The e-commerce sector is flourishing. Within the Global DTC Brand Report, we've identified the market strategies fueling the brands growing. Ulike, the "Global Follicle Sweeper," tops TikTok ads, sweeping sales boards. Raycon's high-performance earphones and GTHIC's gothic accessories find niche market success.

The apparel sector diversifies. Outdoor, shaping, and plus-size categories show potential and demand.

GoodsFox has released the "2024 First Half DTC Independent Station Promotion Trend Report", bridges information gaps, guiding merchants through market trends.

-

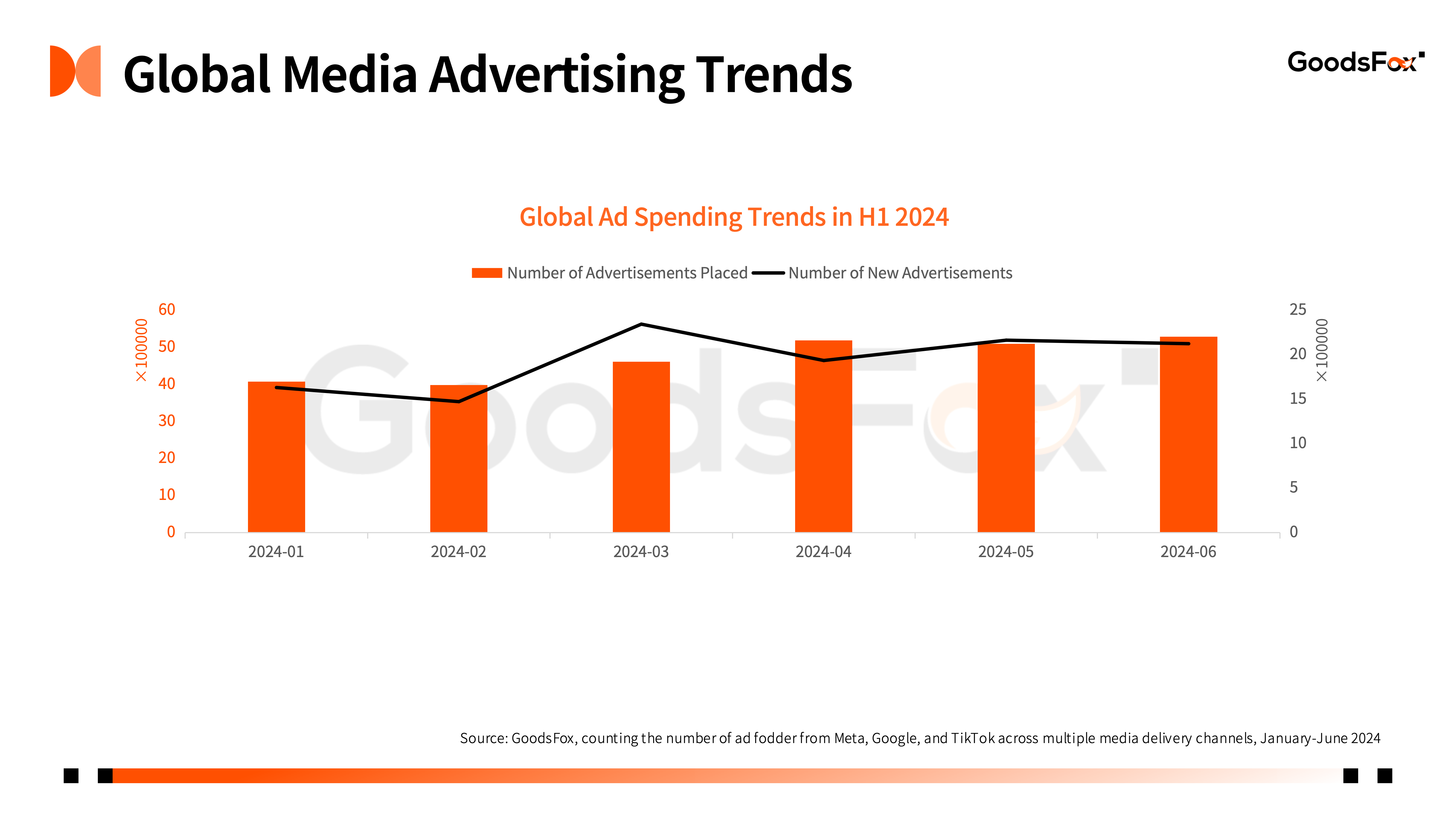

Q2 Market Revival

New ad materials in Q2 signal market activity. A clear growth trend in global e-commerce ads marks 2024's first half. March sees a rise in ads with new products and spring promotions. April peaks for Mid-Year Promotion prep.

