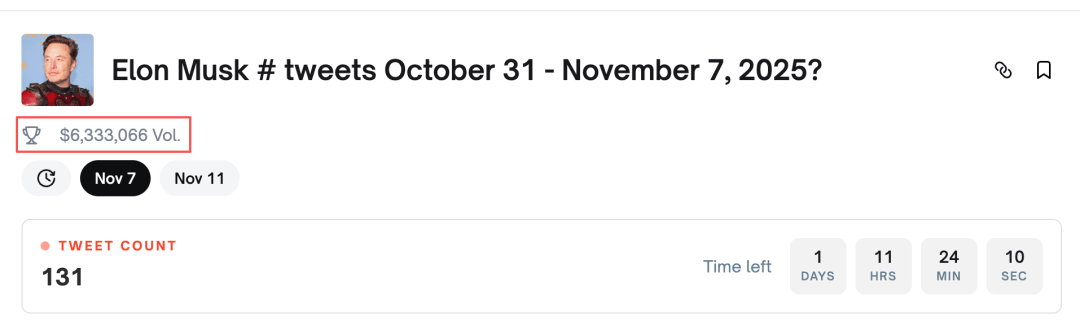

The platform is Polymarket, where users engage in behavior that looks almost like “betting.”

来源:Polymarket

来源:Polymarket 来源:Polymarket

来源:Polymarket

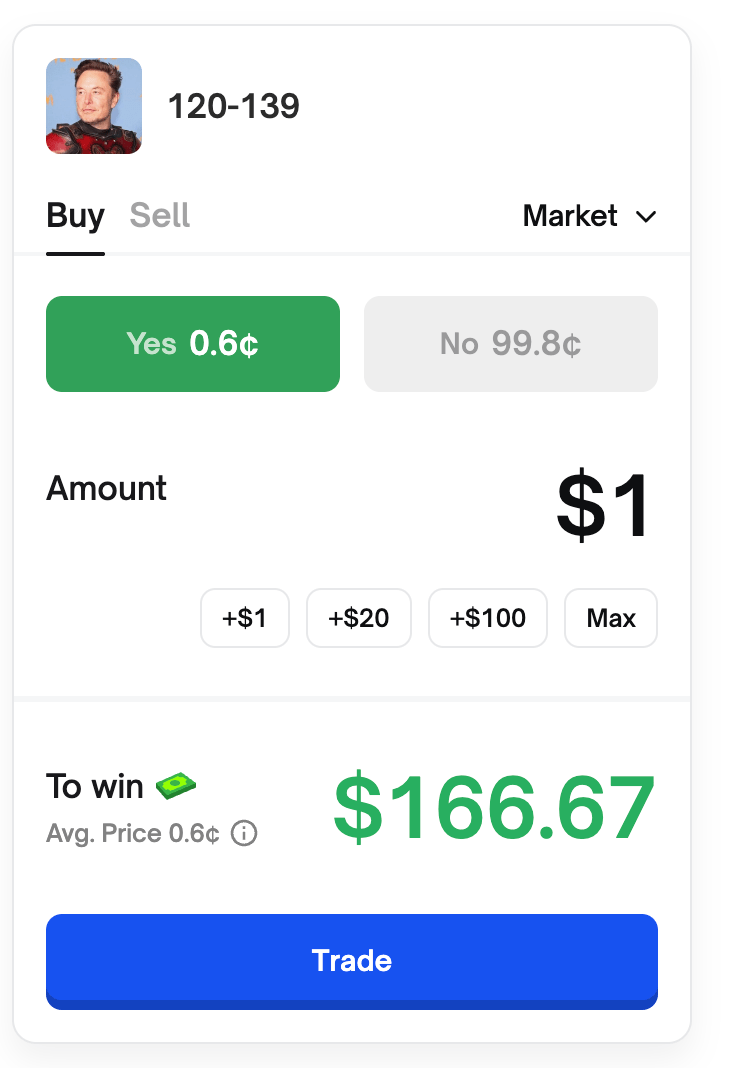

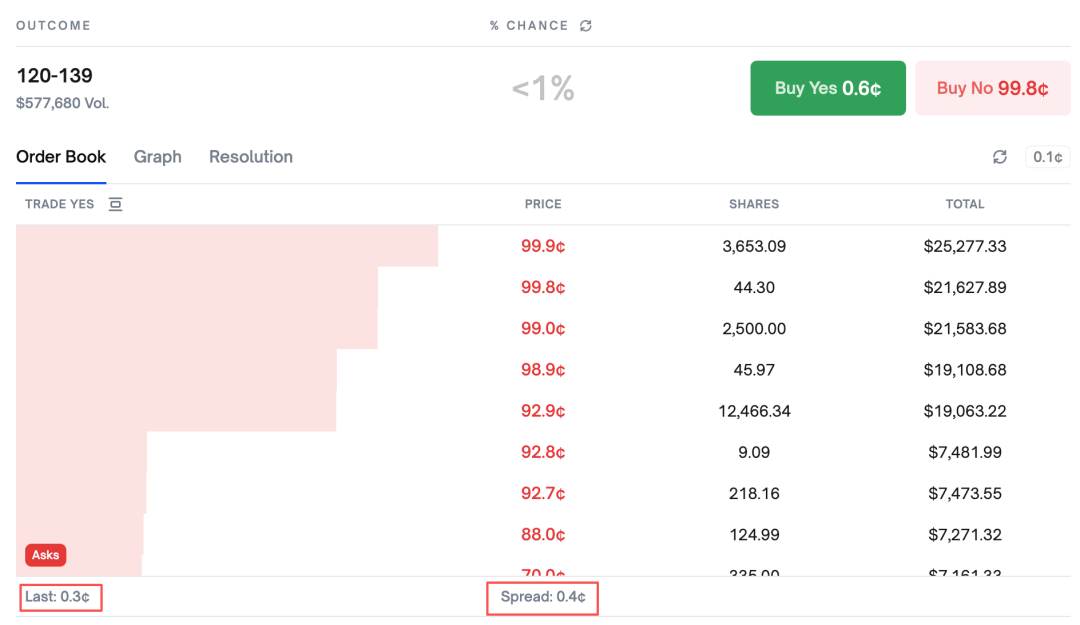

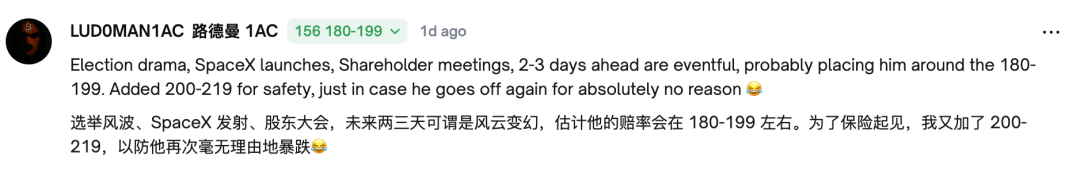

More interestingly, a week ago, this range had a 99.9% predicted probability. As Musk kept posting and market sentiment shifted, the implied probability dropped to below 1%. The volatility is sharper than many stock markets.

