2025.3.17 GoodsFox Daily E-commerce News:

- 5.4 Billion Impressions: Zoomlite’s Travel Gear Takes Over

- Naver Unveils “Naver Plus Store” E-commerce App

- U.S. $800 Duty-Free Policy May End April 1

- U.S. Customs Inspections Hit 70%, Targeting Low Declarations

- TikTok Sale “Very Likely” by April 5

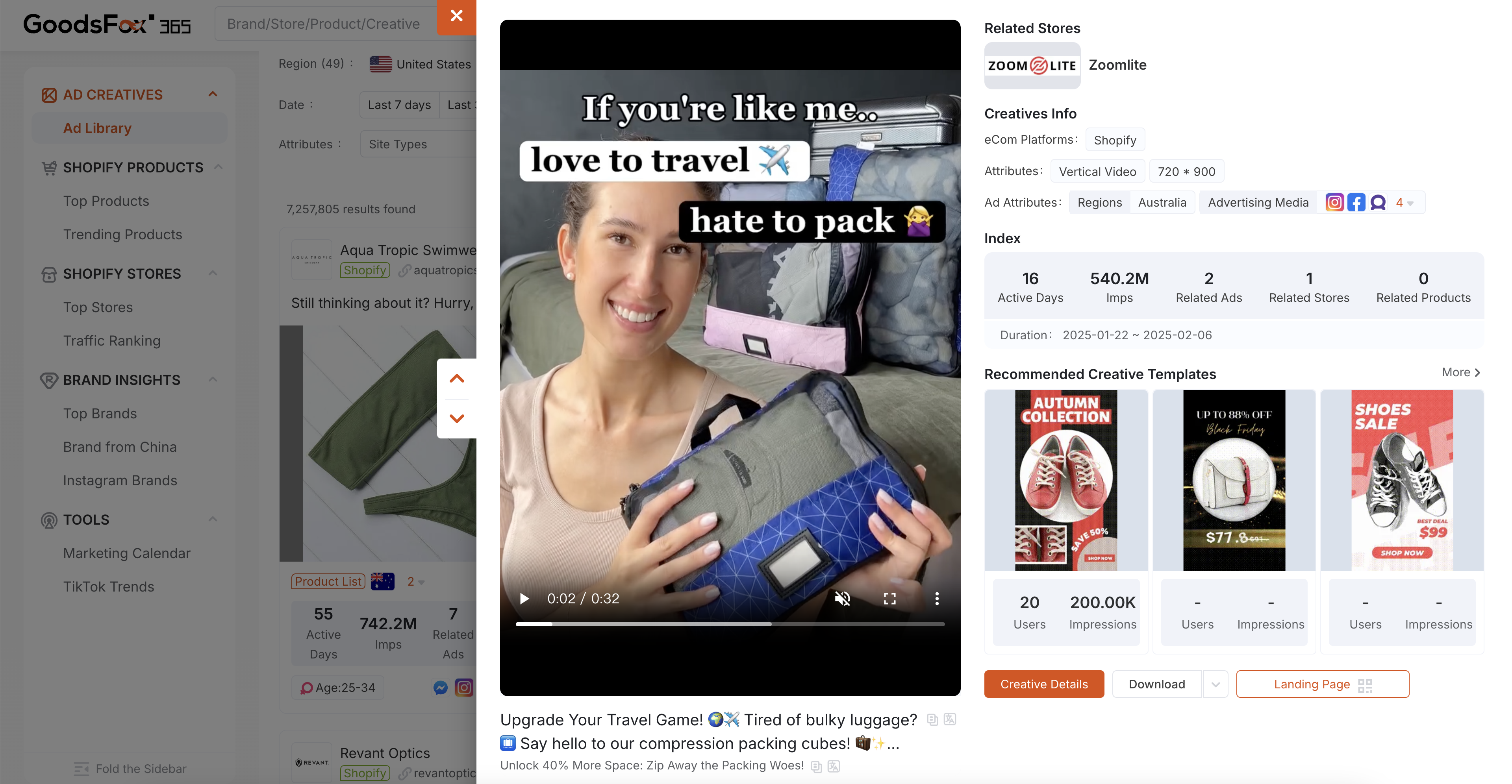

1. 5.4 Billion Impressions: Zoomlite’s Travel Gear Takes Over

GoodsFox data shows Zoomlite, an Aussie travel gear brand, hit 5.4 billion impressions in 16 days. Its compression packing cubes, boasting 40% space savings, solve rough baggage handling woes. Priced at $15-$20, they target mid-tier cross-border travelers. U.S. and European airports see luggage damage rates triple China’s, with 60% of international flyers affected. Zoomlite’s patented honeycomb design offers vacuum compression and cushioning. Post-pandemic travel booms, and demand for space-saving, protective gear soars—growth could top 45% yearly. Zoomlite plans a mini version for business carry-ons in September, eyeing the DTC travel market.

Source: GoodsFox

2. Naver Unveils “Naver Plus Store” E-commerce App

Naver, Korea’s search giant, launched “Naver Plus Store,” an AI-driven e-commerce app. It personalizes shopping with user data and partners with CJ Logistics for same-day or next-day delivery. Naver’s 44.1 million monthly users dwarf Coupang’s 32.9 million. Yet, Coupang leads with 14 million paid members and its Rocket Delivery network. Naver relies on third-party sellers and logistics, raising speed concerns. GoodsFox sees this boosting Korea’s DTC and cross-border e-commerce scenes, leveraging Naver’s data edge.

3. U.S. $800 Duty-Free Policy May End April 1

Rumors swirl: the U.S. might scrap its $800 duty-free threshold for Chinese goods on April 1. This could spike costs for cross-border sellers, erasing low-price edges. Small packages may face 10% tariffs, with logistics costs up 20%-30%. Customs delays could double. Over 10% of China’s U.S. exports use this exemption. GoodsFox suggests stockpiling in overseas warehouses, diversifying markets, or upgrading products and prices. Short-term pain looms, but China’s supply chain strength holds. E-commerce may shift to heavier assets like overseas storage.

4. U.S. Customs Inspections Hit 70%, Targeting Low Declarations

U.S. Customs (CBP) now inspects 70% of Chinese goods, up from 5%. Focus? Low declarations and mixed shipments dodging taxes. Textiles and home goods suffer most, with delays stretching two months. One seller faced a $280,000 fine for misreported values. Rising fees—like demurrage—burden freight forwarders. GoodsFox advises tighter compliance, linking cargo value, documents, and importer credentials. Cross-border trade feels the heat, but robust systems can save costs and time.

5. TikTok Sale “Very Likely” by April 5

Senator Vance told NBC on March 15: TikTok’s sale could finalize by April 5. Biden’s 2024 law pushed ByteDance to divest TikTok’s U.S. arm. Trump delayed the ban, but China restricts exporting TikTok’s algorithm. Oracle and Frank McCourt’s group eye the deal, with Trump demanding 50% U.S. ownership. No sale? TikTok exits America. GoodsFox notes this reflects U.S.-China tech tensions, impacting e-commerce ad strategies. The clock ticks toward April 5.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/