We collected marketing data from 30 European countries to compile the GoodsFox | 2025 European E-Commerce Market Insights Report. The report covers the EU's 27 countries (including Germany, France, Italy, Spain, and others in Northern, Western, Southern, Central, and Eastern Europe) as well as the UK, Switzerland, and Norway.

The report is divided into three main sections:

- Overview of the European E-commerce Market

- Insights on DTC Independent Sites in Europe

- Marketing Analysis of Mobile and Digital Categories in Europe

I. European Market Overview

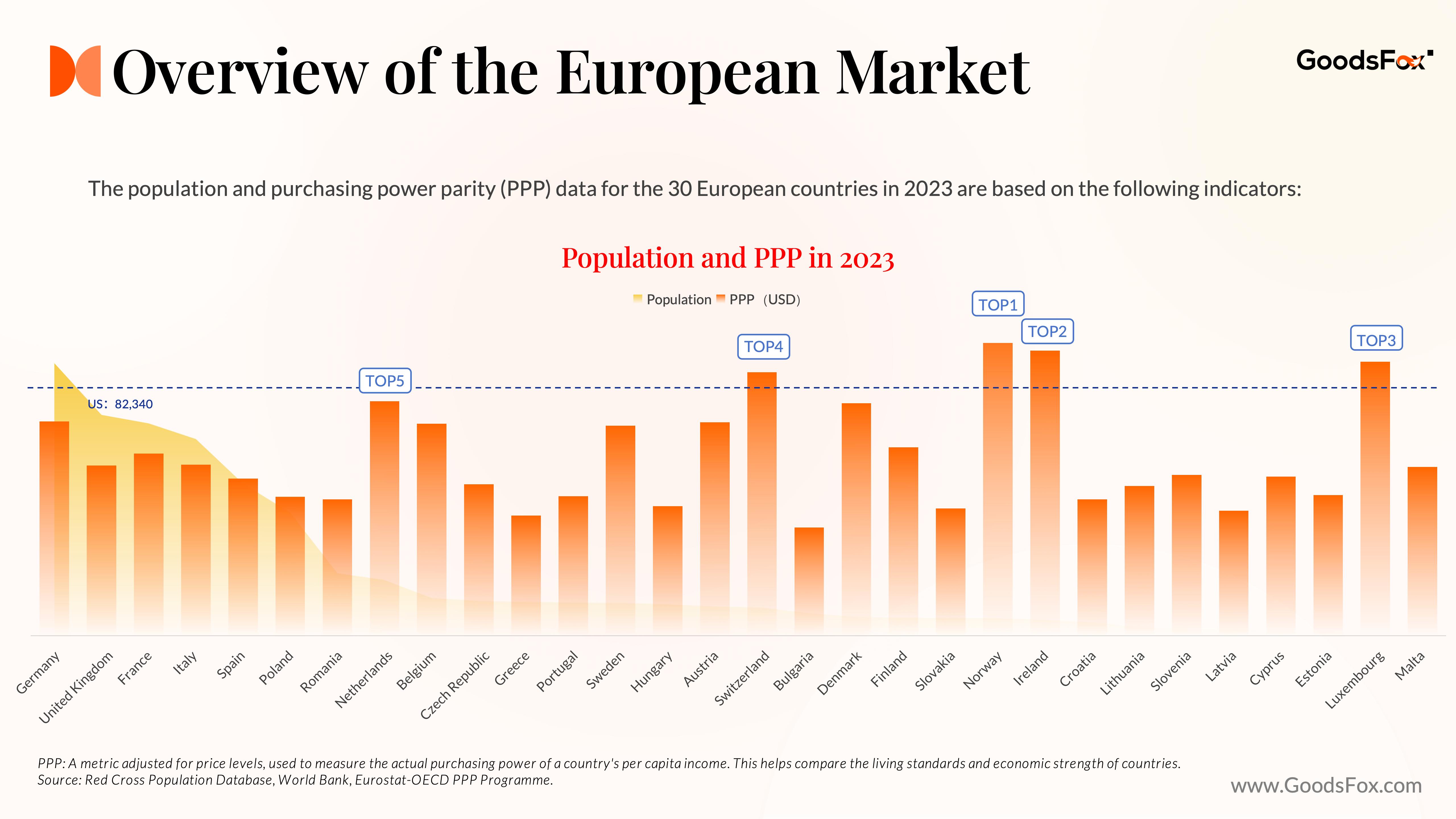

Based on economic development and consumer purchasing power, the European market can be categorized into tiers:

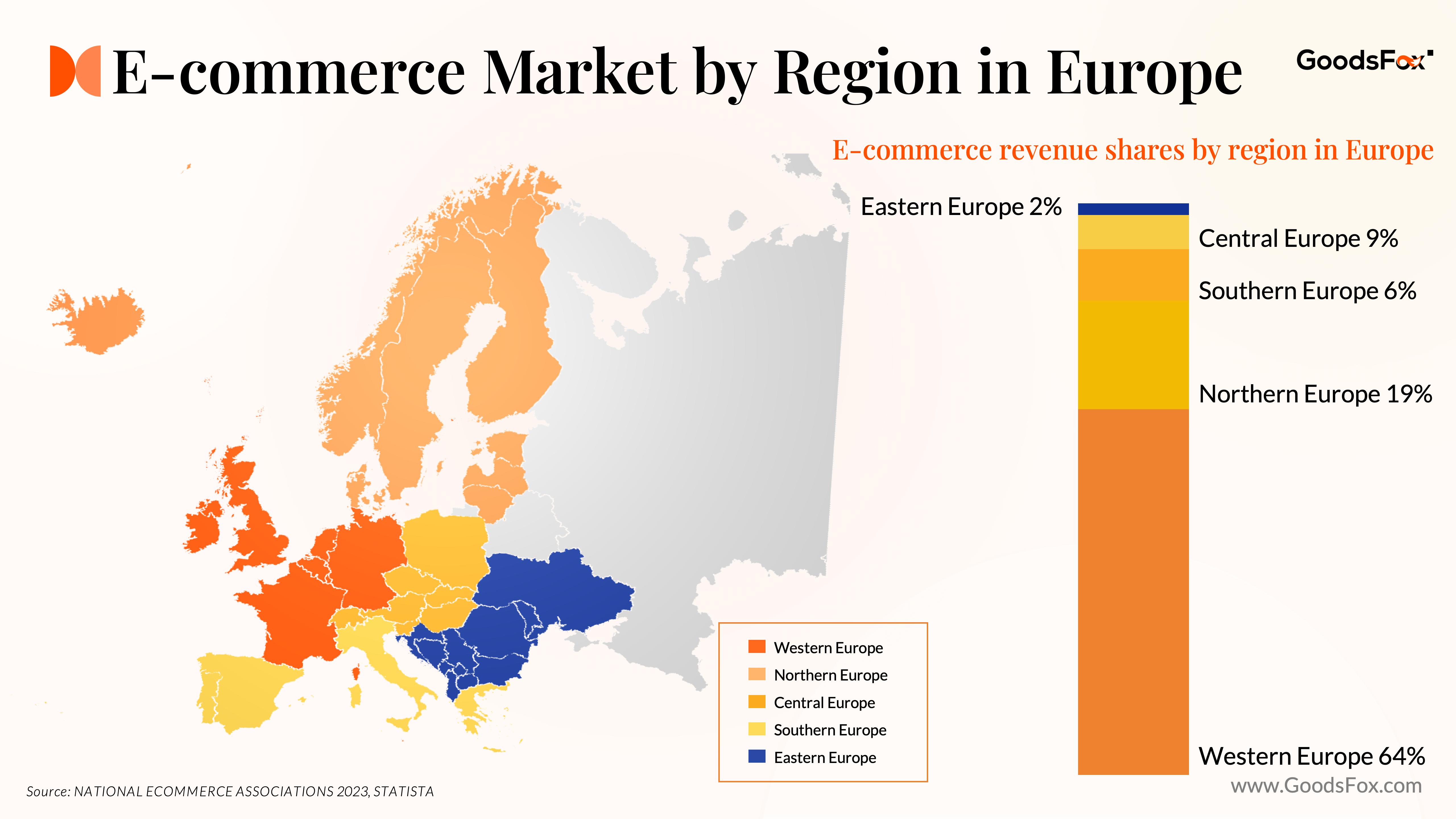

- Western Europe (e.g., Germany, UK, France): Core markets with strong economies, stable consumer bases, and significant population sizes.

- Northern Europe (e.g., Switzerland, Norway, Denmark): High purchasing power with a focus on premium products.

- Southern and Central-Eastern Europe (e.g., Spain, Romania, Bulgaria): Despite lower per capita spending, these regions have large populations and fast-growing e-commerce markets. In 2023, Central-Eastern Europe's e-commerce market grew by 29%, ideal for mid- to low-end brands.

Trend 1: DTC Brands Focus More on Brand Loyalty

Brand loyalty reflects consumers' preference for a specific brand despite numerous options. Maintaining long-term customer relationships and increasing customer lifetime value (CLV) are key.

ROI based solely on one-time purchases is capped, while CLV unlocks exponential potential through repeat business and referrals.(Know more: GoodsFox | 2024 U.S. E-Commerce Marketing Insights Report)

1. Return Policy Optimization

Many brands leverage return policies to boost loyalty. This has spurred growth in outsourced return services, with companies like Happy Returns and Loop Returns offering customized platforms to enhance customer experiences.

2. Loyalty Program Innovation

Subscription models, such as those by Netflix, Spotify, or Amazon Prime, dominate in Europe. Despite regulations ensuring subscription cancellation visibility and ease, brands use tactics like flexible plans and added benefits to retain users.

For instance, Dollar Shave Club allows users to adjust delivery frequency or pause instead of canceling subscriptions. By building habit-forming experiences, brands tap into consumers' fear of losing value, increasing retention rates.

Trend 2: E-commerce Infrastructure Advancements

1. Payment Method Optimization

Traditional payment methods like credit/debit cards and bank transfers are still widely used but cumbersome for cross-border transactions. Digital wallets like PayPal, Apple Pay, and Google Pay have gained traction, especially in the UK (38% usage rate). Account-to-account (A2A) transfers are also growing in markets like Poland, the Netherlands, and Sweden.

Additionally, Buy Now, Pay Later (BNPL) services are rapidly expanding, with 23% of European consumers preferring this method in 2024. Adoption is particularly strong in the Netherlands, rising from 21% in 2023 to 39% in 2024.

