Key Trends in the U.S. E-Commerce Market

1. The Growing Edge of E-Commerce

E-commerce continues to thrive in developed nations due to higher purchasing power and a willingness to pay for quality. However, the trend also leans towards affordability narratives, with platforms like Temu and SHEIN igniting price wars. Even Amazon joined in by launching Amazon Haul, a low-cost store, in November 2024.

Source:Amazon Haul

This reflects deeper changes. Offline logistics in the U.S. have improved significantly, while online platforms have lowered barriers for businesses to enter the market. This has expanded e-commerce’s advantage over traditional distribution systems. From Q1 2019 to Q3 2023, U.S. e-commerce penetration rose from 10% to 15.6%.

-

Shorter physical distances: U.S. overseas warehouses are growing rapidly, with a compound annual growth rate (CAGR) of 36% between 2020 and 2022, far outpacing the retail sector's 5–10% growth. Sellers can now use third-party warehouses to meet platforms like TikTok’s local warehouse requirements.

-

Faster delivery times: Cross-border shipping used to take around 20 days. Optimized localized networks now enable 3–5 day delivery for certain products, making categories like food, baby care, and seasonal personal care more viable.

-

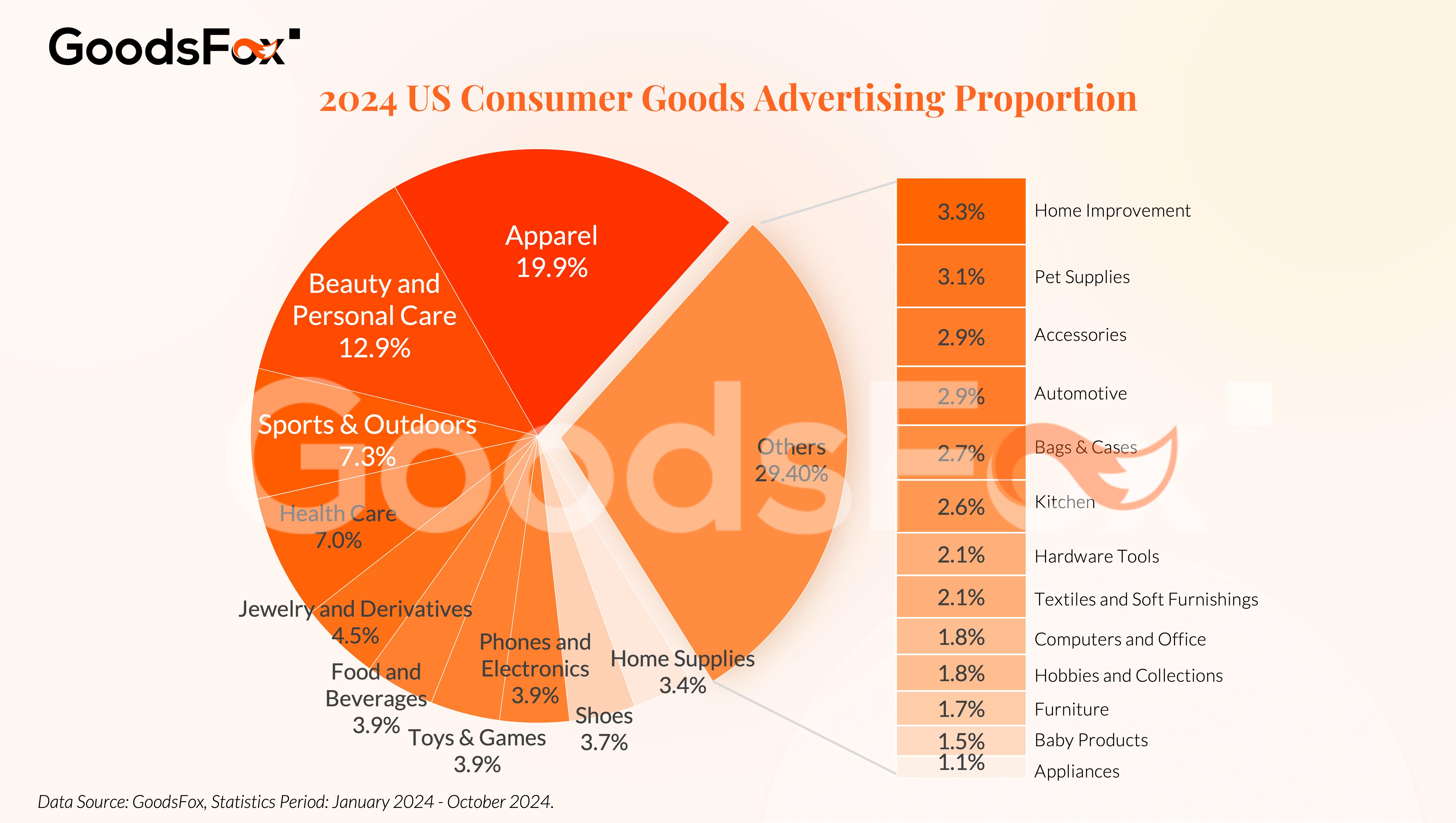

Shifting ad spend: Apparel once dominated ad investment. This year, ad spend has diversified across categories, reflecting new opportunities for growth.

The rapid rise of IoT and AI technologies supports this ecosystem, driving both efficiency and innovation in logistics.

2. Focusing on Customer Lifetime Value (CLV)

Starbucks has long been praised for its customer-centric strategies. However, these efforts are not altruistic but deeply tied to economic returns.

In 2011, Starbucks analyzed its loyal customers and found they generated $25,000 in revenue over 20 years. Based on this, Starbucks reinvests heavily in better store design, employee training, and curated products.

E-commerce brands can adopt similar CLV-based strategies, moving beyond one-time purchases to build long-term relationships. For instance:

-

Replenishment subscriptions: Regular delivery of essential products, similar to milk subscriptions of the past.

-

Curated subscriptions: Personalized product bundles, like pet toys or clothing boxes.

