01 Beauty and Personal Care Advertising Market

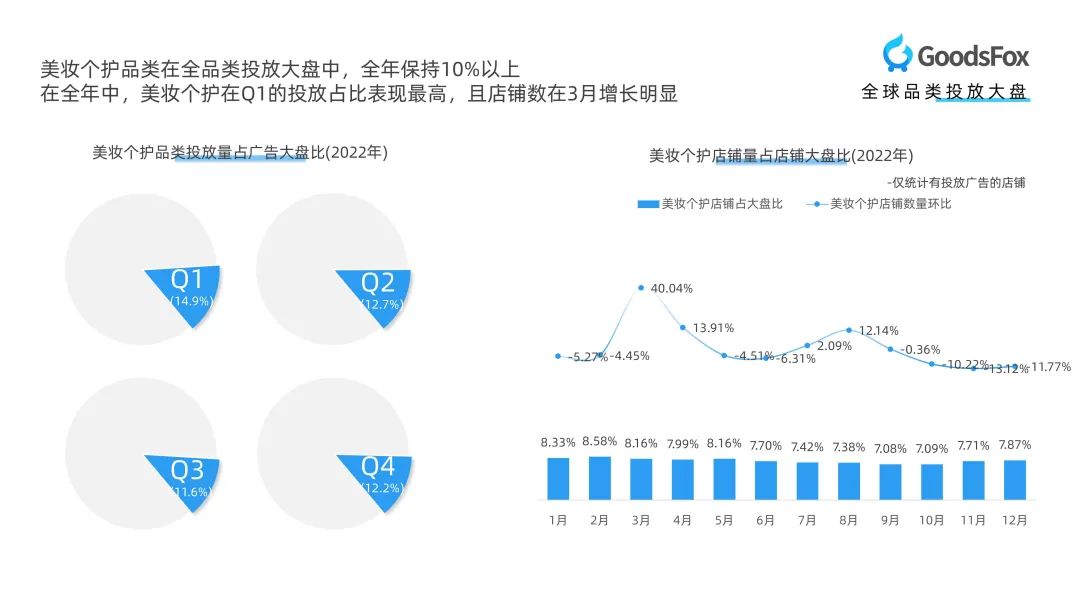

Throughout 2022, global beauty and personal care products (mobile media) maintained a share of over 10% in the overall product category for advertising and promotion, making it the category with the largest advertising and promotion volume, apart from clothing. Looking at the proportion of advertising and promotion in each quarter, the largest investment in beauty and personal care was in Q1 of 2022, accounting for 14.9%. The lowest proportion was in Q3 of 2022, accounting for 11.6%.

In terms of the number of stores with advertising and promotion, the beauty and personal care category accounted for over 8% of the overall product category. The number of stores in this category rose by over 40.04% in spring, specifically in March of 2022. This also reflects the fact that the period from March to May is an active season for marketing and promotion of beauty and personal care products, with high market demand.