-

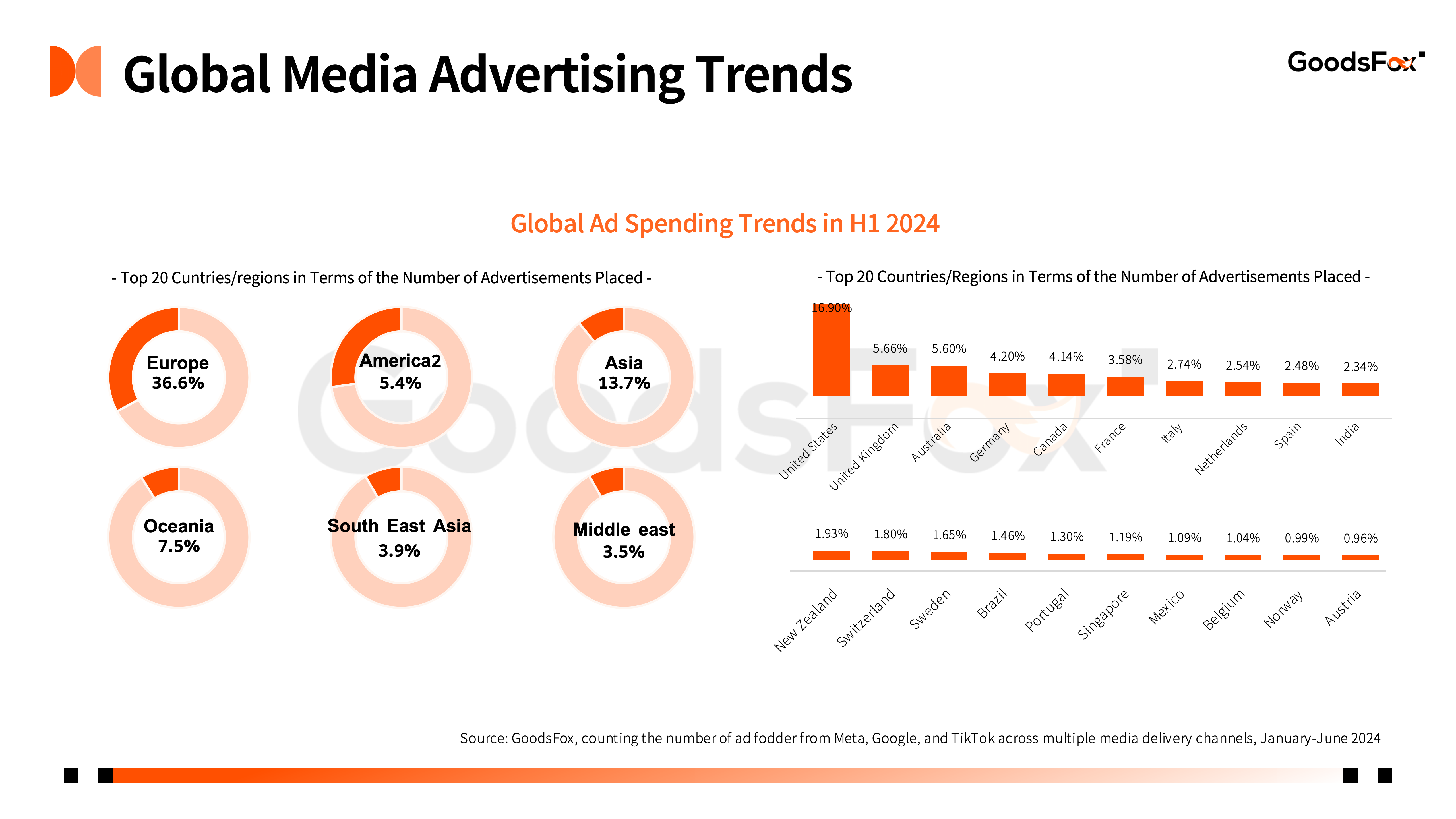

Europe and U.S.: Top Ad Spenders

European and American markets lead ad spending. Over 60% of investments target these regions. Southeast Asia emerges, requiring localized strategies.