-

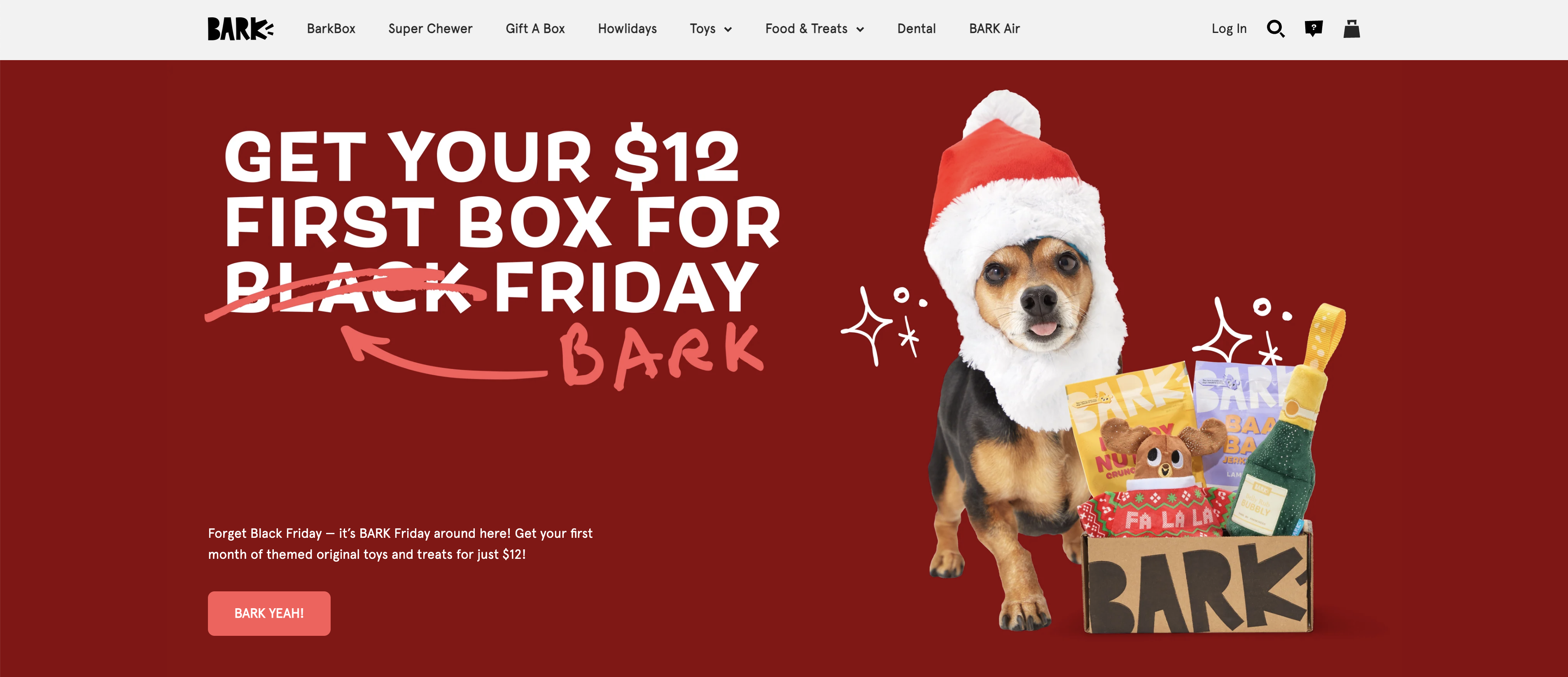

Access subscriptions: Paid memberships offering exclusive perks, such as BarkBox’s monthly pet-themed boxes starting at $25/month.

By focusing on CLV, brands can justify higher marketing costs, invest in customer experiences, and create lasting partnerships.

Source:Barkbox

ROI based solely on one-time purchases is capped, while CLV unlocks exponential potential through repeat business and referrals.

3. From “Search Shopping” to “Interest-Driven Commerce”

Before TikTok entered the U.S. market in 2022, most online shopping relied on search engines or Amazon, requiring consumers to have clear purchasing intent.

TikTok introduced interest-driven commerce, where users discover products passively while scrolling through videos. Algorithms and engaging content create the need, driving impulse purchases.

In China, TikTok’s counterpart Douyin demonstrated the power of this model, with its GMV growing by 60–80% annually after launching the concept in 2021. While not infinite, this validated an effective growth avenue.

As platforms refine these strategies, interest-driven commerce will likely lead U.S. trends, reducing the need for consumers to actively search for products.