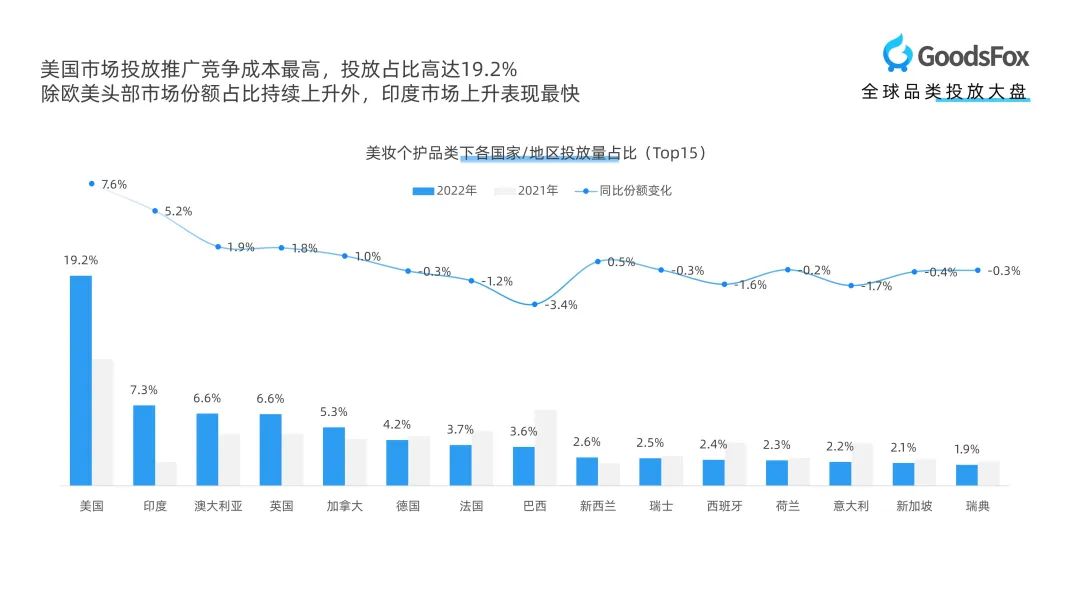

Looking at the global market performance, Europe and the United States are still the main areas for advertising and promotion of beauty and personal care products. For example, the United States, which has the largest advertising investment, accounts for 19.2% of the global advertising share, followed by Australia and the UK, accounting for 6.6% each. In addition to Europe and the United States, there are also many emerging markets that sellers should pay attention to, such as India, which is ranked second with a rapidly increasing advertising share of 7.3%. There are also Brazil (3.6%) and Singapore (2.1%), among others, which indicates that the demand for beauty and personal care products in these new markets is constantly increasing, attracting more and more sellers to join.

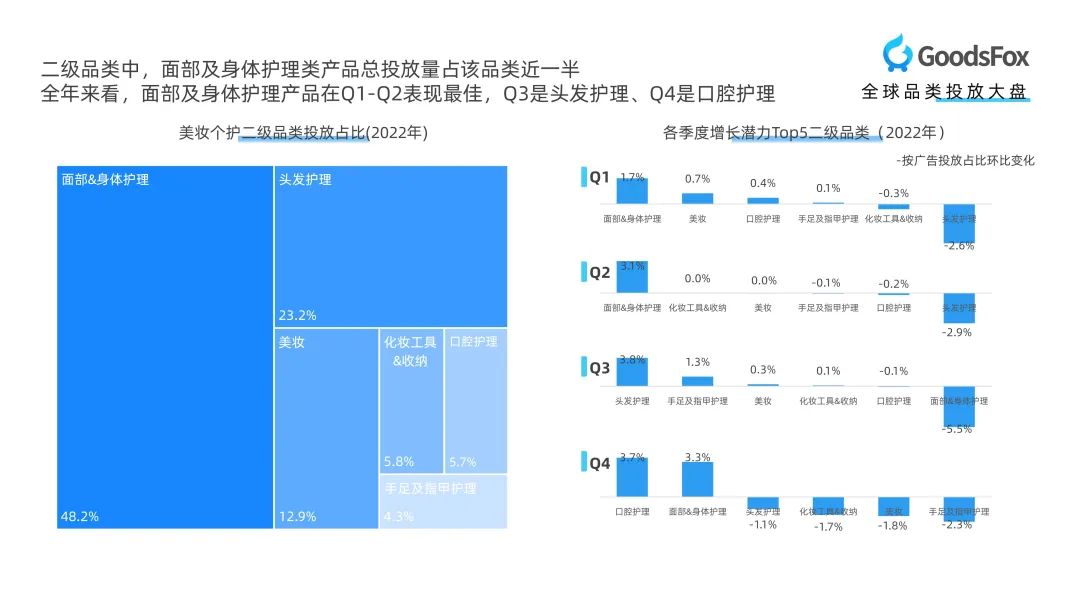

Looking at the sub-categories of beauty and personal care, the advertising and promotion share of facial and body care products is the highest, reaching 48.2%. Hair care products come second, accounting for 23.2%. In terms of the fastest-growing product categories in each quarter of 2022, facial and body care products had the fastest growth in Q1-Q2, hair care in Q3, and oral care products in Q4.