-

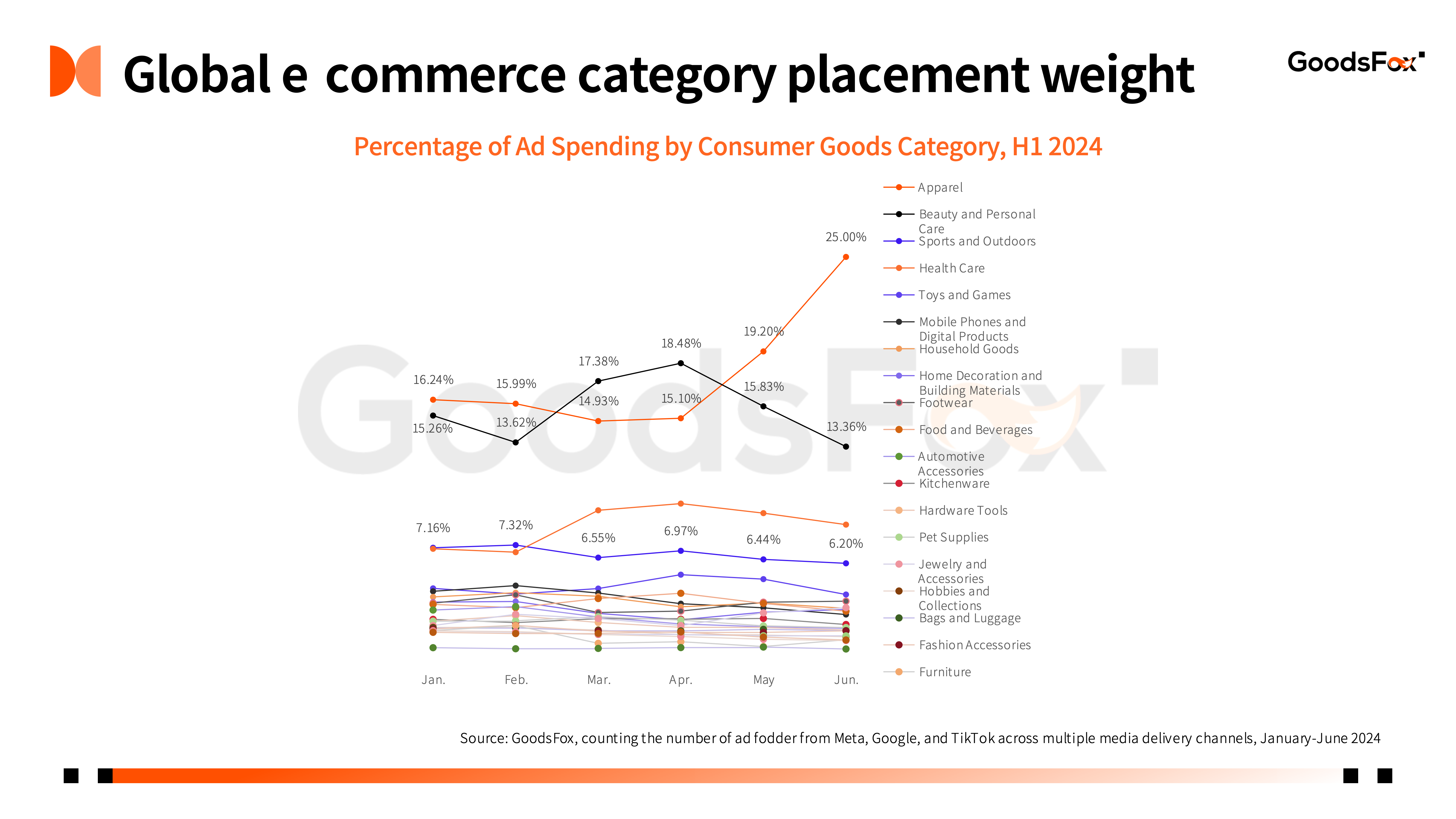

Apparel and Beauty Dominate Ads

Clothing and beauty ads dominate. Seasonal demand and market competition drive this trend. Independent station sellers must invest in seasonal changes for revenue.