来源:Polymarket

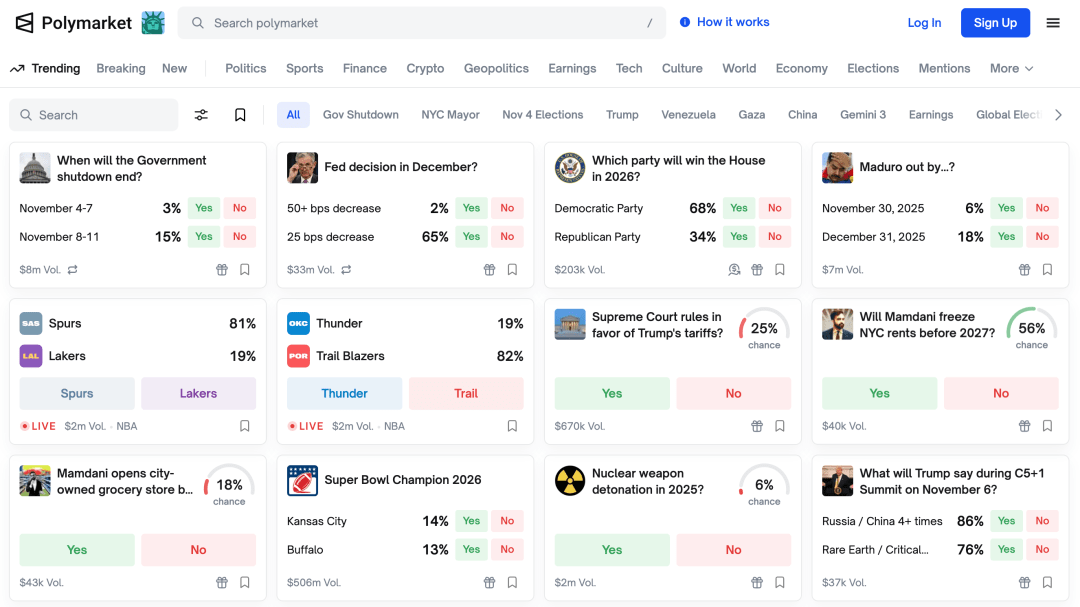

This is how prediction markets work on Polymarket.

From “Will the Fed cut rates in December?”, to “Which company will lead the AI model race?”, to even “Will Taylor Swift be pregnant in 2025?” Almost any future outcome can be traded.

来源:Polymarket

Each event corresponds to a contract, priced between $0 and $1, reflecting the real-time market probability of the outcome. A price of $0.50 means the market assigns a 50% chance of it happening. When the event concludes, the correct side receives $1 per contract, and the incorrect side receives nothing.

At first glance, this may look like pure gambling. There is no doubt that the platform does grow from people’s natural appetite for risk. However, the underlying mechanism is much closer to financial markets than betting. Participants express their views through positions. Today, even many quant funds and investors monitor Polymarket data to track sentiment and predictive trends.

So, what exactly is this prediction market built on cryptographic infrastructure?

Is it operating in a regulatory grey zone — or is it the early signal of financialized information markets?

(This article is for analysis only. This is not financial advice. Please avoid any form of gambling.)

01 Valuable Consensus

Polymarket is a prediction market where users trade event-based contracts to express their views on future outcomes.

There is no bookmaker and no fixed odds, which is completely different with traditional gambling. Every trade is matched directly between buyers and sellers. The platform only provides the contract marketplace and settlement layer.

来源:Polymarket

Prediction markets have three defining features:

First, Price reflects probability.

Contract prices act as real-time estimates of how likely an event is to happen.

Second, Predictions are tradable.

Users can buy or sell positions at any time before the final result. Forecasting becomes liquid and market-driven.

Third, Liquidity is incentivized.

The more users participate, the more stable and accurate the consensus becomes.

Recently, news about “Trump launching a casino platform” gained attention. In fact, it was his social platform Truth Social launching its own prediction market called Truth Predict.

Donald Trump Jr. is also an investor in Polymarket.

The category is expanding aggressively.

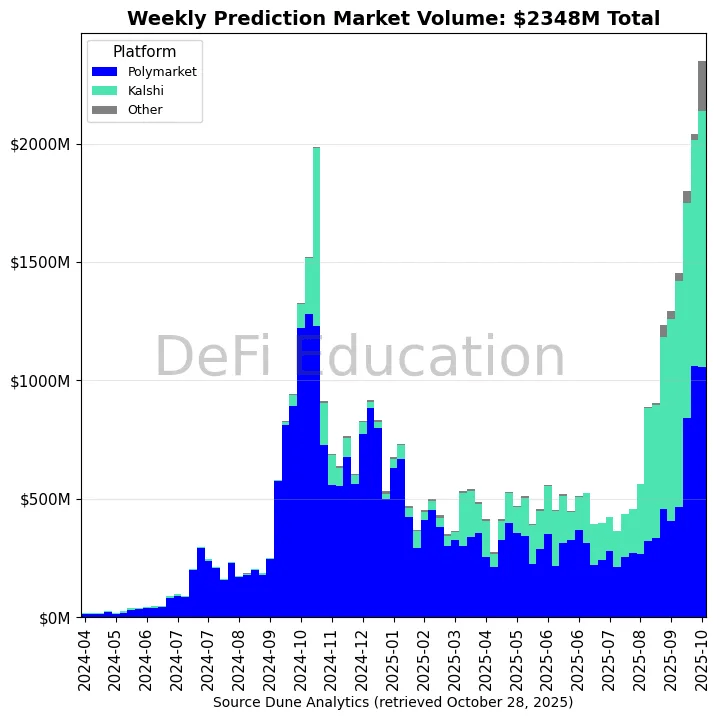

In the week ending October 19, 2025, platforms like Kalshi and Polymarket recorded over $2B USD in trading volume, setting a new weekly record.

