GoodsFox Daily News (July 11, 2025): How a Small Fan Became a Hot Seller Overseas – Learn the Secrets!

- Small Fans, Big Growth: Jisulife's Global Success

- Trump's New Tariff Threats

- CHAGEE Secures 1.42 Billion Baht Investment for Expansion in Thailand

- Lazada Surpasses Shopee in Thailand, Dominating Southeast Asia’s E-Commerce Scene

- Chi Forest Expands Its Iced Tea Line in Indonesia

1. Small Fans, Big Growth: Jisulife's Global Success, Lazada Tops in Thailand, and Genki Forest's Southeast Asia Expansion

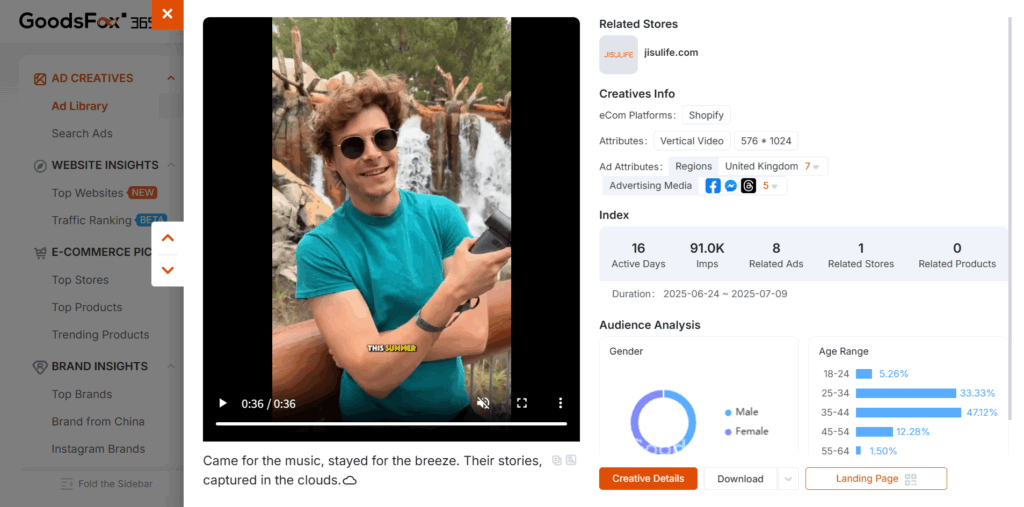

Jisulife, a leading portable fan brand, is seeing impressive success worldwide. The company has grown nearly 50% year on year. In 2024, it sold over 30 million units, with revenues exceeding $100 million. A popular product, their $14 handheld fan, sold 60,000 units in one month. This makes Jisulife the global leader in portable fan sales for three consecutive years. The brand has transformed portable fans from low-end "toys" into essential outdoor products. Its focus is on North America and Southeast Asia, where demand for cooling products is high.

2. Trump's New Tariff Threats

On July 9, Trump announced new tariffs. They will take effect on August 1. The tariffs include a 50% tax on products from Brazil. A 30% tariff will be applied to goods from Libya, Iraq, Algeria, and Sri Lanka. Products from Moldova and Brunei will be taxed at 25%. Trump emphasized that the tariffs could increase based on political relationships. Countries that retaliate will face extra taxes.

3. CHAGEE Secures 1.42 Billion Baht Investment for Expansion in Thailand

CHAGEE, a popular Chinese tea brand, has secured a 1.42 billion Baht (approx. $31.19 million) investment in its Thai subsidiary, gaining a 51% stake. The investment is led by Thailand's top industry giants, including Thailand President Foods, Flash Express, and Ananda Development. These three partners will assist CHAGEE in optimizing its supply chain and accelerating its store expansion across Thailand. The brand, which entered the Thai market in December 2023, offers healthy, 100% real tea products and is planning a significant expansion, similar to its success in Malaysia, where it plans to add 300 new stores over the next three years.

4. Lazada Surpasses Shopee in Thailand, Dominating Southeast Asia’s E-Commerce Scene

Lazada has overtaken Shopee as Thailand’s most popular e-commerce platform, with a 65.7% brand awareness, according to YouGov data. This surge is thanks to the platform’s heavy investment in AI and targeted advertising. In 2024, the Thai e-commerce market grew by 21.7%, driven by an expanding middle-class consumer base. The introduction of Lazzie, Lazada’s AI-powered shopping assistant, has significantly boosted conversion rates. As Southeast Asia’s e-commerce market becomes increasingly competitive, Lazada, Shopee, and TikTok Shop are now the top three platforms, capturing over 80% of the region's $128.4 billion GMV in 2025. For cross-border sellers, Thailand presents a rapidly growing market ripe for localized strategies.

5. Chi Forest Expands Its Iced Tea Line in Indonesia

Chi Forest’s iced tea series has officially launched in major retail channels in Indonesia, adding to its successful lineup of sparkling waters. This new series features tea brewed with real leaves, boasting fresh flavors such as lemon and grapefruit that cater to local preferences. With distribution in leading chains like Carrefour and Grand Lucky, the iced tea range is set to capitalize on the rapidly growing Indonesian ready-to-drink tea market, which is worth over $1.2 billion and growing at more than 8% annually. Chi Forest’s expansion into Southeast Asia is proving to be a successful strategy, with Indonesia providing significant growth potential for the brand.

For more marketing insights and tools, visit GoodsFox.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/