-

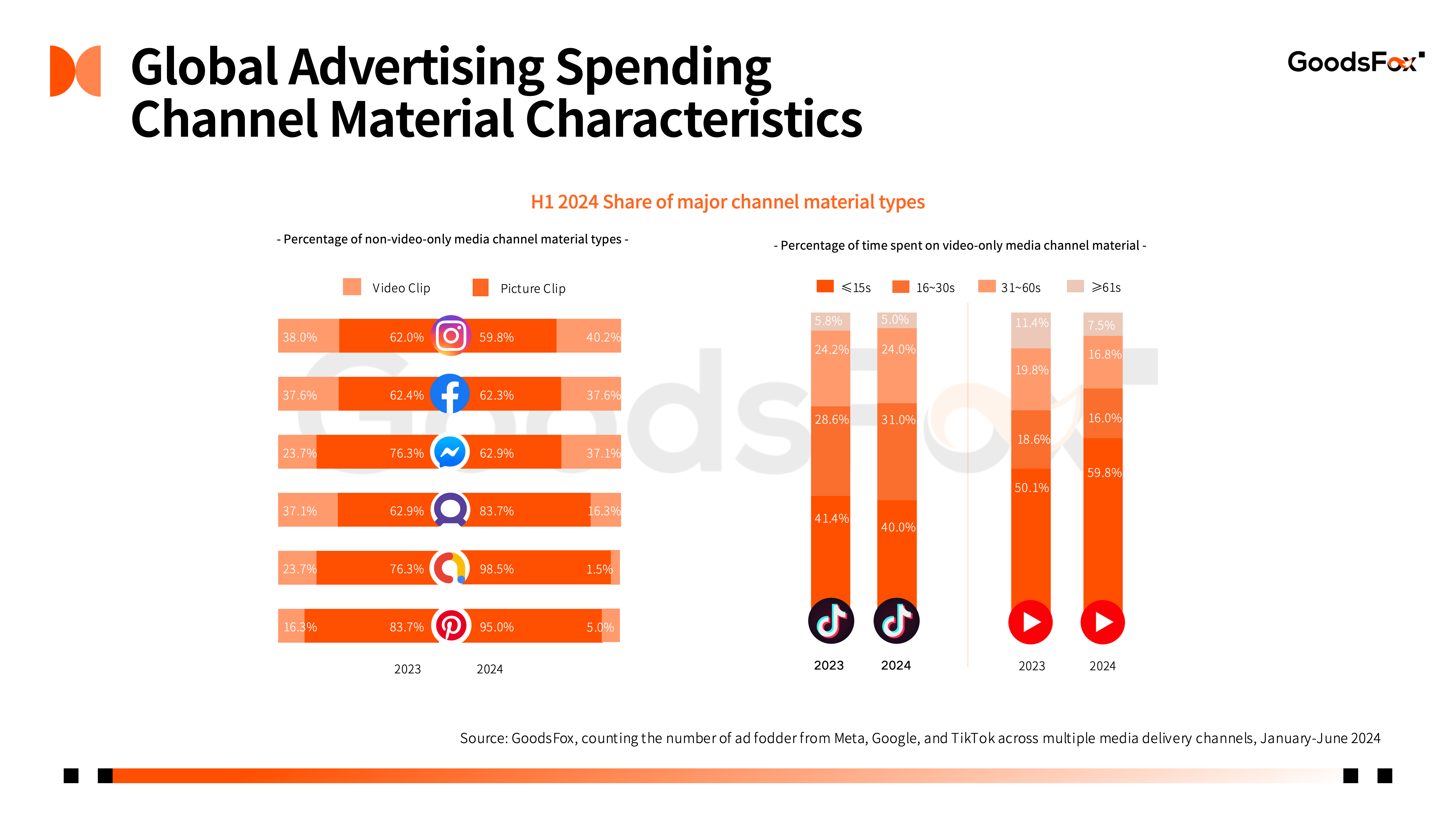

Video Content Rises

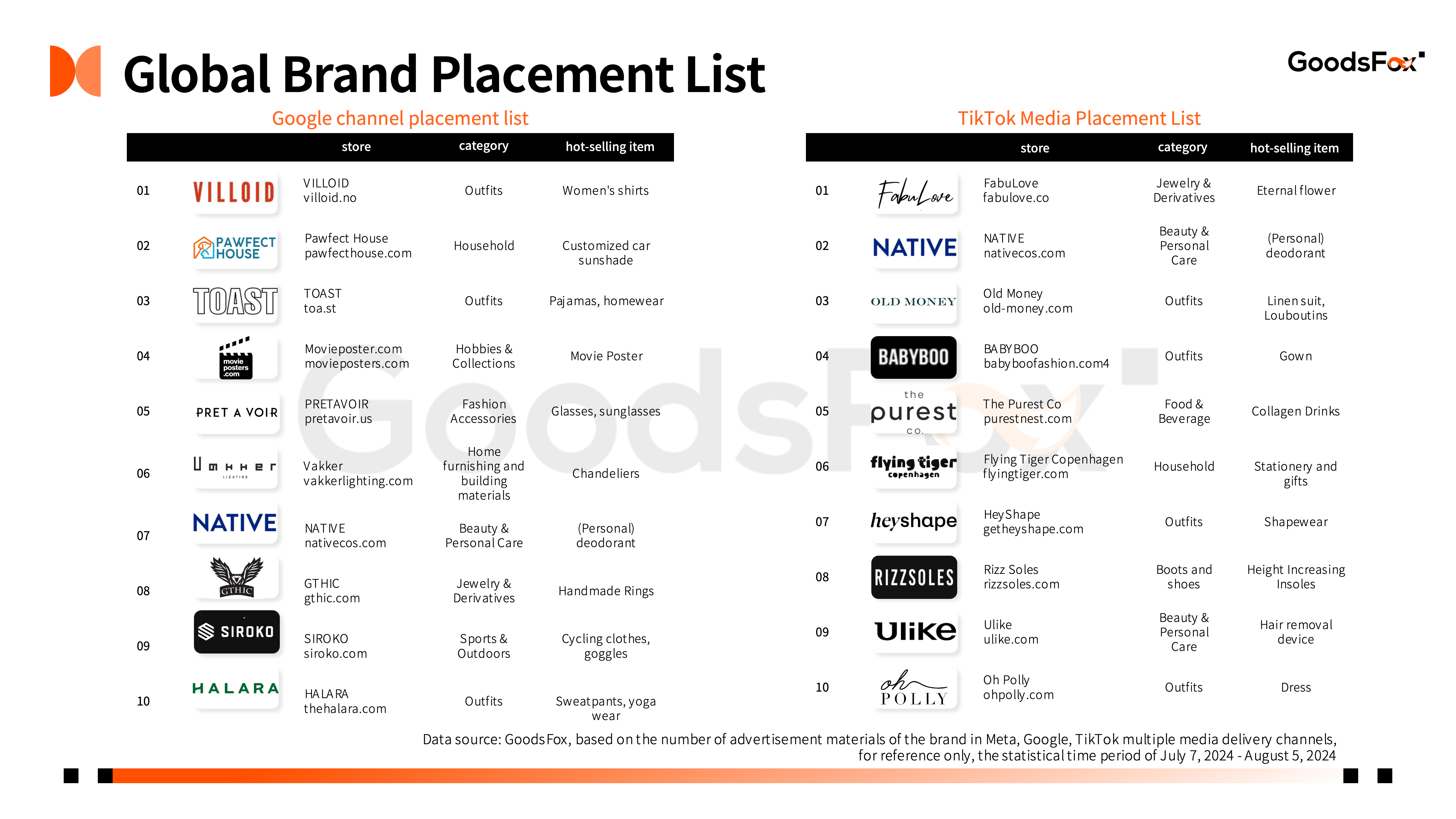

Video material increases on platforms like Facebook. Yet, image content retains its messaging edge. Advertisers must tailor strategies to channel user habits.