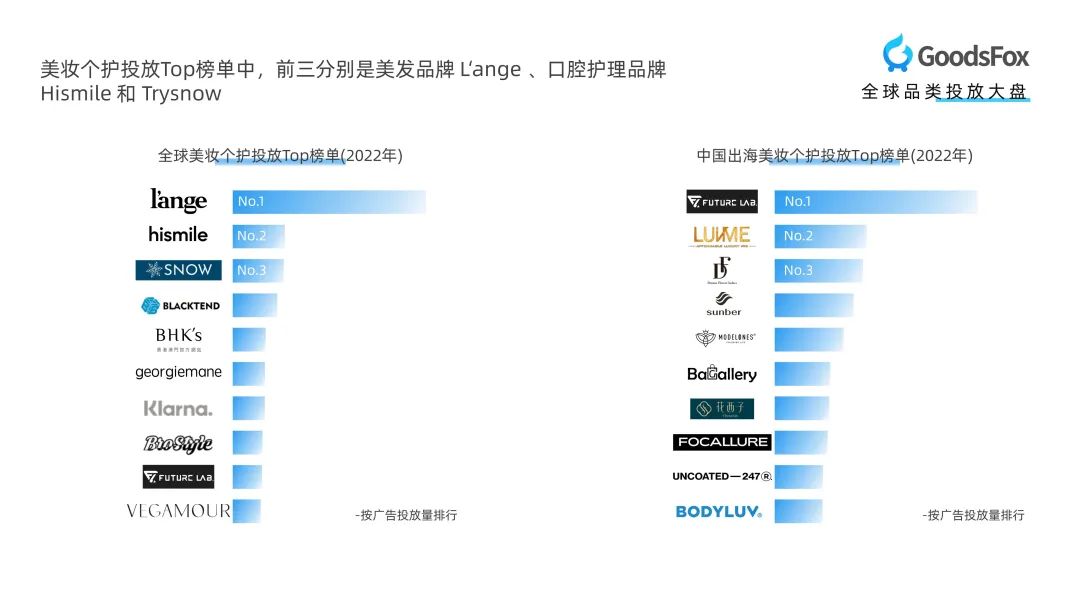

Looking at the global top brands in advertising and promotion for beauty and personal care, Lange, a brand specializing in hair care products, had the highest advertising investment and promotion volume, followed by two brands specializing in teeth whitening products, Hismile and Snow. Overall, there are relatively few Chinese brands in the global top advertising list, reflecting the intense competition among the leading brands in the beauty and personal care category.

02 Key Market and Marketing Analysis of Beauty and Personal Care.

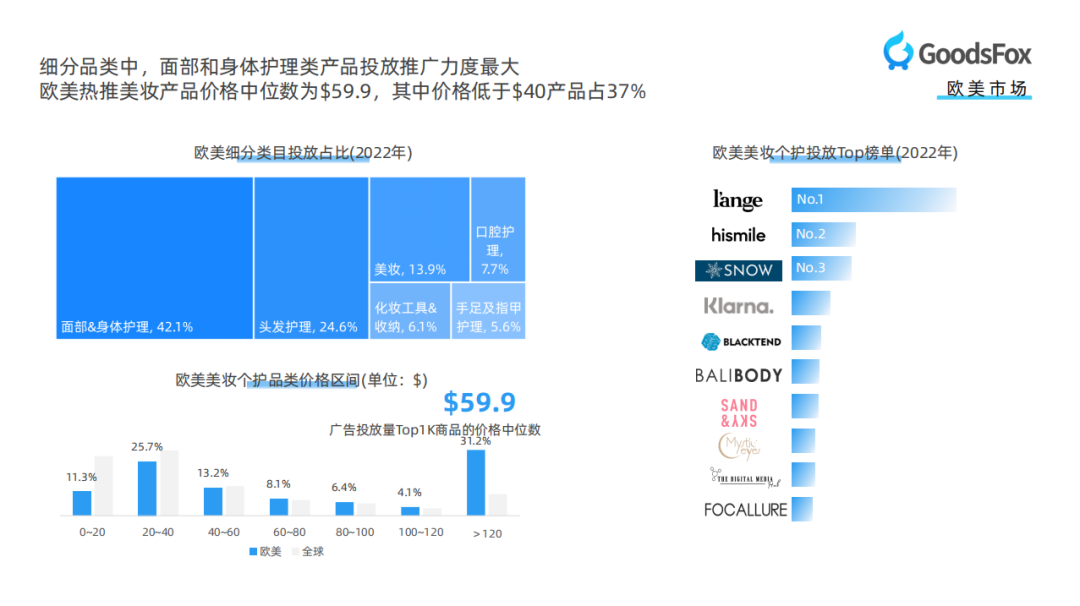

In the European and American markets, the top 3 popular beauty and personal care subcategories are facial and body care products (42.1%), hair care products (24.6%), and makeup products (13.9%). In terms of price, the median price of the top 1,000 beauty and personal care advertisements in Europe and America is $59.9, with 25.7% of the products priced between $20-40. The top 3 brands in the beauty and personal care advertising list are Lange for hair care products, Hismile and Snow for teeth whitening products.

