ended. The US canceled the tariff exemption for packages below $800 and imposed a 10% “China special tariff.” This move broke the profit line for many cross‐border sellers. Independent websites and DTC brands in the e‑commerce arena also felt the impact.

Second, USPS suddenly halted acceptance of packages from mainland China and Hong Kong. The cross‑border e‑commerce community was thrown into chaos.

Then, within 24 hours, things reversed dramatically. On February 5, USPS urgently updated its website. It announced an immediate resumption of accepting packages from China and promised to work with customs to set up a new tariff collection system to reduce disruptions.

Now, as policy roller coasters become the norm, the fundamentals of cross‑border business are being rewritten.

1. E-commerce From “Policy Benefits” to “Compliance Pressure”

The US introduced the “de minimis” exemption in the 1930s. In recent years, Chinese sellers began exploiting this rule. In 2016, US law raised the de minimis threshold from $200 to $800. This change lowered barriers for cross‑border e‑commerce. According to US Customs and Border Protection, duty‑free packages surged from 139 million in 2015 to 1.36 billion in 2024 – nearly 90% of all US cargo. This policy fueled the rise of giants like Temu and Shein while benefiting countless small sellers by reducing local warehousing costs and enabling flexible supply chains.

Yet, the policy also sparked fierce price wars. Domestic retailers and manufacturers decried the unfair low‐price tactics of Temu and Shein. Unable to compete, many joined the race. Last November, Amazon launched “Amazon Haul” with ultra‑low‑priced items in clothing, home goods, and gadgets – products similar to those found on Shein, Temu, and AliExpress.

The Biden administration once proposed narrowing the exemption’s scope. Estimates suggested that 40% of US imports and 70% of Chinese apparel and textiles might lose duty‑free status. In contrast, Trump’s new tariff policy cancelled the exemption entirely. An economist from Yale and UCLA warned that without the de minimis rule, sellers would face extra administrative costs – including fees paid to US authorities and customs clearance charges from logistics companies – adding over $20 per package.

Let’s consider a Chinese‑exported T‑shirt priced at $10 (FOB):