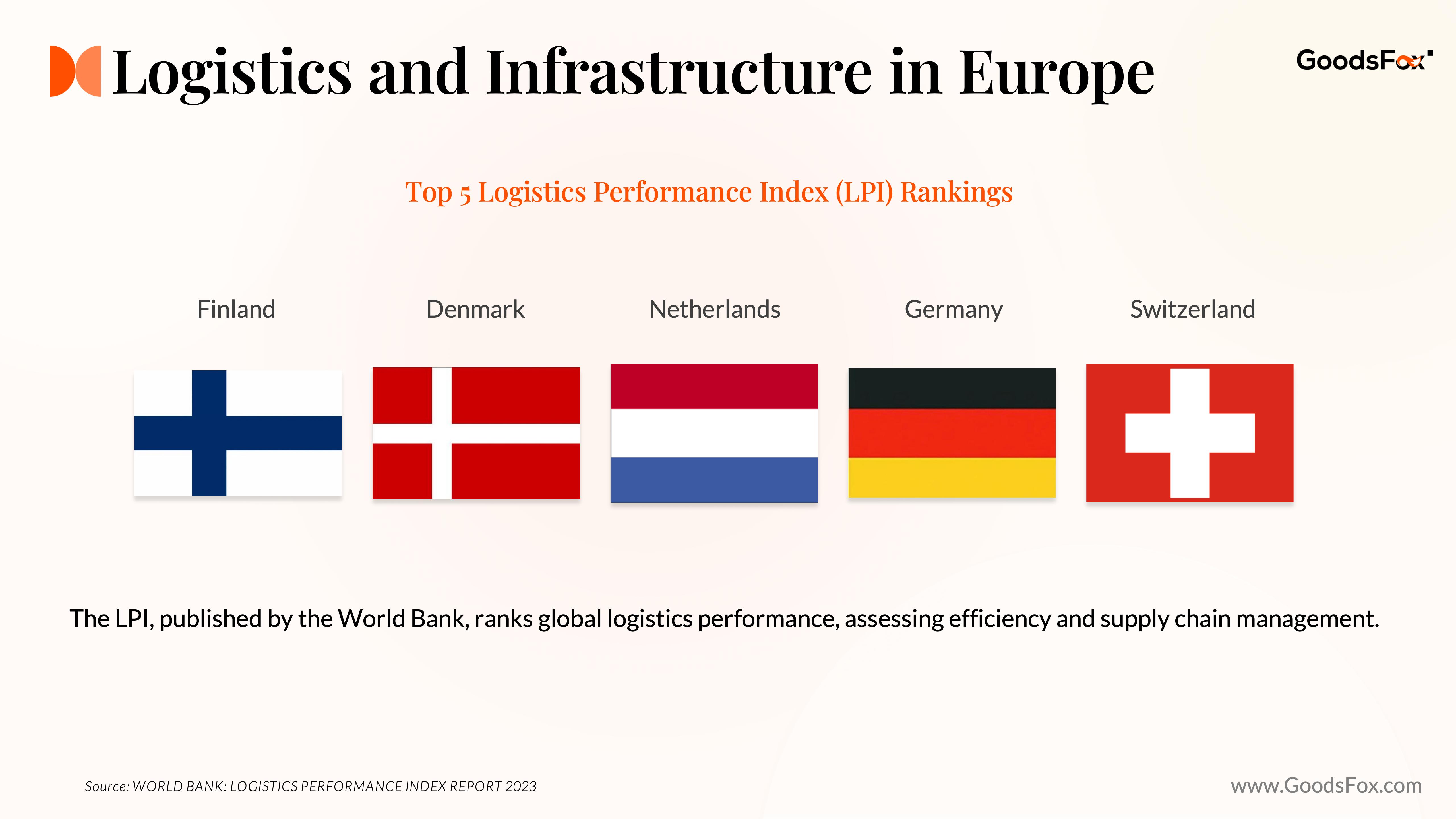

2. Logistics and IoT Enhancements

Despite varied infrastructure across Europe, brands are leveraging local warehouses in advanced IoT markets like Germany and the Netherlands. Post-Brexit, UK-based warehouses continue to support nearby countries, ensuring efficient distribution.

Trend 3: Smart Tech Reshaping E-commerce Experiences

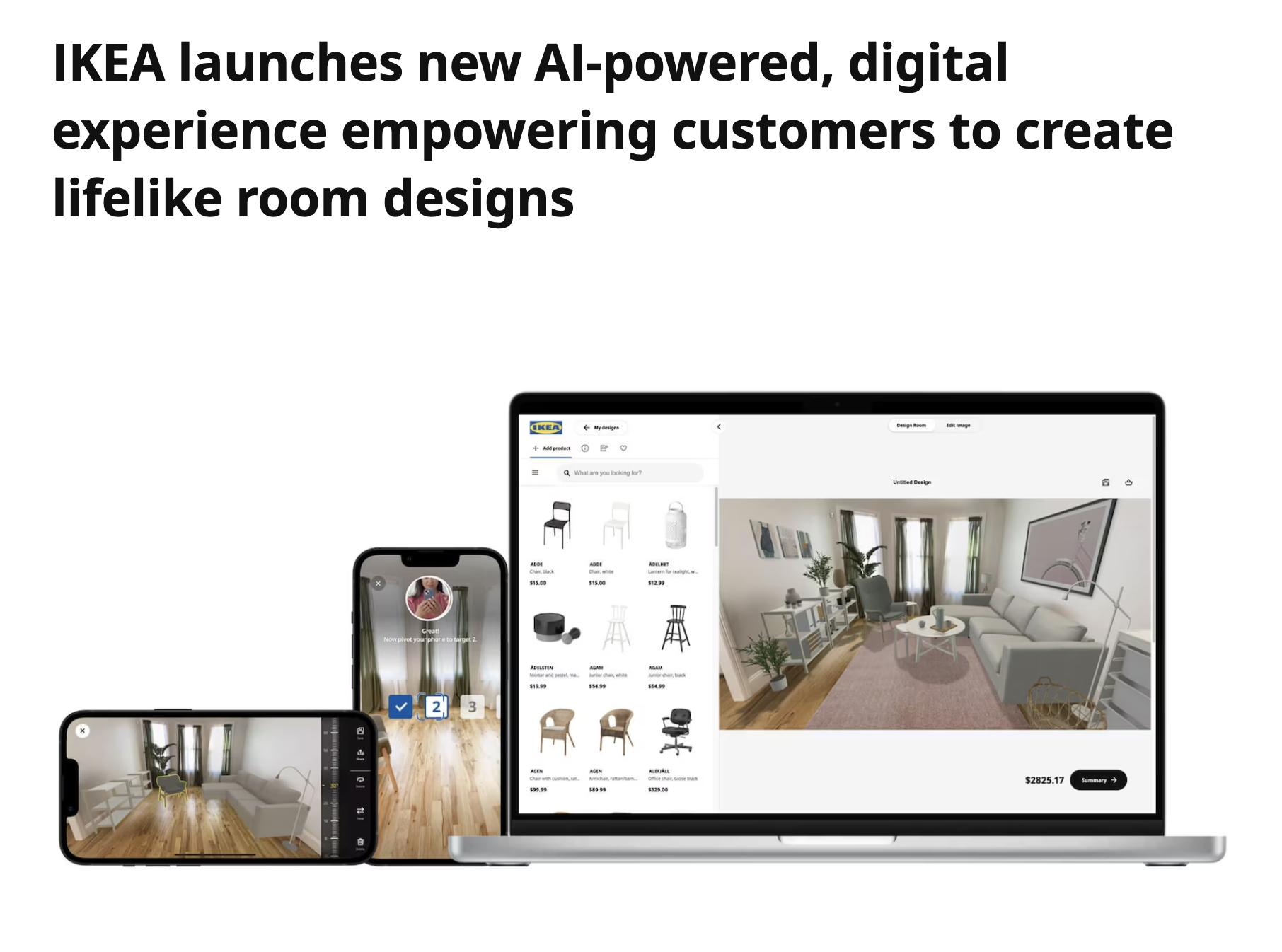

In Europe, AR and 3D technologies enhance online shopping, mimicking in-store experiences. According to Euromonitor, half of European consumers seek immersive and personalized online shopping. These tools reduce return rates, especially in fashion and luxury segments.

Brands like IKEA and Nike actively promote AR/VR applications. For example, IKEA's AR app lets users visualize furniture placement at home, streamlining purchase decisions.