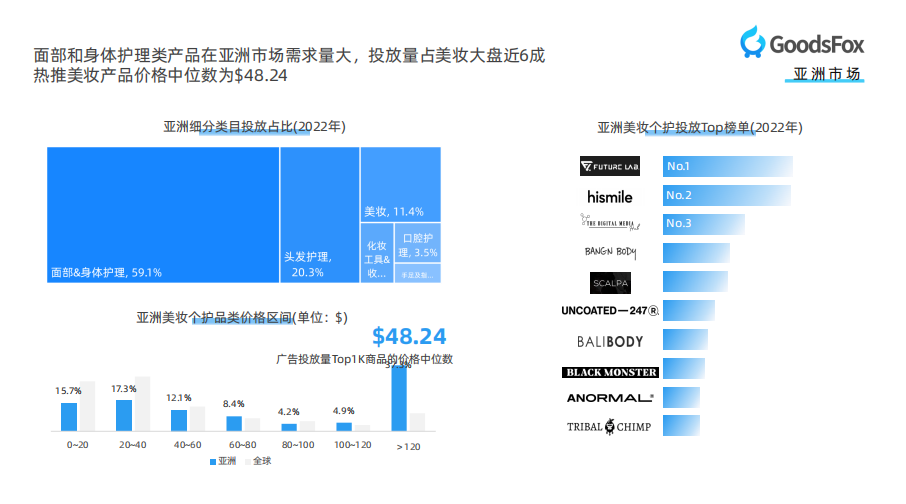

In the Asian market, facial and body care products are heavily promoted, accounting for 59.1%. The second is hair care products, accounting for 20.3%. The lowest proportion is hand, foot and nail care products, accounting for only 1.8%. In terms of price, the Asian market is lower than Europe and America. The median price of the top 1,000 promoted products is 48.24%, with 33.0% of the products priced below $40. In the brand advertising list, the top 3 brands are Futurelab, Hismile and The Digital Media Hub.

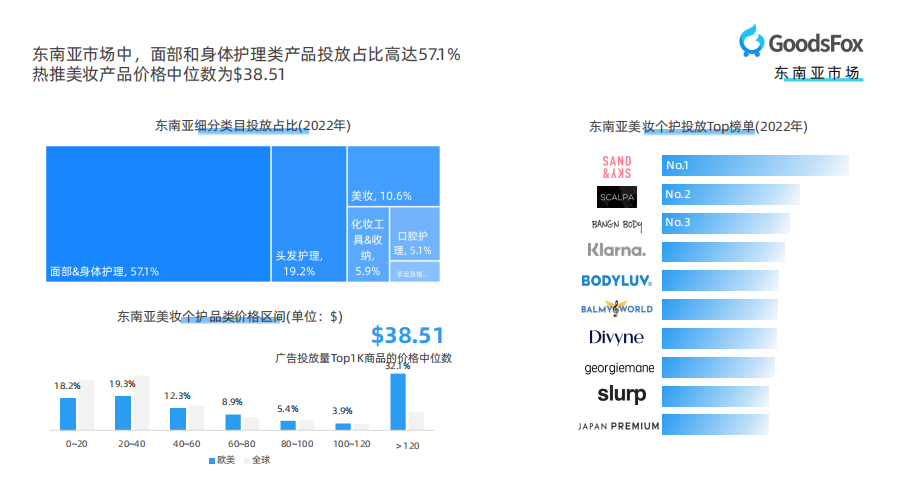

In the Southeast Asian market, the top 3 popular beauty and personal care subcategories are facial and body care products (57.1%), hair care products (19.2%), and makeup products (10.6%). In terms of price, the median price of the top 1,000 beauty and personal care advertisements in Southeast Asia is $38.51. Among them, 37.5% of the products are priced below $40. The top 3 brands in the brand advertising list are Sandandsky, Scalpa and Bangn Body.