Effective Marketing Strategies

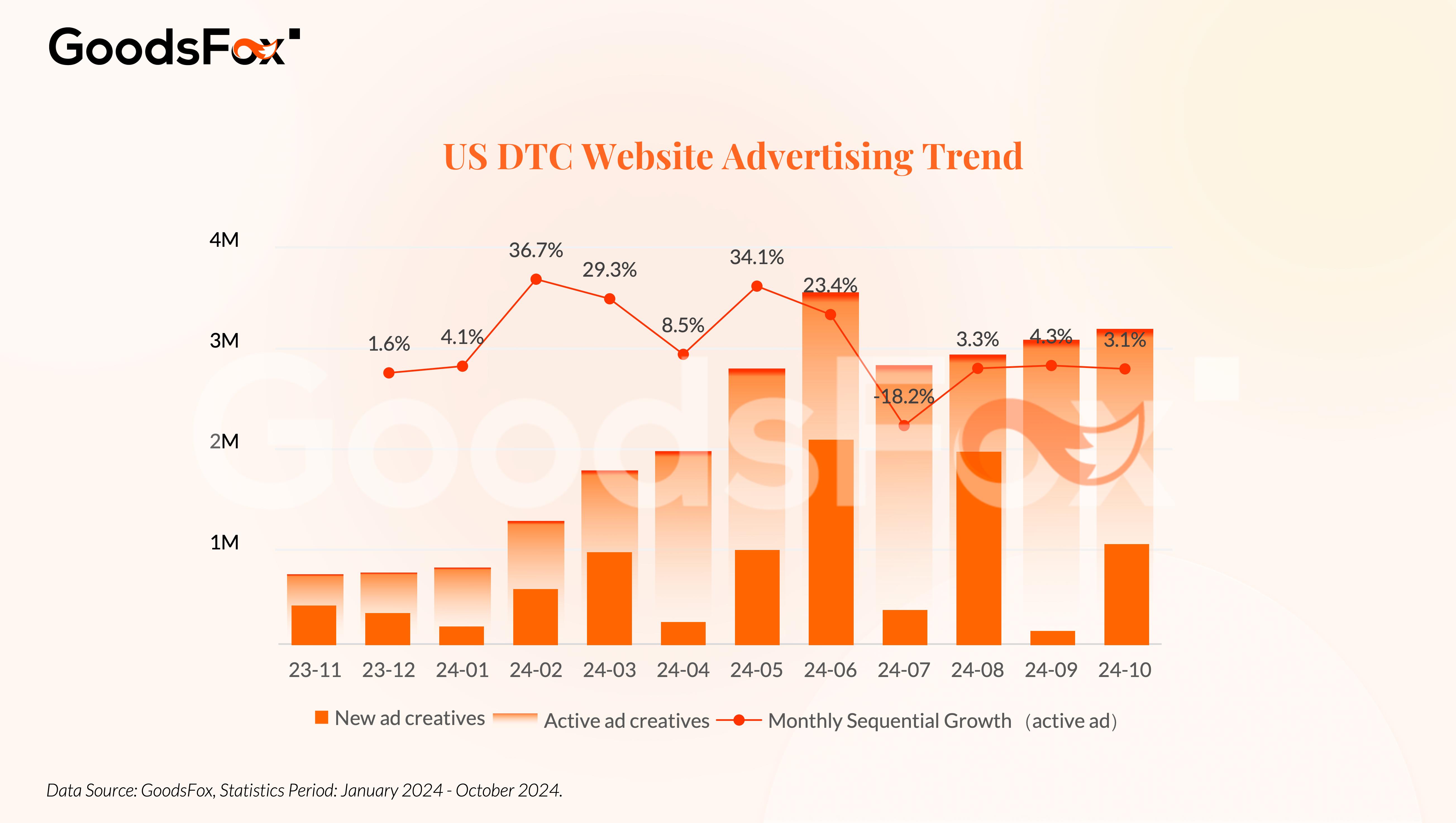

Seasonal Opportunities

Ad spending in the U.S. aligns closely with seasonal events. Notable spikes include:

-

February: Valentine’s Day, Super Bowl

-

March: St. Patrick’s Day, Easter, March Madness

-

August–September: Back-to-School season

The second half of the year, with events like Black Friday and Cyber Monday, offers even more concentrated marketing opportunities.

