2025.4.17 GoodsFox Daily E-commerce News: Trump’s Tariff Policies Trigger Butterfly Effect, Taobao Soars to #2 on U.S. App Download Charts

- Korean Beauty Brand MISSHA Leads Amazon Rankings, Explosive Growth in North America

- Trump’s Tariff Policies Trigger Butterfly Effect, Taobao Soars to #2 on U.S. App Download Charts

- AliExpress Unveils Support Plan for POP Sellers Amid US Tariff Changes

- China Condemns US 245% Tariffs: "Trade Wars Benefit No One"

- U.S. Beauty Market Grows 5%, Amazon and TikTok Shop Gain Share

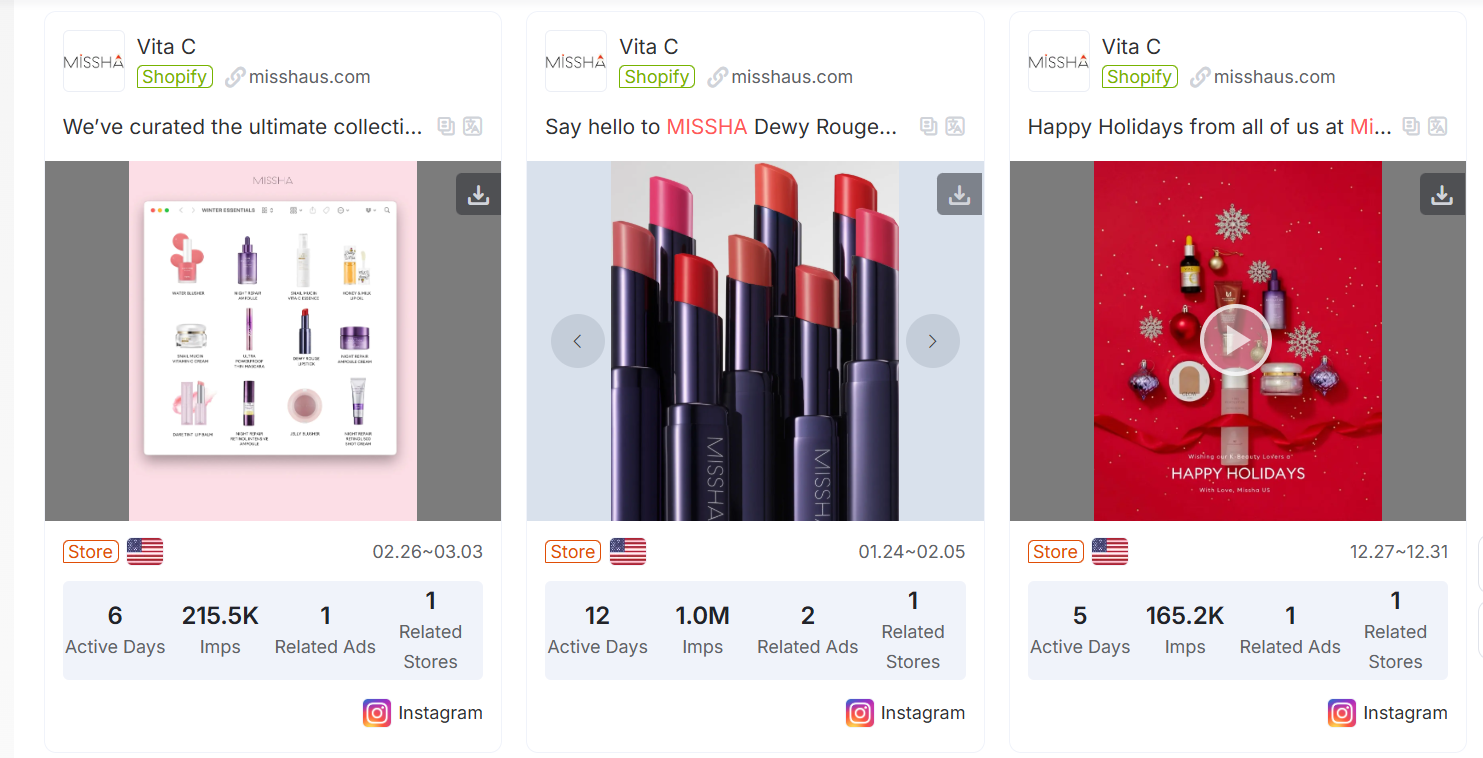

1. Korean Beauty Brand MISSHA Leads Amazon Rankings, Explosive Growth in North America

Korean beauty brand MISSHA is thriving in the U.S. market. On April 14, its parent company AbleCNC reported a 428% year-over-year sales surge for MISSHA’s BB cream during Amazon’s Big Spring Sale last month. This growth stems from MISSHA’s sharp positioning and product optimization on Amazon.

The brand launched M Perfect Cover Serum BB Cream, enhancing its popular M Perfect Cover BB Cream line to meet consumer demands. This series topped Amazon’s BB cream category in July’s annual sale and continues to lead as a bestseller through early April.

Source: GoodsFox

2. Trump’s Tariff Policies Trigger Butterfly Effect, Taobao Soars to #2 on U.S. App Download Charts

Data from April 16 shows Trump’s new tariff policies driving overseas consumers to Chinese e-commerce platforms like Taobao. Taobao’s global downloads spiked, hitting second place on app charts in the U.S., Canada, and the UK, and first in France. Analysts say high tariffs are fueling a "tariff-avoidance consumption" trend, as users seek cost-effective Chinese goods.

3. AliExpress Unveils Support Plan for POP Sellers Amid US Tariff Changes

On April 16, AliExpress announced updates to its POP U.S. tariff policy, aiding sellers in adapting to new U.S. tariffs. Starting April 18, 2025, POP sellers can choose between two fulfillment options:

- Platform logistics: No price changes needed; AliExpress will manage U.S. tax displays from April 23.

- Custom offline shipping: Sellers adjust prices to offset new tariffs.

AliExpress also offers overseas warehousing, links to domestic channels like Taobao and 1688, and green channels for Lazada and Daraz with benefits like traffic boosts and commission discounts.

4. China Condemns US 245% Tariffs: "Trade Wars Benefit No One"

In response to the U.S. imposing 245% tariffs on Chinese medical supplies (alongside 173% on lithium batteries and 145% on toys), Chinese Foreign Ministry spokesperson Lin Jian stated: "The U.S. initiated this tariff war. China’s countermeasures are a lawful defense of global trade justice." He warned that escalatory tactics risk destabilizing global supply chains, urging diplomatic solutions over confrontation. The tit-for-tat measures come as U.S. consumer prices rise 18% year-over-year, exacerbating costs for low-income households.

5. US Beauty Market Grows 5%: Amazon and TikTok Shop Gain Share

A TD Cowen report projects the U.S. beauty market will reach $115 billion by 2030, growing at a 5% CAGR. Amazon’s market share is set to rise from 10% (2024) to 15% (2030), second only to Walmart, as DTC brands migrate to its stable logistics amid tariff chaos. TikTok Shop aims to triple its share from 1% to 3% via influencer-driven live commerce, leveraging Gen Z’s preference for discovery-based shopping through unboxing videos and limited-edition drops. The report highlights AI-driven demand forecasting and cross-platform inventory management as critical for brands to maintain margins in a shifting landscape.

For more e-commerce insights and tools, visit GoodsFox.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/