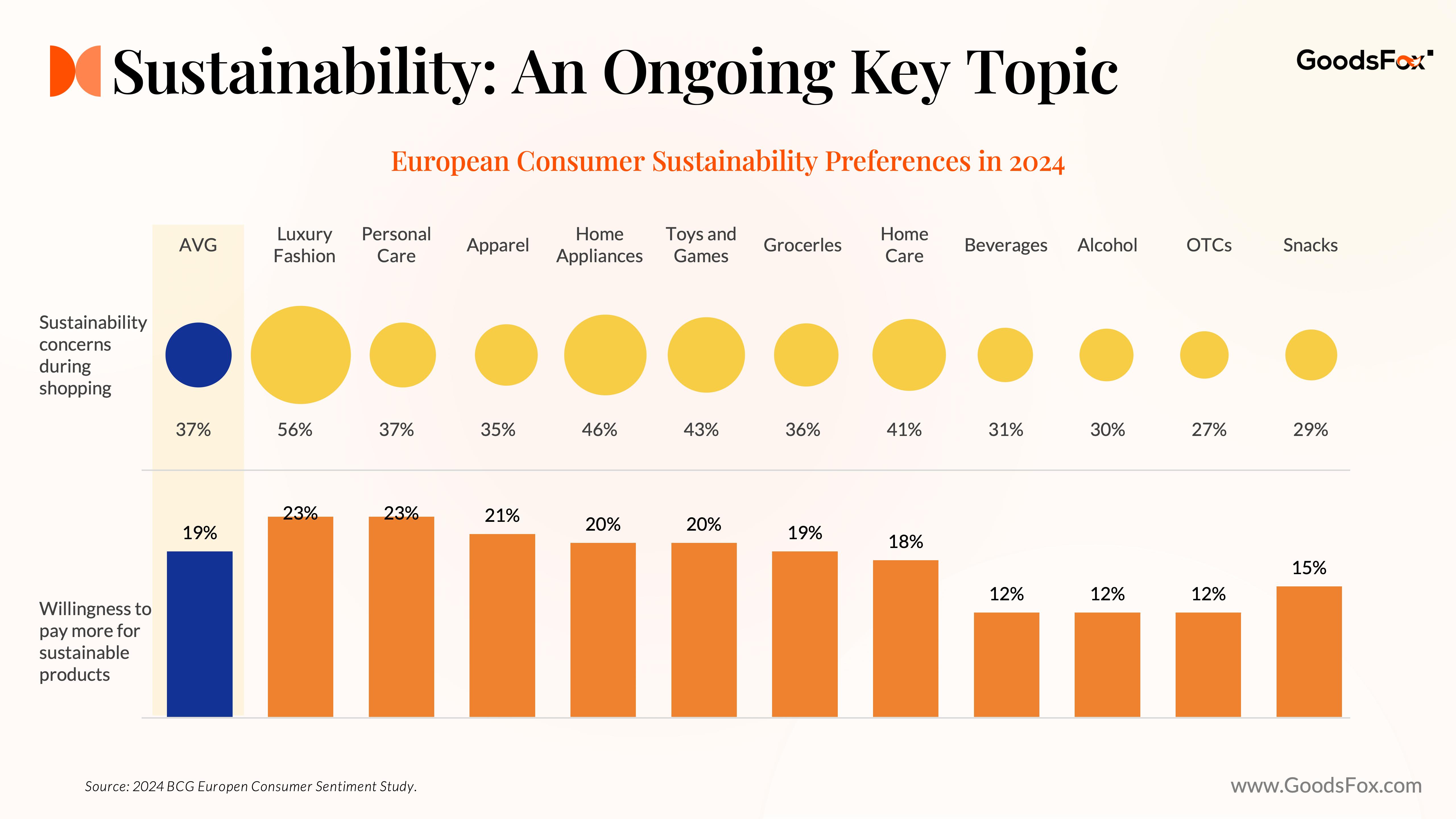

Trend 4: Sustainability as a Key Topic

Sustainability dominates European markets due to a heightened awareness of environmental issues. Consumers prioritize brands offering ethical sourcing, eco-friendly packaging, and reduced carbon footprints. Incentives like recyclable packaging and carbon-neutral shipping options further strengthen loyalty.

Additionally, "Recommerce 2.0" (second-hand goods market) is rising, particularly in apparel and accessories. Brands like Rebelle thrive in selling pre-owned luxury items, gaining popularity in Germany, France, the UK, and Italy.

II. Insights on Marketing for European Independent E-commerce Sites

1. Marketing Trends and Promotions

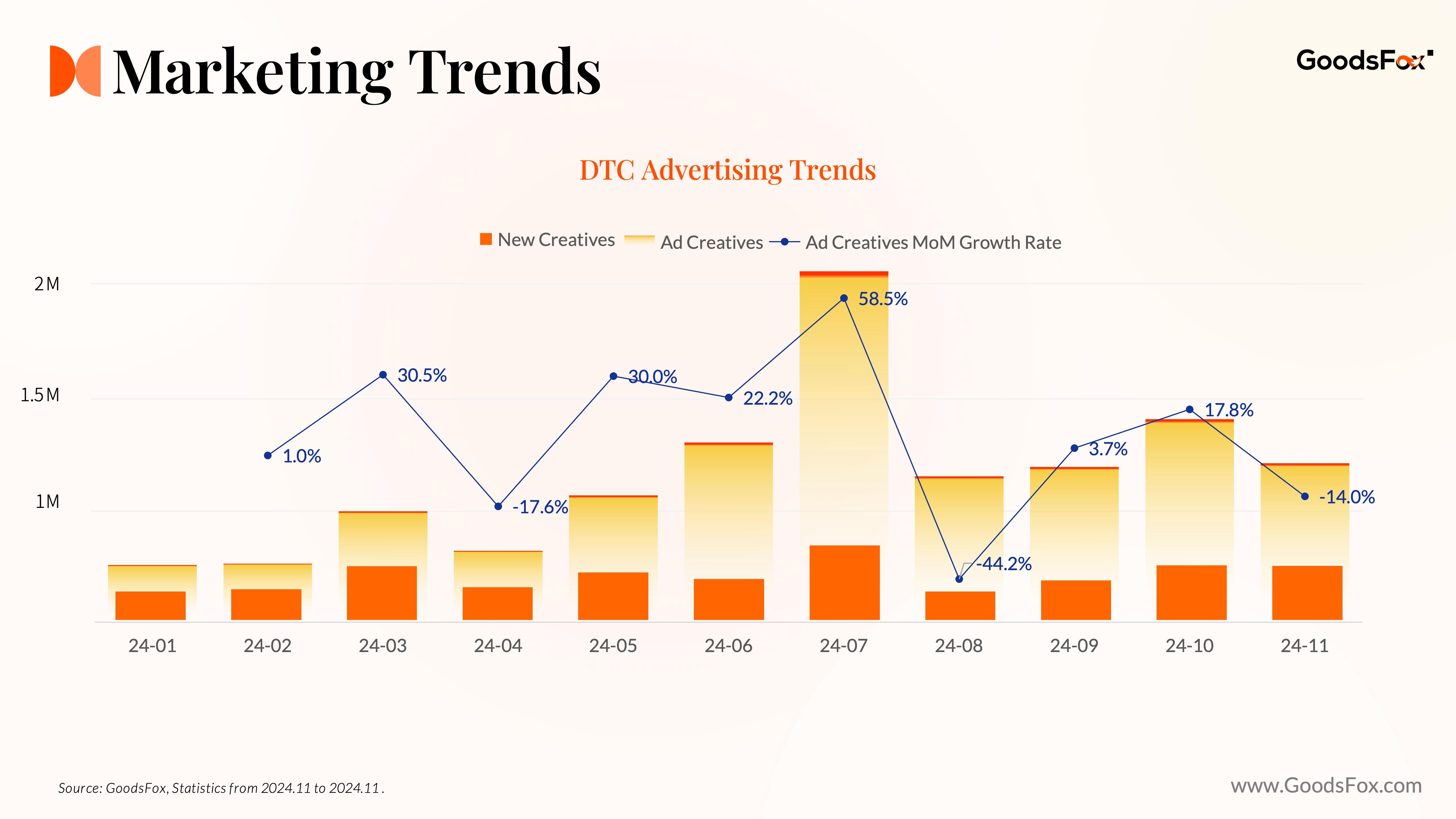

In Europe, advertisers prefer peak-season campaigns and maintain a conservative approach during off-seasons. The sharp decline in ad spending between July and August may result from summer clearance sales ending or seasonal product withdrawals. Summer discounts are common in Europe, focusing on apparel, footwear, home goods, and outdoor items. Countries like France and Italy host major summer sales ("Soldes d'été").

