On September 17, Jerome Powell walked onto the stage and said the most expensive words of the year: “Good afternoon.”

Wall Street jokes that when Powell opens with “Good afternoon,” it signals a hawkish tone. If he says “Hello everyone,” it’s usually dovish.

This time, it was indeed “Good afternoon.”

Other central bankers also send signals through small gestures. Russia’s Elvira Nabiullina wears a dove brooch for dovish speeches and an eagle brooch for hawkish ones. These details reinforce personal branding. Buffett has his Coca-Cola, NBA legends have their cigars, and Powell has his words.

Back to business. The Fed cut its benchmark rate by 25 basis points to 4.00%-4.25% and hinted at two more cuts this year.

For global businesses—and especially cross-border sellers—what does this mean?

1. What Does a Rate Cut Mean?

On the surface, a rate cut means cheaper loans and lower returns on savings.

But U.S. banks are not state-owned. The Fed cannot force them to lower lending rates. Instead, the Fed adjusts the federal funds rate—the cost banks pay to borrow from each other overnight.

By lowering this target range, the Fed reduces the “price of money” across the system.

In theory, this encourages capital to flow into consumption and investment. That’s the textbook story.

But what’s the real impact on global e-commerce businesses?

2. The Cross-Border Balance Sheet

For exporters and cross-border sellers, a Fed rate cut creates both opportunities and risks.

If your business relies on dollar financing—large sellers, supply chains, warehouses, or brand factories—your cost of capital goes down.

Capital-intensive industries like tech, internet, and commodities also benefit.

Lower rates can stimulate U.S. consumer demand. With borrowing cheaper, Americans may spend more and even take on loans for consumption.

The timing matters. Ahead of the holiday season, rate cuts send a positive signal to consumer sentiment.

But a weaker dollar is the downside. For sellers earning in dollars and spending in RMB, exchange rates can erode profit margins.

For example, a product selling at $100 with a 50% margin. At 7.20 CNY/USD, profit is about 360 yuan. At 7.10, it drops to 355 yuan. That’s just 5 yuan per unit, but if you sell 10,000 units a month, it’s 50,000 yuan lost—roughly half a year’s salary for an employee.

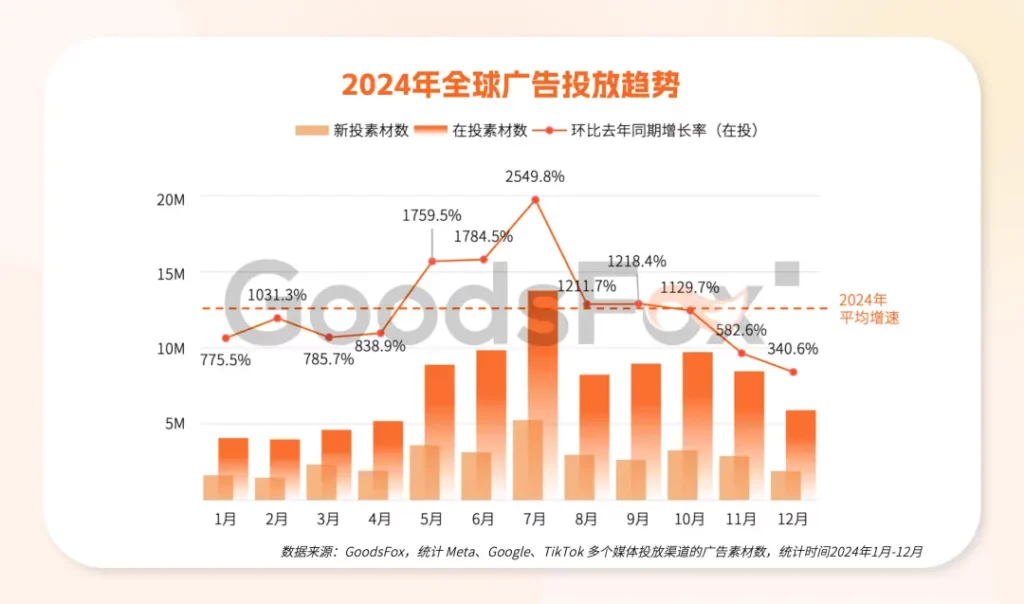

Another challenge is “ad inflation.” More liquidity means more ad budgets. Meta, Google, and TikTok CPCs may rise as competition intensifies.

Our data shows health products usually rise steadily into year-end. Growth potential here remains strong.

3. Will This Black Friday Be Hotter?

In theory, rate cuts boost U.S. consumption.

But real results depend on inflation.

Powell admitted inflation pressure is building, driven mainly by rising goods prices. He expects these pressures to grow through this year and next.

In plain words: inflation is rising, but the Fed is prioritising growth and jobs.

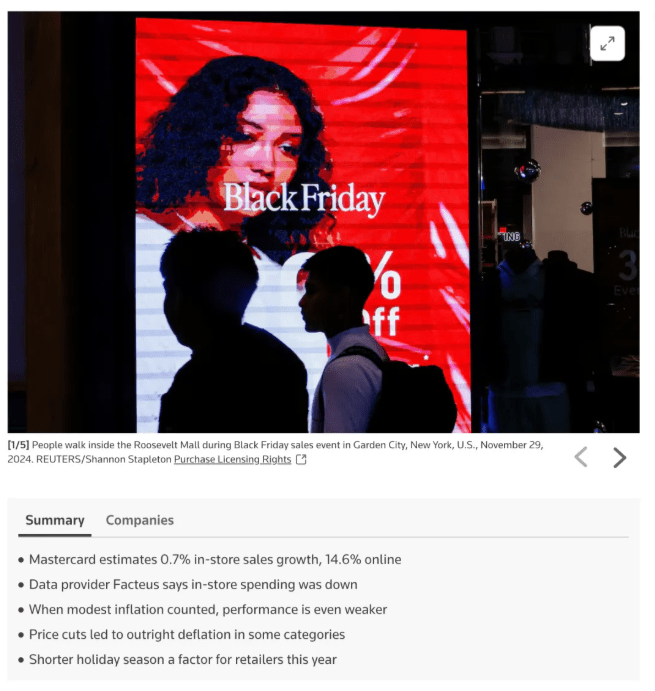

Last year is a useful reference. The Fed cut rates three times, even once by 50 basis points in September. Yet Black Friday sales growth was modest.

Reuters reported U.S. Black Friday sales grew 3.4% in total. Online sales rose 14.6%, while offline sales barely grew 0.7%. After inflation, offline sales actually fell.

So rate cuts don’t guarantee a spending boom. Cross-border sellers should remain cautious.

Promotional seasons like Black Friday and Cyber Week are longer now. Consumers are pickier, and ad costs keep rising.

In the end, inflation, wages, and living costs matter more to spending than interest rate policy.

4. Strategy for Sellers

After a rate cut, a weaker dollar is almost inevitable.

Sellers must review pricing strategies carefully. Avoid blindly lowering prices. Hedge against FX risks and plan settlements early.

Ad costs are likely to rise. Precision targeting and ad monitoring will be critical. Our annual report “Global E-commerce Growth Playbook 2025” shows last year’s ad cycles shifted compared to previous years.

Liquidity in the system also means more chances. Brands should leverage this period for expansion, funding, and branding.

In the overlap of capital, FX, and consumer cycles, sellers must find their own survival space.