来源:Dune, DeFi Education

Traditional finance struggles to support this model.

Prediction markets sit at the intersection of gambling laws, jurisdiction restrictions, and sensitive public topics such as elections.

(Some regulators still ask: “You’re allowing people to bet on election outcomes?”)

The economist Friedrich Hayek once said: “Price is the aggregator of social knowledge.”

Scattered, individual insights only become actionable when converted into market signals.

Prediction markets monetize consensus.

02 Advertising Is Also a Bet

Polymarket is the production of web3, but how did it break out of the Web3 Niche, attracting core users?

According to GoodsFox advertising intelligence, one of Polymarket’s Meta ads provides key clues.

来源:GoodsFox

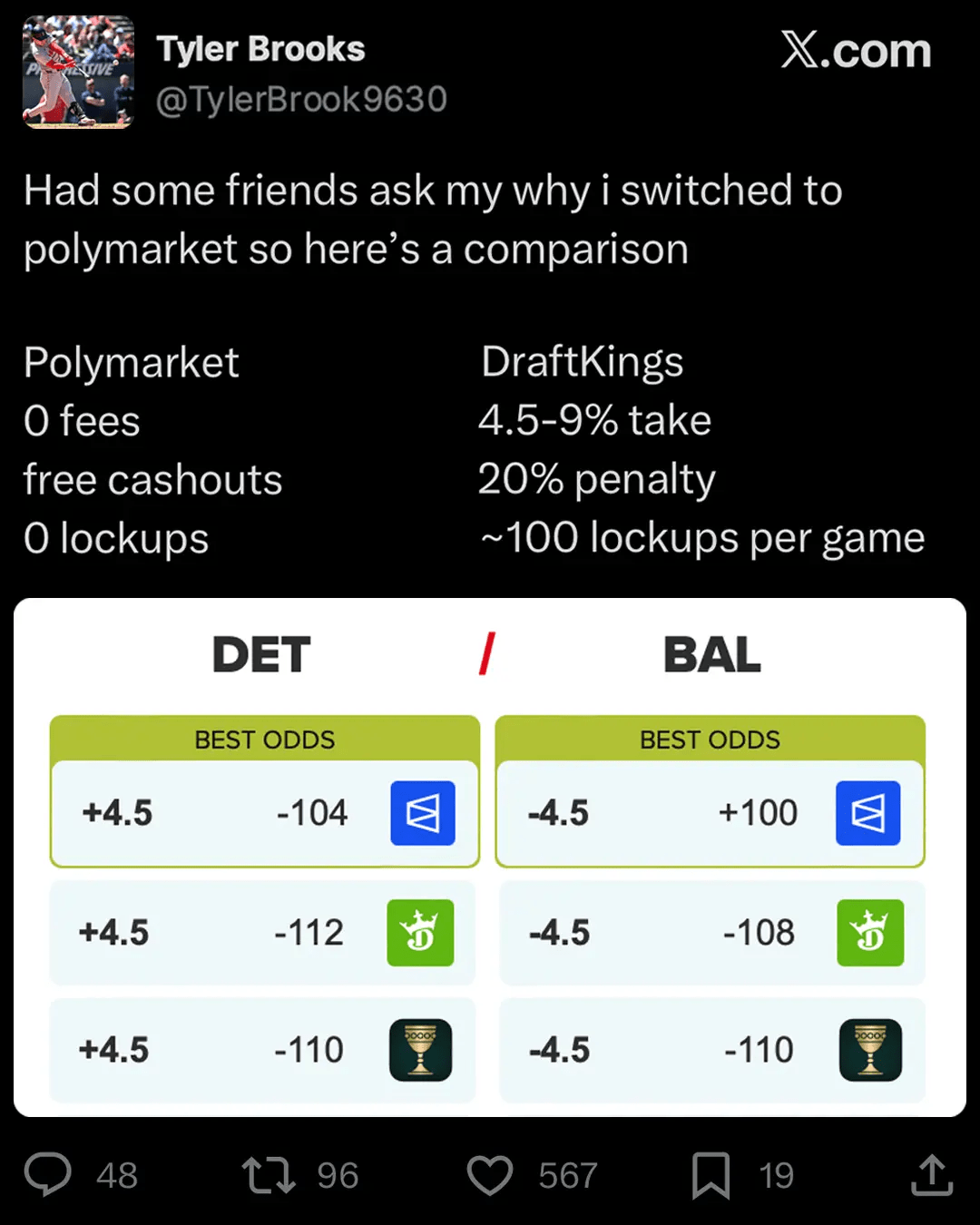

The ad uses the voice of a fictional user named “Tyler Brooks”, explaining why he moved from DraftKings to Polymarket.

“DET / BAL” refers to Detroit vs. Baltimore in U.S. professional sports. DraftKings, mentioned in the ad, is the #1 regulated sports betting platform in the U.S.

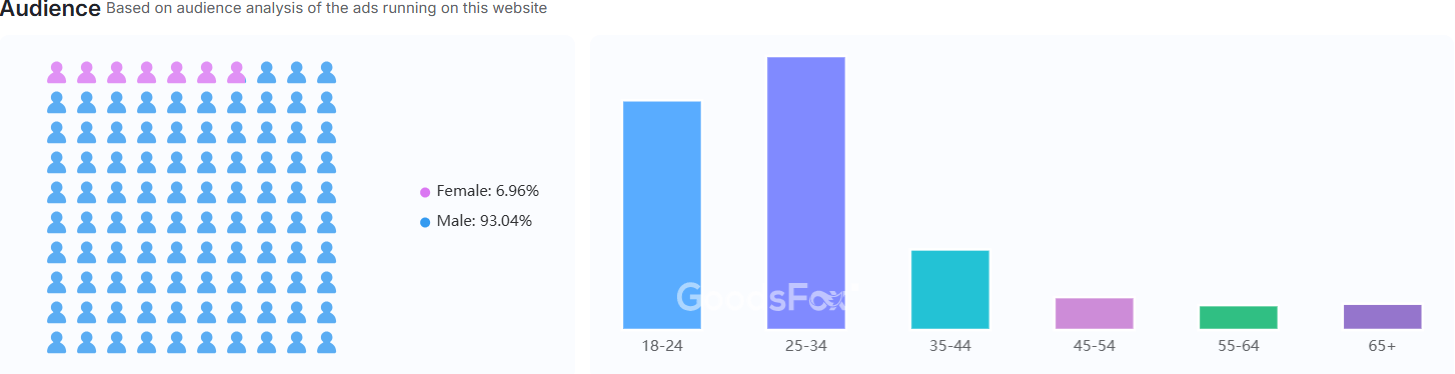

This signals Polymarket’s target audience: Men aged 18–34 who are familiar with sports betting culture.

来源:GoodsFox

From a narrative strategy perspective, the ad highlights two core elements:

- Storytelling Perspective

The account @TylerBrooks9630 does not actually exist.

Yet, framing the message as a personal explanation to a friend makes the message feel non-promotional and peer-to-peer. This reduces resistance.

- Comparison Framework

The ad compares Polymarket with two traditional Web2 betting platforms: DraftKings and BetMGM.

A simple comparison table highlights Polymarket’s advantages:

-

0 fees

-

No lock-in

-

Instant settlement

Below it, a pricing chart shows Polymarket consistently offering better odds for the same match.

The message is visual, direct, and rational.

Visually, the design uses:

-

Data instead of text to gain attention

-

Balanced layout to reduce cognitive load

-

Clear ranking to make the “best choice” obvious at a glance

Even if users don’t know the platforms, they instantly recognize Polymarket is the optimal option.

Money is a vote.

Polymarket uses capital to aggregate information and advertising uses budgets to aggregate signals.

Brands spend money to target the right audience and context, placing bets on the future market—and then verify those bets through performance.