Additionally, July-August marks school holidays and vacation peaks, prompting marketing for holiday and back-to-school sales. However, this aggressive spending approach may increase traffic costs while missing out on off-season opportunities. Advertisers should explore off-season campaigns to maximize budget allocation.

New ad creatives account for only 26% of the total, suggesting brands focus on long-term ad effectiveness and brand building over short-term promotions. Privacy regulations also limit data collection, pushing advertisers to adopt more "general-purpose" ads.

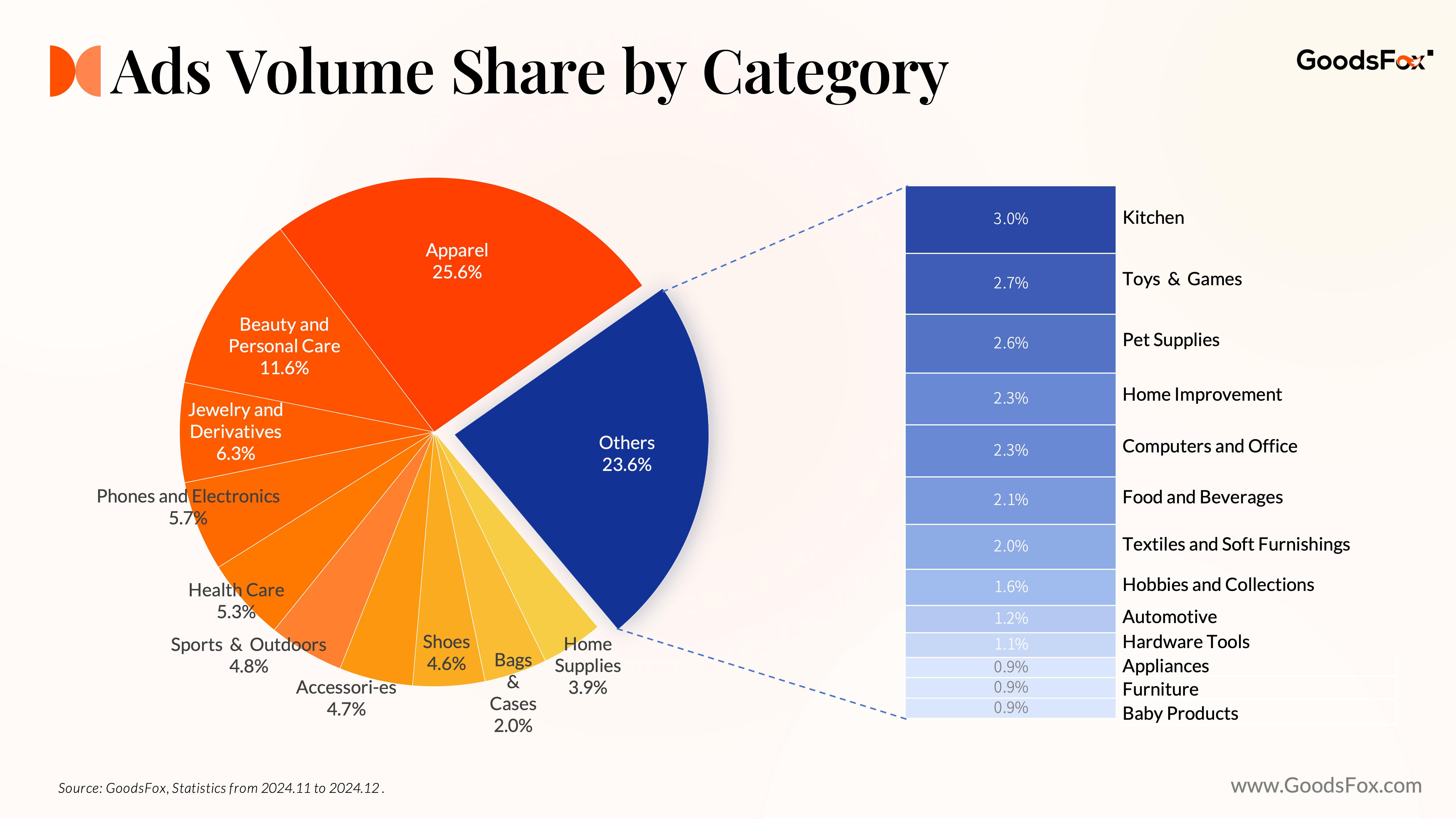

2. Ad Volume Share by Categories

Europe's reputation as a fashion hub ensures strong ad investments in apparel, jewelry, footwear, accessories, and bags, driven by fast fashion and luxury brands' digital strategies. These categories' high profit margins also support increased advertising.

Categories with lower ad spend include kitchenware, pet supplies, and home improvement. However, these markets show niche potential. For instance, Europe’s pet supplies market reached €20 billion in 2023, with a CAGR of 5.8%-7% (2023-2027). Growth drivers include rising pet ownership and premium product adoption, expanding markets for pet accessories and grooming.