03 Case Study of a DTC Beauty and Personal Care Brand - HiSmile

HiSmile, founded in 2014, is a brand that specializes in teeth whitening products. It has grown to become a top brand in the teeth whitening market, with over 100,000 customers worldwide and annual sales of over $25 million. HiSmile's products are especially popular among younger consumers.

In terms of product offerings, HiSmile's product line is not extensive, primarily consisting of teeth whitening strips, LED light kits, mouthwash, teeth whitening serums, and toothpaste. The brand operates as a typical niche boutique store. HiSmile adopts a high-value-for-money sales model compared to competitors, even maintaining a price advantage of 20%-30% below newer brands such as Smilelab. To maintain control over costs, HiSmile has established a low-cost production system in China, which enables it to sell products globally. Additionally, HiSmile sets up dedicated discount sections on its website, such as the recent "Black Friday Promotion Zone," offering discounts of 30-40% to attract customers.

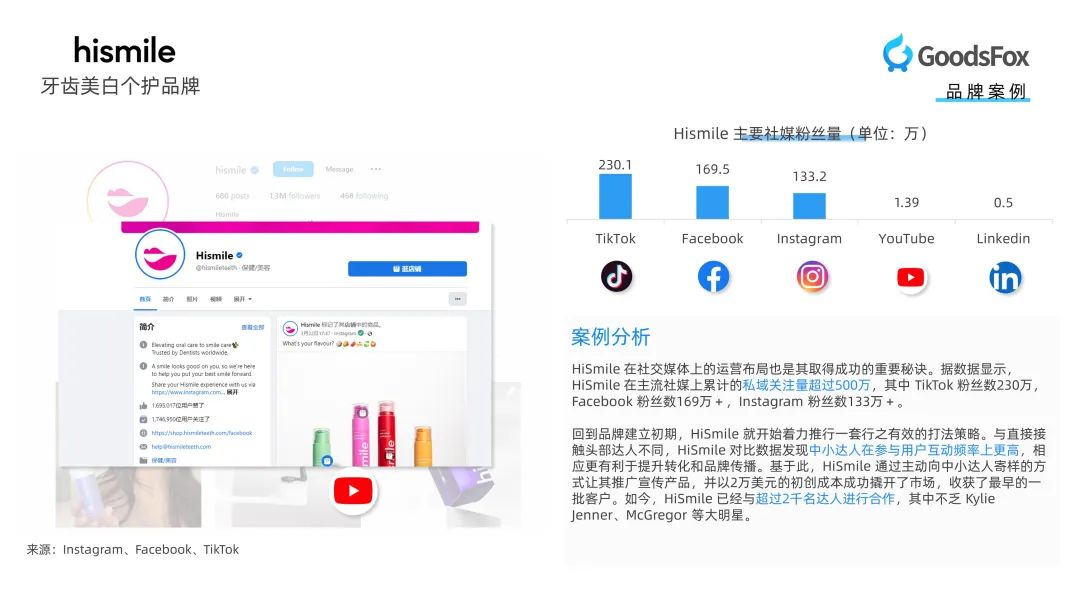

HiSmile's success is also attributable to its effective social media strategy. The brand has garnered over five million followers across various social media platforms, with 2.3 million followers on TikTok, 1.69 million on Facebook, and 1.33 million on Instagram.

In the early stages of building the brand, HiSmile adopted an effective marketing strategy. Unlike other brands that directly collaborate with top influencers, HiSmile found that smaller influencers had higher user engagement rates, which led to increased conversions and brand exposure. Therefore, HiSmile partnered with smaller influencers by sending them samples to promote its products. With a start-up cost of $20,000, this strategy helped HiSmile gain its initial customer base. Today, the brand collaborates with over two thousand influencers, including top celebrities like Kylie Jenner and Conor McGregor.

HiSmile has maintained a stable advertising performance on social media. According to GoodsFox data, its advertising volume increased steadily throughout 2022, with the most intensive advertising period in the second half of the year. In November 2022, HiSmile's advertising volume exceeded 6,000, a 25% increase from the previous month, making it the second-highest beauty and personal care store on the advertising leaderboard.

HiSmile mainly advertises on Facebook-related media, with video content accounting for over 99% of its materials. The brand primarily targets the European and American markets, with the top three countries being the UK, Australia, and the US. However, HiSmile is also exploring new markets for growth, with minimal advertising in Asian countries such as Singapore, Hong Kong, and Japan.