-

DTC Brands Diversify

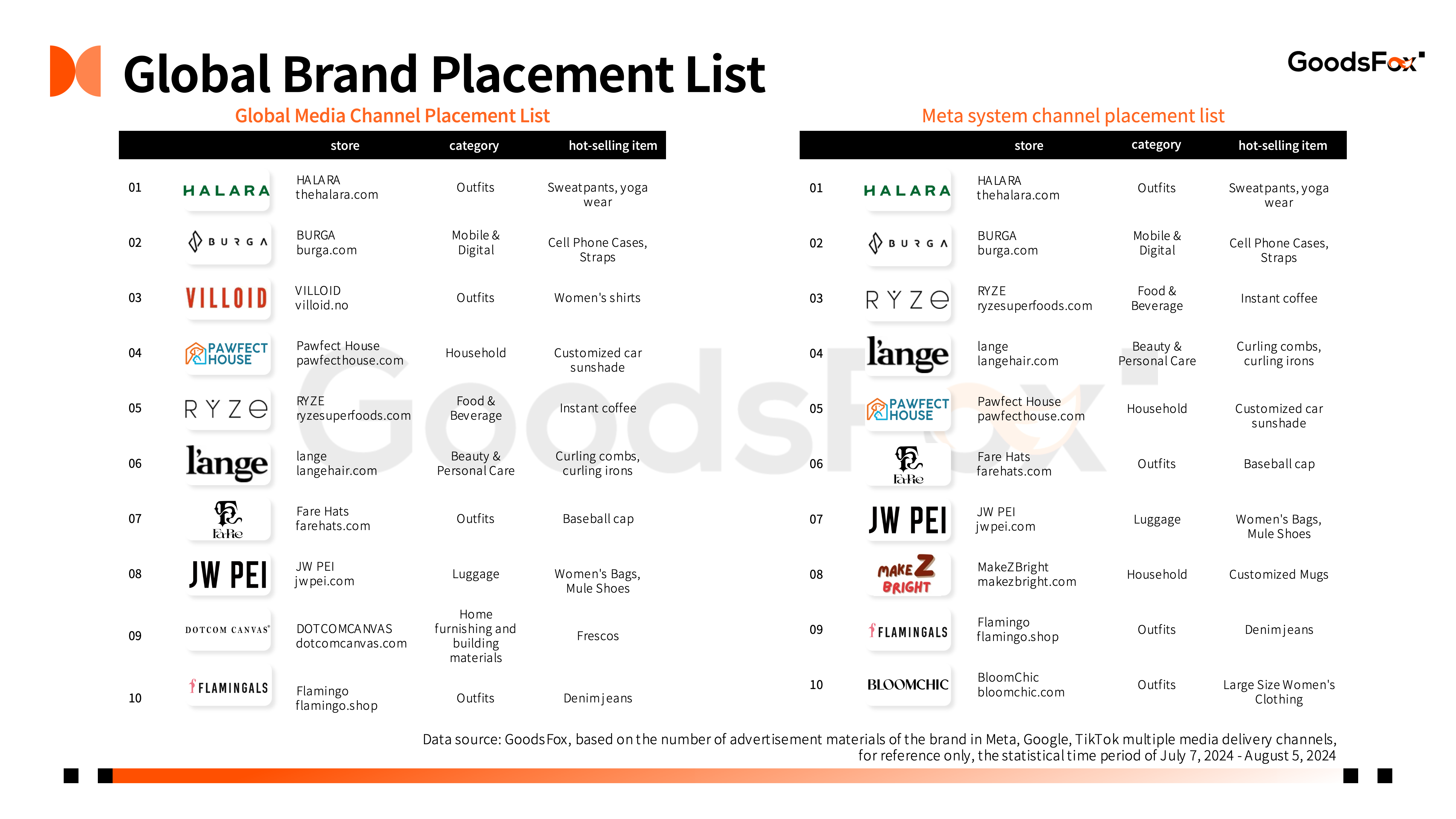

Top DTC brands diversify, breaking through segmentation. Cell phones and digital, household, food and beverage, beauty and personal care, etc., showing a diversified consumption trend. Consumer demand for global e-commerce is no longer limited to traditional popular categories, and there are market opportunities in all areas.

The apparel category continues to dominate the advertising landscape, with a growing trend towards segmentation. This segmentation strategy is not only applicable to the apparel category, but DTC brands in other sectors have also demonstrated similar market positioning, such as Pawfect House, which focuses on customized products, lange, which is dedicated to curly hair care, and DOTCOMCANVAS, which focuses on the decorative mural market. These brands have found a way to differentiate themselves from the competition by pinpointing their market segments.

Focusing on market segments helps build brand image, but for brands to realize long-term development, they need to break through category limitations and expand broader market space through brand influence.