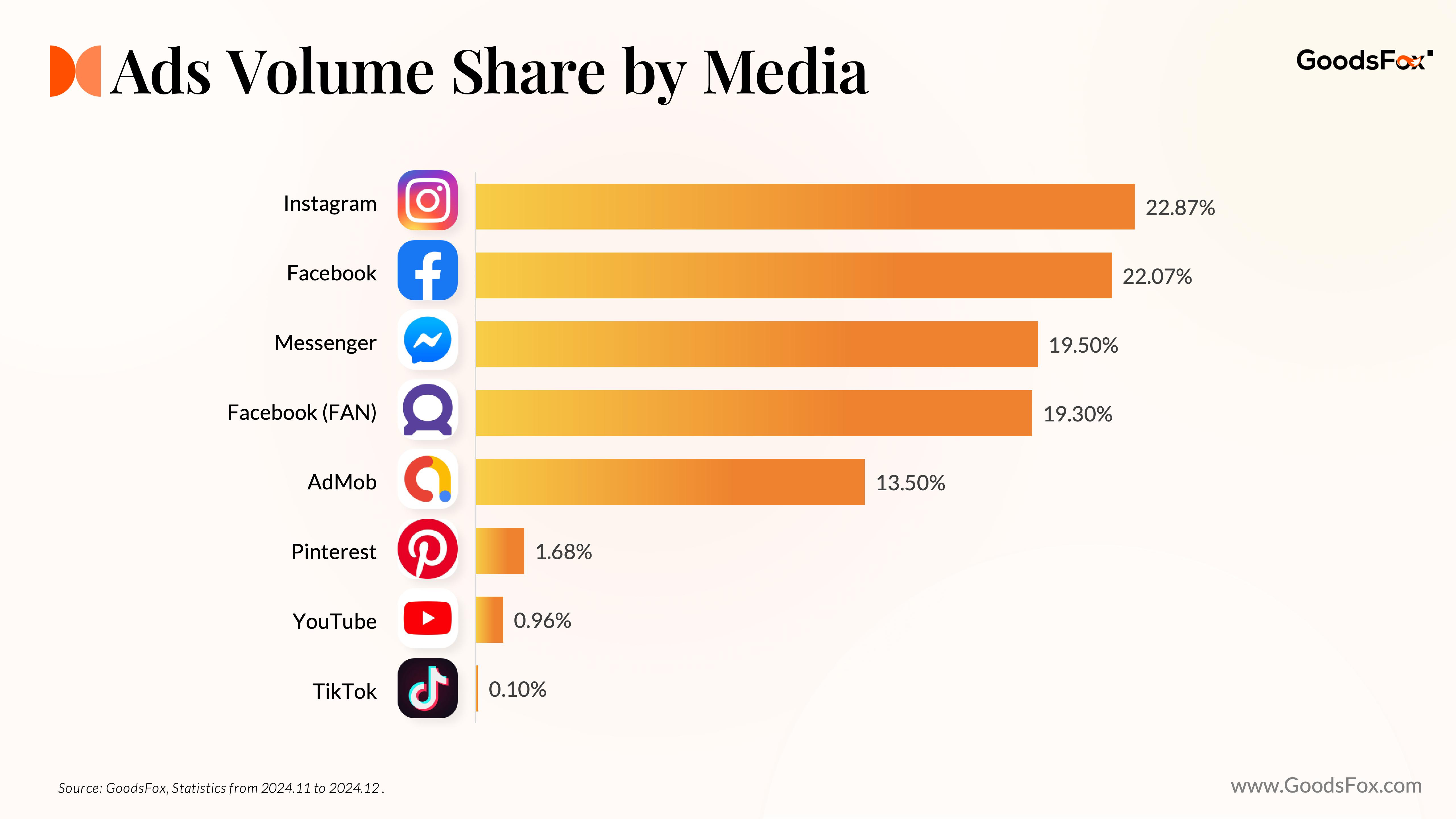

3. Ads Volume Share by Media

Mobile shopping continues to grow in Europe. In 2023, over 55% of online traffic came from mobile devices. Platforms like AdMob see higher adoption due to strong compliance capabilities and Google’s technological support.

Pinterest stands out as a high-intent platform for inspiration in home decor, fashion, and travel. Unlike many social platforms, Pinterest users often search with clear purchase goals, boosting conversion rates. For example, searching “living room decor” or “wedding planning” indicates precise consumer intent, making it an effective channel for advertisers.