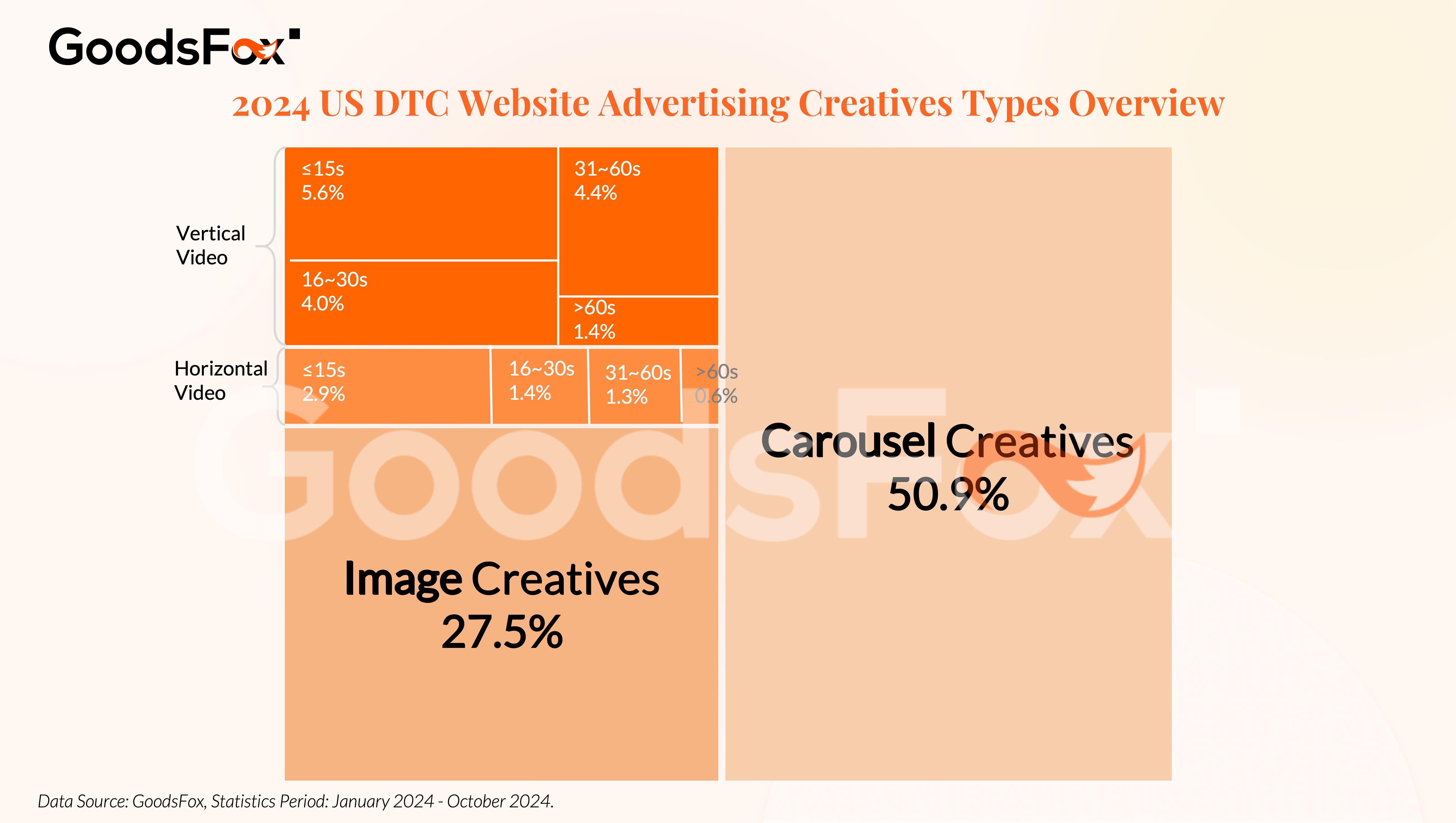

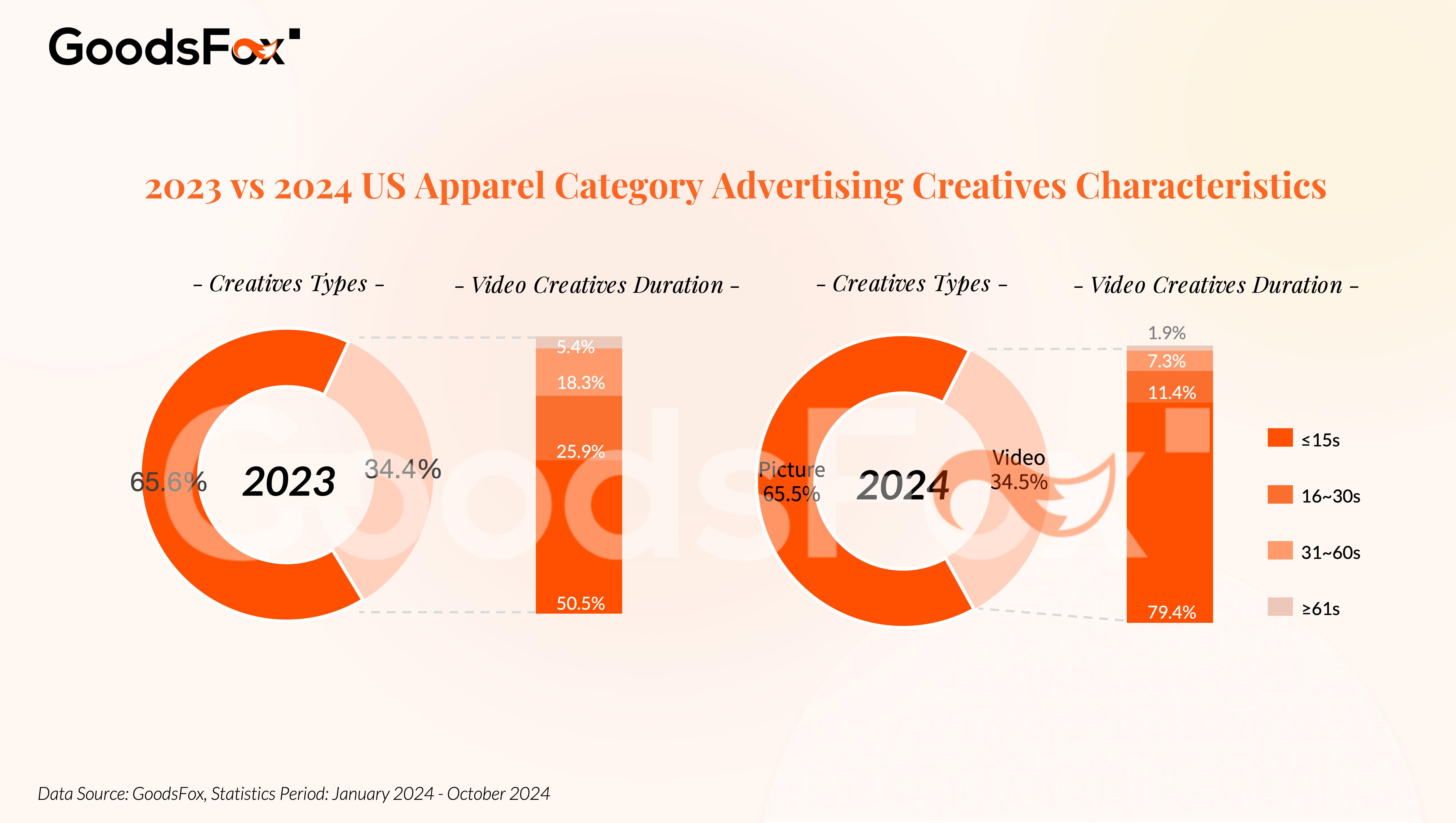

Winning with Short-Form Video Ads

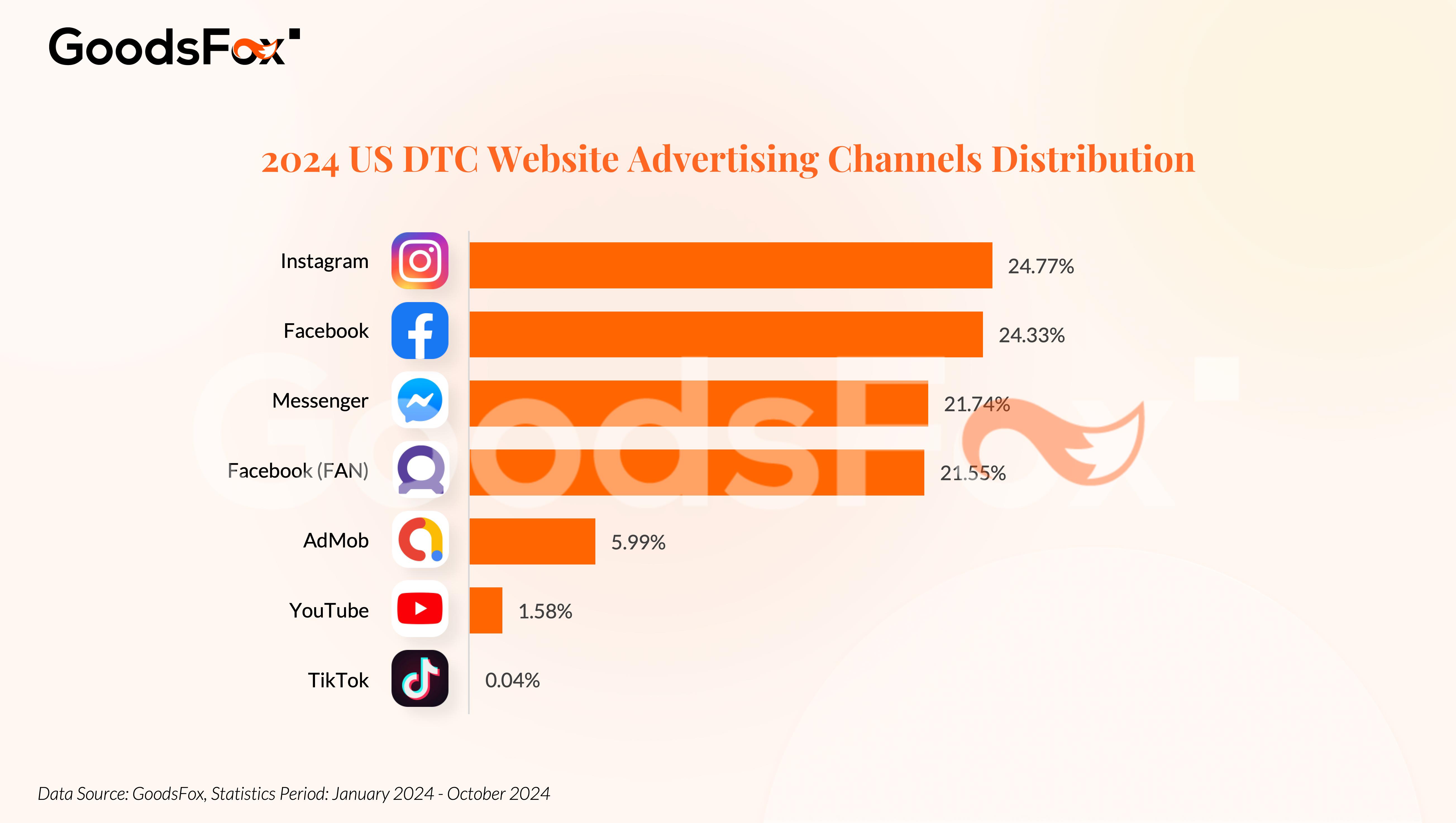

Short-form videos are becoming indispensable in e-commerce marketing. Platforms like Facebook and Instagram dominate DTC brand campaigns, thanks to advanced audience targeting and versatile ad ecosystems.

Facebook’s Messenger and FAN (Facebook Audience Network) enhance reach across devices and scenarios, optimizing ad delivery efficiency.

YouTube, historically focused on long-form content, introduced YouTube Shorts Ads to address its traffic concerns. Early data shows Shorts ads outperform traditional formats in conversion rates by 20%.

Key advertising strategies include:

-

Prioritizing the “golden first three seconds” to capture attention.

- Leveraging mix-cut storyboards to visualize product benefits.

Hot Product Categories in U.S. E-Commerce

Based on our data, these categories are trending in 2024:

-

Apparel

-

Beauty & Personal Care

-

Sports & Outdoors

-

Health & Wellness

Beauty and personal care stand out for their high ROI due to strong repeat purchases and profit margins. Sports and wellness are boosted by the rise of smart and functional products, while mobile, tech, and digital accessories show steady growth.

AI Revolution in E-Commerce Ads

2024 marks the beginning of AI’s large-scale adoption in advertising. Meta launched AI tools like AI Sandbox and Meta AI to improve campaign creation, delivery, and performance analysis.

AI-generated ad creatives are gaining traction, especially for categories like custom apparel. This reduces production costs and accelerates testing cycles, enabling brands to stay agile.

Get the Full Report

The above is a glimpse into the GoodsFox | 2024 U.S. E-Commerce Marketing Insights Report. Join our Discord community to download the complete PDF version and stay ahead in the e-commerce game.