2025.3.4 GoodsFox Daily E-commerce News:

- The Foldie Foldable Travel Bag Captures Europe’s Aging Market

- Temu’s MFI Crackdown: 90% of Banned Listings Stay Blocked

- China Plans Tariff Retaliation Against U.S.

- Amazon Launches AI-Driven Rufus Ads

- Global Smart Audio Sales Jump 11.2% in 2024

1. The Foldie Foldable Travel Bag Captures Europe’s Aging Market

GoodsFox data reveals that The Foldie, a premium foldable travel bag targeting high-end markets, is gaining explosive traction among Europe’s middle-aged and elderly consumers. Over the past 30 days, its Standalone Website's ad creatives saw a staggering 5,030% increase in Europe, with campaigns specifically targeting women aged 55-64. Priced at €99.94, the bag features a patented foldable design and military-grade abrasion-resistant fabrics for expandable storage. Key selling points like “one-click folding” and “airline carry-on compliance” are highlighted in ads, coupled with authentic reviews from senior influencers, successfully tapping into the niche “empty nest parent travel” market. The product now tops travel gear charts across Europe and may become a staple for elderly travelers this summer.

Source: GoodsFox

2. Temu’s MFI Crackdown: 90% of Banned Listings Stay Blocked

Temu sellers recently face severe penalties for non-compliant product certifications or misleading claims, including listing removals, fines, and store suspensions. Apple MFI copyright violations are under strict scrutiny: 90% of delisted products fail to regain approval. Sellers must submit complete screenshots of brand certifications from Apple’s MFI official website, along with trademark authorization documents matching the brand name on packaging. Any unauthorized use of “Apple-related elements” in product pages, packaging, or ads is strictly prohibited.

3. China Plans Tariff Retaliation Against U.S.

Insiders report that China is drafting retaliatory measures—including tariffs and non-tariff actions—to counter the U.S.’s proposed 10% tariff hike on Chinese goods over fentanyl concerns. Agricultural and food products imported from the U.S. are likely targets. The source emphasized that China will “respond decisively with forceful countermeasures” if the U.S. proceeds unilaterally.

4. Amazon Launches AI-Driven Rufus Ads

Amazon continues to innovate in AI with its new Rufus ads, integrated into the Rufus shopping assistant tool. When shoppers ask Rufus for product advice, sponsored listings now appear in search results. As Rufus evolves into a primary shopping entry point—potentially surpassing traditional search bars—sellers must adapt their traffic strategies, ad logic, and listing optimizations. Early adopters could unlock significant sales growth.

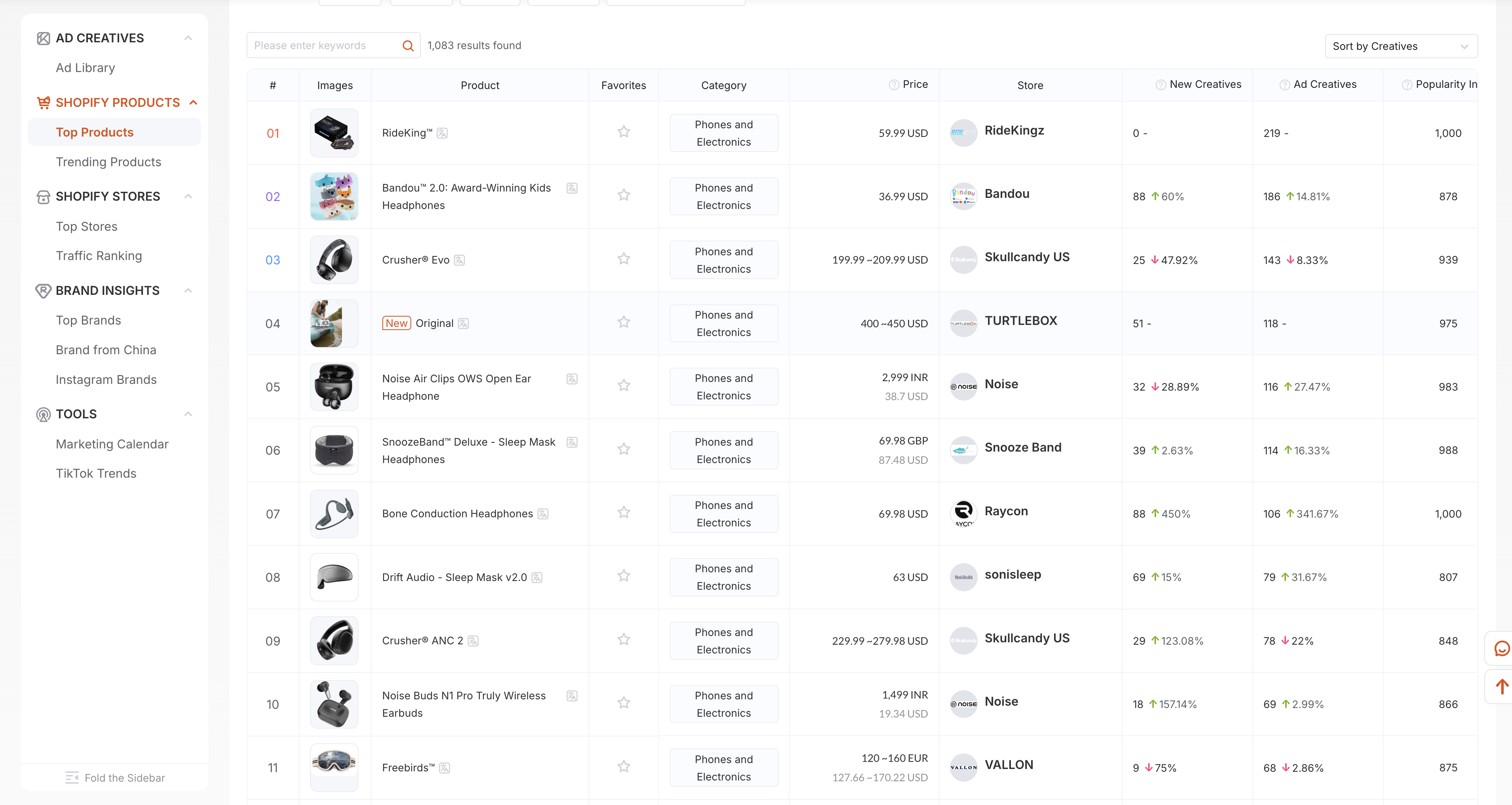

5. Global Smart Audio Sales Jump 11.2% in 2024

According to Canalys, global smart audio shipments (including TWS, wireless headphones, and earbuds) reached 455 million units in 2024, up 11.2% year-on-year. China and emerging markets (Asia-Pacific, Latin America, Middle East, and Africa) are key growth drivers. Canalys predicts shipments will exceed 500 million by 2025. Established brands like Sony, Bose, and Edifier dominate 25% of the premium wireless headphone market with advanced audio tech, while newcomers like Shokz and Cleer Audio target fitness enthusiasts with open-ear designs. AI translation-enabled earbuds are also gaining traction overseas. Regionally, Greater China leads with 22% growth, followed by Asia-Pacific (19%), EMEA (10%), and Latin America (7%).

Source: GoodsFox

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/