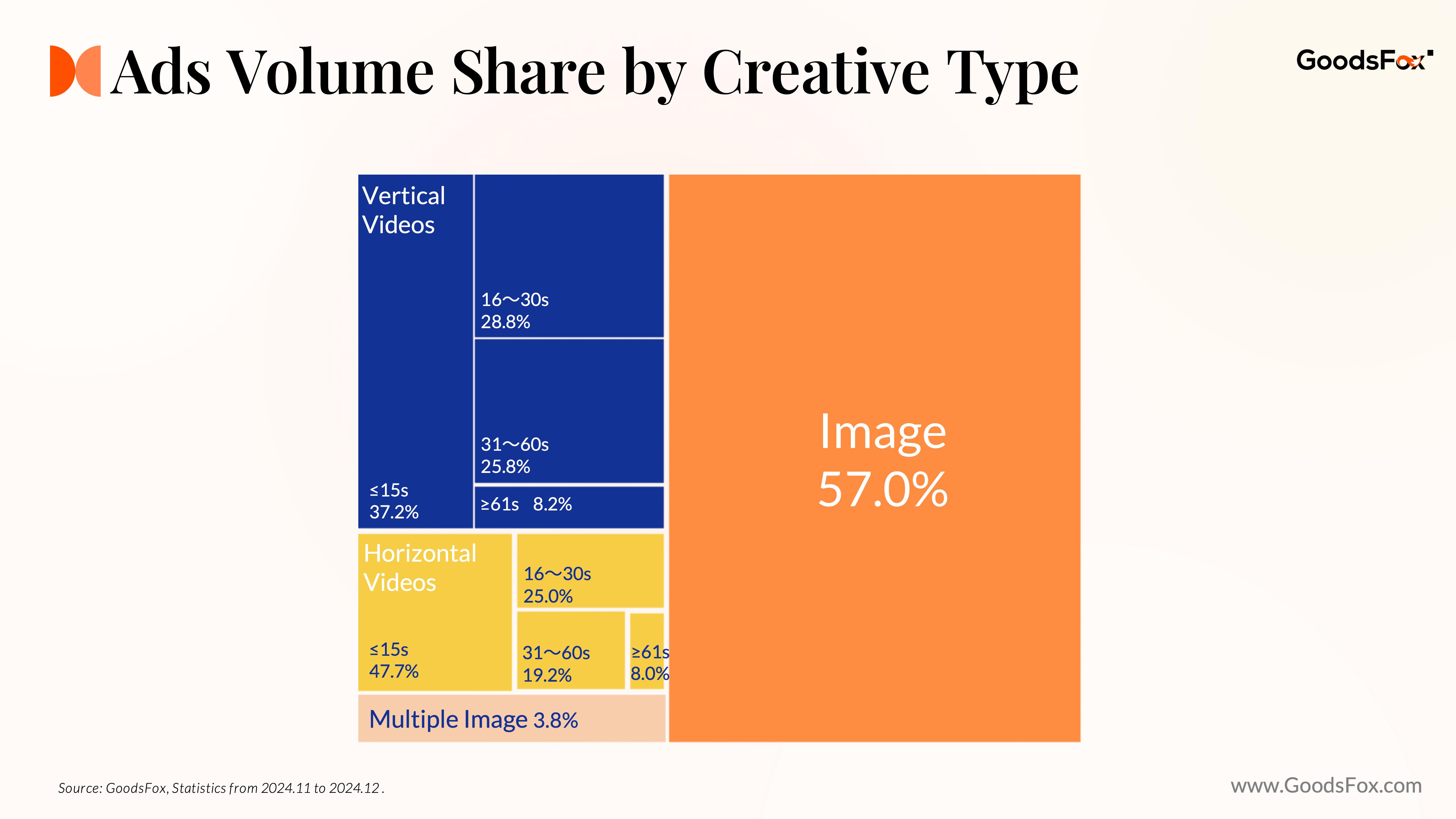

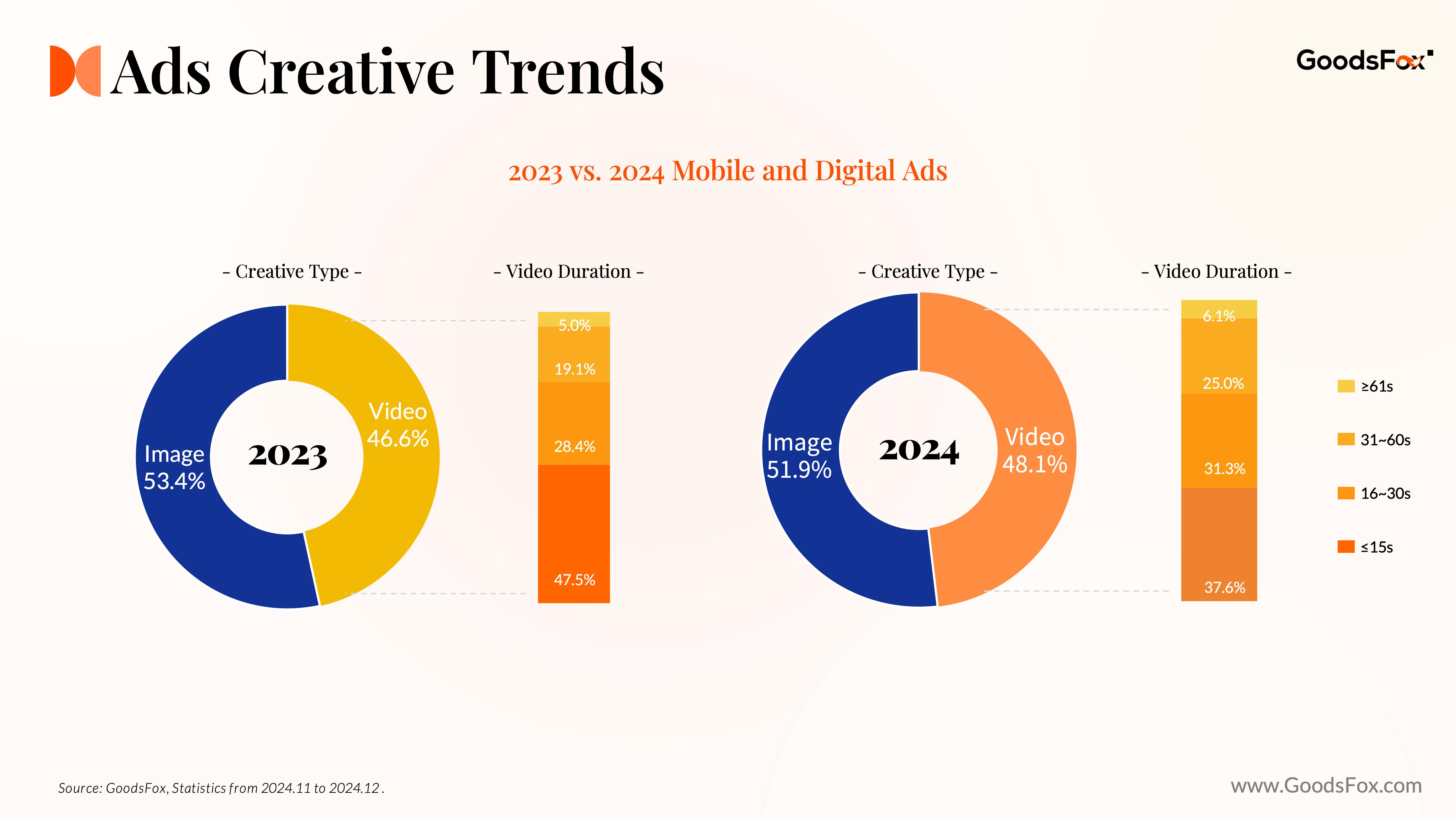

4. Ads Volume Share by Creative Type

Landscape videos dominate ad formats in Europe, given the continued reliance on PCs. Short videos (≤15s) are the most popular format across devices, especially in Western Europe (UK, Germany, France), driven by platforms like TikTok, Instagram Reels, and YouTube Shorts.

Carousel ads see less use in Europe compared to single-image creatives, likely due to their longer conversion paths and reliance on user interaction.