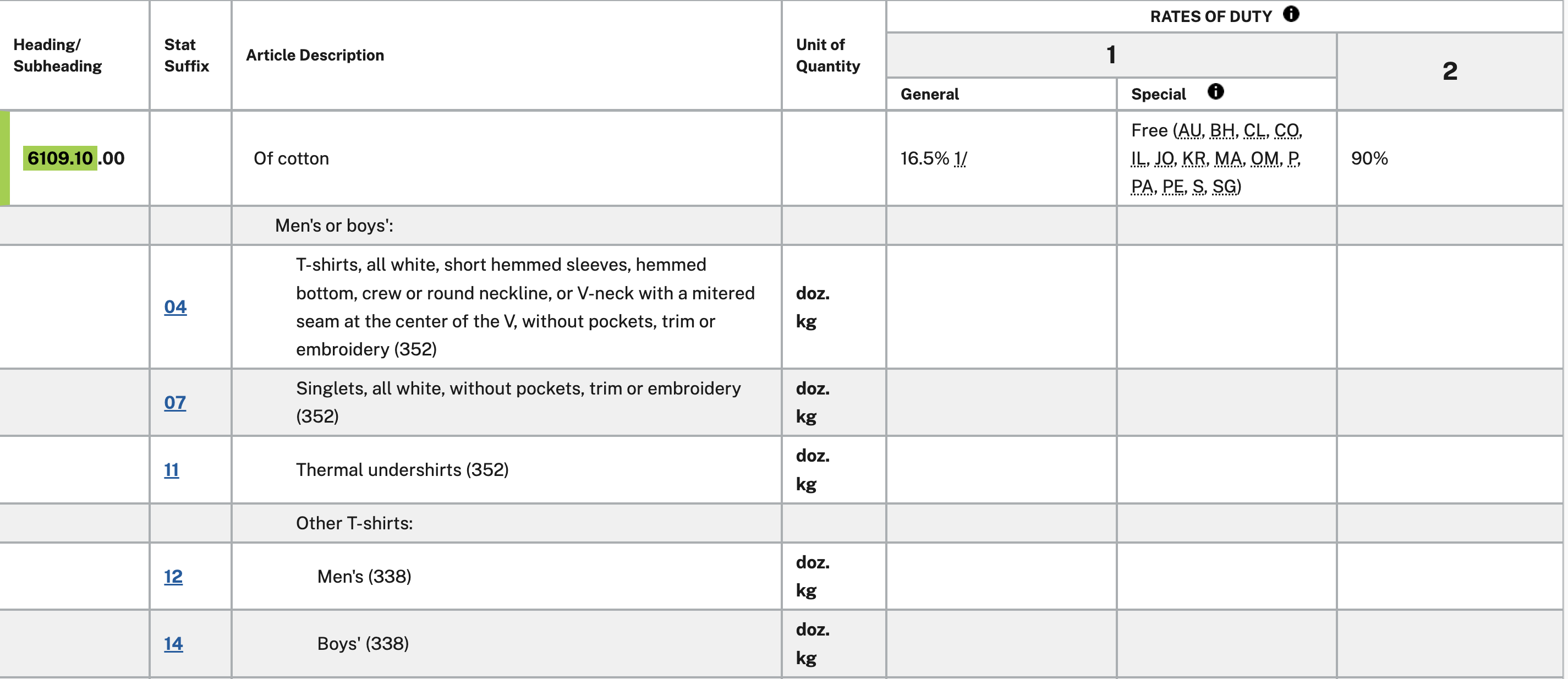

- Basic Tariff: Under HTSUS 6109.10, cotton T‑shirts incur a 16.5% duty ($1.65).

- New Tariff: Trump’s order adds an extra 10% ($1).

- Potential Additional Tariff: If the T‑shirt contains synthetic fibers, Section 301 adds 25% ($2.50).

The total tariff could reach $5.15. Overall, the duty rate may climb to between 26.5% and 41.5%. Retail prices might need to rise by 30%–50% to maintain profits. (Calculations by DeepSeek and ChatGPT – for reference only.)

The domino effect of the new tariff policy is just beginning.

2. E-commerce Industry Reshuffling

The latest US policy changes are delivering real damage.

Short‑Term Pain:

Small sellers who depend on fragmented supply chains and duty‑free direct shipping are hit hard. Their profits may shrink by over 50%, and many long‑tail SKUs might be forced off the market. Even sellers with overseas warehouses are not spared. Tactics like splitting orders to avoid tariffs are now blocked, risking supply chain disruptions.

Price War Retreat:

Low‑price strategies now hurt more than help.

New policies and market conditions squeeze small sellers, especially those relying on rock‑bottom pricing. Industry resources are shifting to top brands.

Even low‑price platforms are integrating supply chains. For instance, Temu has introduced a semi‑managed model requiring sellers to stock products in overseas warehouses to boost fulfillment and avoid tariff uncertainty. Shein plans to invest $500 million in regional distribution centers to reduce delivery cycles to three days.

Meanwhile, rising compliance costs are driving companies to focus on high‑value products. Brands with market certification and design patents are poised to capture the market. EcoFlow, for example, evolved from a factory model to a high‑end energy storage brand, pricing its products over 50% higher than ordinary outdoor power supplies.

Changing Logistics Models:

Under tighter tariffs, overseas warehouses have become a survival necessity.

Frost & Sullivan predicts that China’s B2C cross‑border e‑commerce logistics market will grow at a 13.7% compound annual rate. The overseas warehouse model may reach 387 billion RMB by 2028, capturing 51% of the market. That means 5.1 out of every 10 cross‑border packages will be delivered from pre‑positioned warehouses.

3. E-commerce Recommendations

In the short term, higher costs and product eliminations are inevitable. Yet, compressed survival space also forces industry upgrades. By optimizing supply chains and adjusting pricing strategies, short‑term pressures can evolve into long‑term competitiveness.

1. Diversify Logistics Channels:

Do not put all your eggs in one basket. Today, USPS may stop service. Tomorrow, other carriers might follow or hike prices. Use multiple international couriers – such as USPS, DHL, and FedEx – and dedicated logistics lines. Consider leveraging overseas warehouse shipping. This approach boosts delivery speed and disperses risk.

2. Adjust Pricing and Marketing Strategies:

Simply cutting costs is not enough. Consider modest price increases instead. Allow pricing flexibility to handle fluctuations in exchange rates, logistics, and tariffs. Raise free‑shipping thresholds moderately to absorb extra costs. For high‑repurchase products, subscription‑based models can secure long‑term revenue.

Globally, e‑commerce is under review. Besides the US, the EU, Turkey, and others are tightening policies. The recent US moves may be just the first exam of the year.

The industry is shifting toward models based on overseas warehouses and localized services. New sectors such as social commerce, AI applications, and innovative advertising strategies – including dynamic ad creatives – will inject fresh energy.

The new year is an ideal time for businesses to re‑strategize.