-

The "beauty economy" is hot

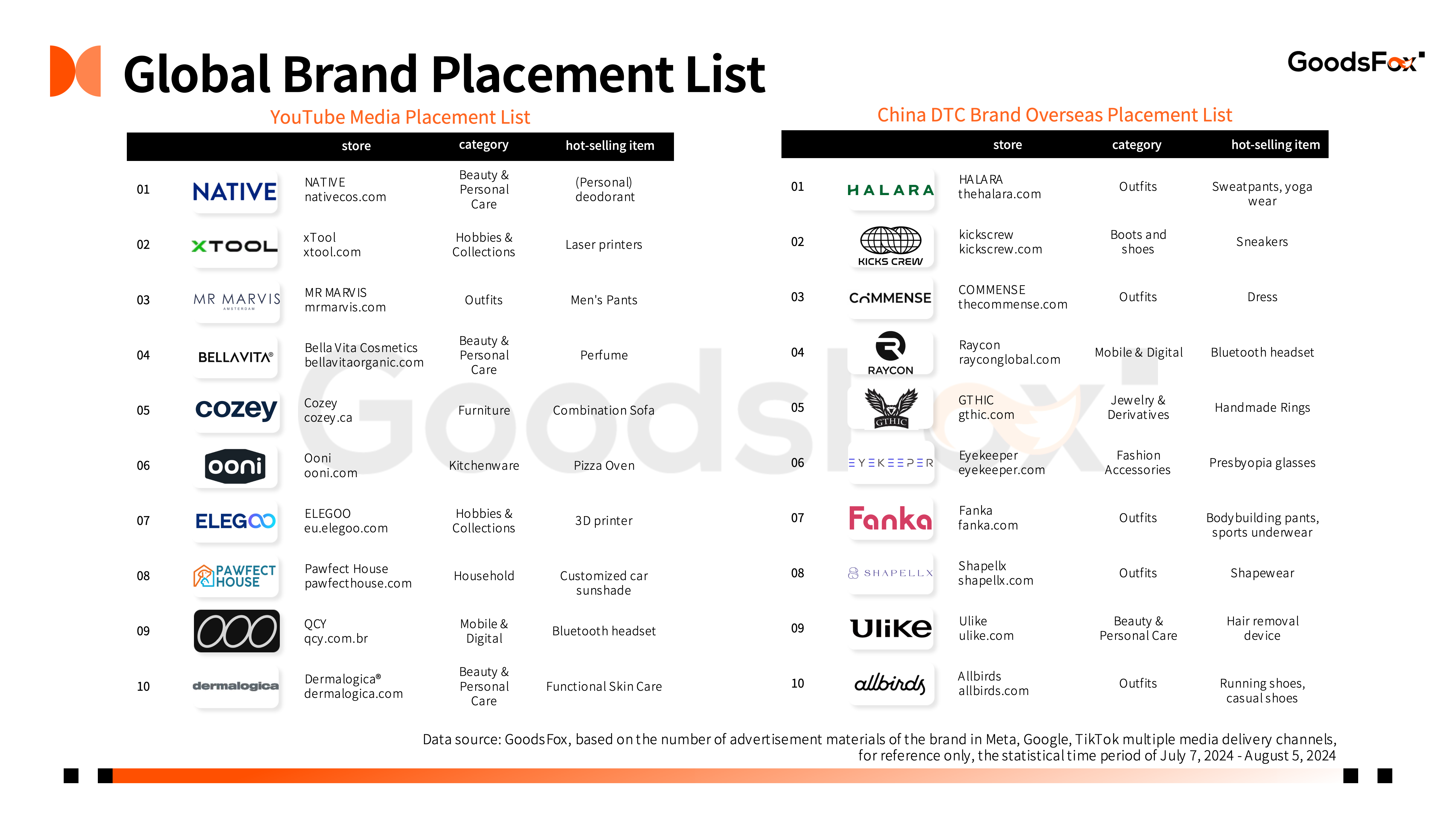

The apparel and footwear category has a strong performance in overseas placement, occupying the top 3 positions of the head placement brands.

From the perspective of category focus, the "beauty economy" is particularly prominent, with products such as bodybuilding pants, shapewear, and hair removal devices.

At the same time, new categories are also emerging in the international market. More and more domestic FMCG brands are going to the sea to explore the gold and have achieved remarkable results.

"Made in China" expands globally.