III. Marketing Analysis for Mobile and Digital Products in Europe

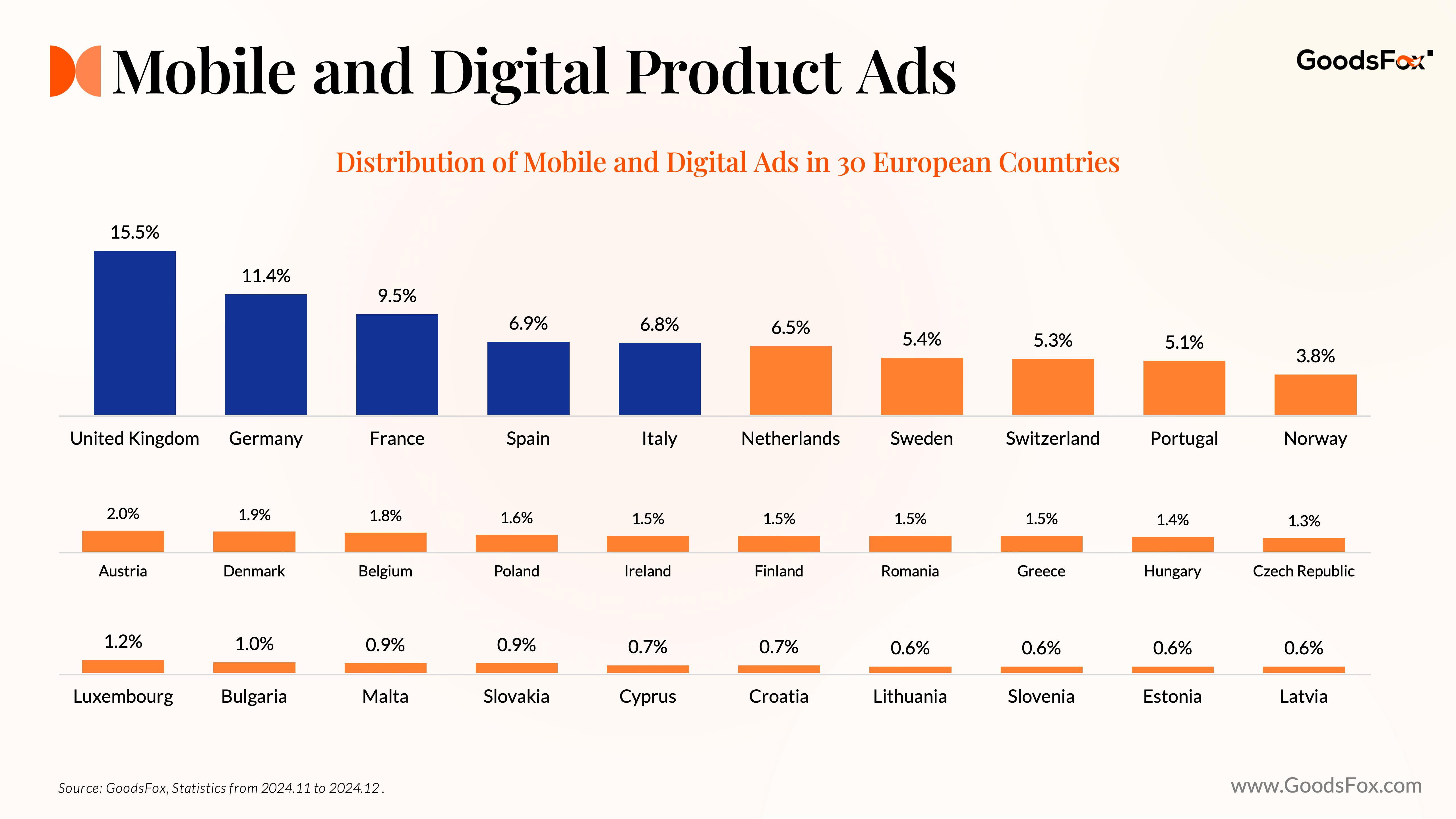

1. Ad Distribution in the Mobile and Digital Category

Europe's consumer electronics market shows steady growth. It’s projected to reach $647.34 billion in 2024, with an 8% CAGR through 2029, totaling $951.16 billion. However, the fragmented market reflects regional diversity:

- UK: High digital adoption and a wide mobile user base foster strong interest in new products.

- Germany: As Europe’s industrial hub, consumers prioritize technological innovation.

- Southern Europe (e.g., Spain, Italy): Lower income levels favor value-for-money brands like Xiaomi and OPPO.

TikTok Shop has launched in major markets like the UK, Germany, France, and Spain, reflecting its growth potential. These countries, along with Italy, dominate mobile and digital ad investments.

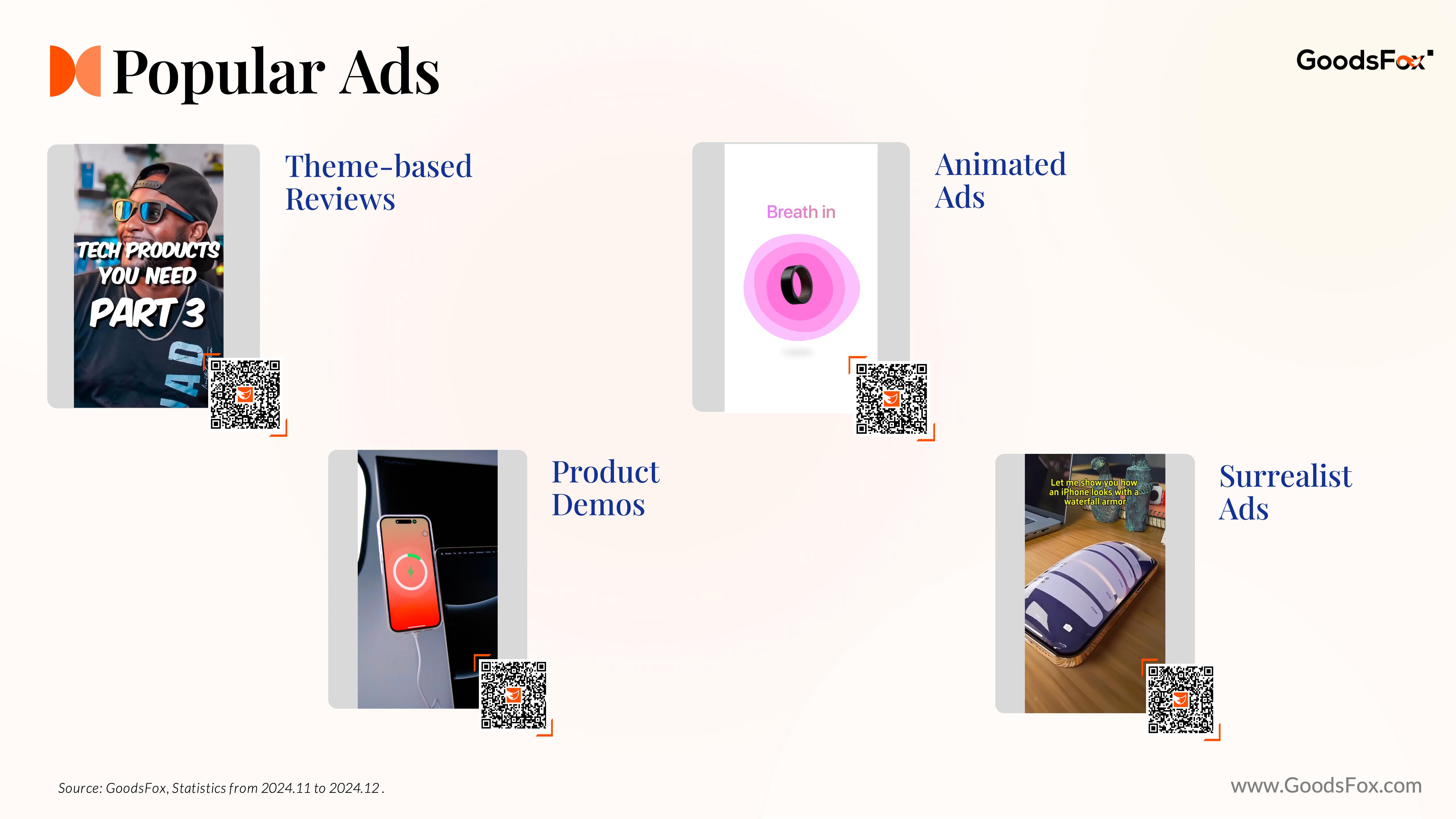

2. Trends in Ad Content for Mobile and Digital

Ad strategies in this category highlight innovation and practicality, aligning with regional consumer behavior. Video ads emphasize product features and user scenarios to drive engagement, especially among younger, tech-savvy audiences.

Short-form content, including demos and tutorials, performs best across platforms like TikTok and YouTube. High-quality visuals and storytelling also resonate with European consumers, emphasizing brand value and trustworthiness.

Get the Full Report

Connect with me on LinkedIn to download the complete PDF version and stay ahead in the e-commerce game.