GoodsFox Daily News June 17, 2024 ● RTAUYS Sonic Electric Toothbrush is a hit in the US TikTok market, with a single-day sales volume of 3,303 ● eBay to Add Venmo as a New Payment Option ● Shopify Report Shows: 82% of UK Consumers Believe Promotions Can Increase Loyalty ● The First Beauty Cross-Border E-Commerce Conference to be Held in Guangzhou on July 3 ● TikTok Shop Lowers the Threshold for Southeast Asia Cross-Border Entry 1.RTAUYS Sonic Electric Toothbrush is a hit in the US TikTok market, with a single-day sales volume of 3,303 Photo from: GoodsFox RTAUYS is a sonic automatic toothbrush that provides in-depth and thorough cleaning for teeth, with a cleaning effect five times that of adult low-frequency electric toothbrushes. According to GoodsFox data, on June 16, the product's daily sales volume in the US region of TikTok reached 3,303, with a 30-day sales volume of 27,577. 2.eBay to Add Venmo as a New Payment Option In order to expand payment options and meet the preferences of a new generation of shoppers, eBay will add Venmo as a payment option on its platform this week. eBay users in the United States will be able to use Venmo to pay on their website or app, completing transactions through Venmo balance, associated bank accounts, debit cards, or credit cards. 3.Shopify Report Shows: 82% of UK Consumers Believe Promotions Can Increase Loyalty According to the latest UK Business Conditions Report by Shopify, 82% of UK consumers believe that promotions can increase user loyalty. However, facing economic pressures in the macro environment, only 6% of UK retailers plan to invest in improving customer experience. 82% choose to pass on costs to consumers. 4.The First Beauty Cross-Border E-Commerce Conference to be Held in Guangzhou on July 3 The first Beauty Cross-Border E-Commerce Conference will be held at the Guangzhou Airport Expo Center from July 3 to 5. The iPDE International Future Packaging Exhibition will also be held concurrently with the conference. Seven cross-border e-commerce sessions will feature companies such as SHEIN, TikTok Shop, Shopee, Temu, etc., and they will interpret cross-border platform and overseas regulatory policies for the audience. 5.TikTok Shop Lowers the Threshold for Southeast Asia Cross-Border Merchants. Previously, the threshold for Southeast Asia cross-border entry on TikTok Shop was high, requiring merchants to have a business license, and the legal representative of the license must have operational experience on third-party e-commerce platforms to enter. Currently, according to the latest merchant recruitment policy of TikTok Shop Southeast Asia cross-border, merchants with a business license and individual merchants with experience in cross-border and domestic e-commerce platforms can directly enter.

Father's Day Eve Book "Dad, I Want to Hear Your Story" Goes Viral on TikTok in the U.S., with Nearly 20,000 Copies Sold in a Single Day

GoodsFox Daily News June 17, 2024 Father's Day Eve Book "Dad, I Want to Hear Your Story" Goes Viral on TikTok in the U.S., with Nearly 20,000 Copies Sold in a Single Day Amazon's European Sites Experience "Free Purchase" Incident Shopee Philippines Launches In-Transit Return or Refund Feature for Buyers Shein Hosts Craftsmanship Tool Day Reports Indicate Huge Impact of TikTok on the Beauty Industry 1.Father's Day Eve Book "Dad, I Want to Hear Your Story" Goes Viral on TikTok in the U.S., with Nearly 20,000 Copies Sold in a Single Day "Dad, I Want to Hear Your Story" is a book suitable as a gift for fathers, helping them share their life stories through reading, which is beneficial for promoting family relationships. According to GoodsFox data, on June 12 in TikTok's U.S. region, the product's daily sales reached 18,332, with a 30-day sales volume of 136,294. 2.Amazon's European Sites Experience "Free Purchase" Incident On the evening of June 5, several of Amazon's European sites, such as Turkey, Italy, and the UK, experienced an abnormal product pricing situation. Many merchants' product prices were mistakenly set to very low prices, leading to a frenzy of mass purchases by consumers. This incident has caused economic losses to sellers and greatly affected the upcoming Prime Day sales event. Currently, sellers are anxiously waiting for a solution. 3.Shopee Philippines Launches In-Transit Return or Refund Feature for Buyers Recently, Shopee Philippines announced that after June 10, 2024, buyers can apply for in-transit return or refund due to a change of mind. This feature allows buyers to apply for a return or refund for goods orders that have been shipped but have not yet been delivered. 4.Shein Hosts Craftsmanship Tool Day Recently, Shein's Craftsmanship Tool Day was held at its clothing manufacturing innovation research center. During this event, Shein showcased more than 60 self-developed technical tools, covering more than 20 industry processes, along with a series of industry-leading intelligent equipment. Shein is committed to continuously empowering its flexible supply chain through technological innovation, continuously iterating process improvements and optimization to achieve more standardized delivery quality and more lean production processes. According to the latest data, Shein has held 230 full-link supplier training sessions in the past six months, and as of May, has helped nearly 200 partner factories complete the expansion and transformation of 500,000 square meters of factory space. 5.Reports Indicate Huge Impact of TikTok on the Beauty Industry Beauty content is one of the most popular video types on TikTok. According to a report by American media The Verge, TikTok Shop is rapidly becoming a major retailer in the beauty industry. According to a report by Dash Hudson and NielsenIQ, TikTok Shop is currently the ninth largest online beauty and health retailer in the United States and the second largest in the UK. Over the past few months, TikTok Shop has been steadily growing in the industry. According to AdWeek, TikTok Shop has surpassed competitors such as large department stores, small beauty specialty stores, and direct-to-consumer brands.

GoodsFox Daily News June 14, 2024 TikTok Shop's U.S. Summer Promotion Sets Records The U.S. cross-border self-operation model expands merchant recruitment Shein's 2023 revenue reaches $32.2 billion, surpassing Zara and H&M Mercado Livre dominates search volume on Brazilian e-commerce platforms Nearly 10,000 units sold in a single day! This baby and mother product is a hit on TikTok! 1.TikTok Shop's U.S. Summer Promotion Sets Records During this U.S. summer promotion, TikTok Shop's U.S. region GMV broke through three records: single-day GMV in the U.S. region, single-day GMV of short videos on the platform, and single-day live broadcast GMV on the platform. Founder Stormi achieved a single session sales exceeding 1 million U.S. dollars in a recent live broadcast, setting […]

GoodsFox Daily News June 13, 2024 1.Mercado Libre Launches Eco-Friendly Product Series 2.Temu's Repeat Customer Attraction Surpasses eBay 3.eBay Launches Official Website eBaymag 4.South Africa to Significantly Increase Procurement Taxes on Temu and Shein 5.TikTok plans to invest $2.1 billion in Malaysia 1.Mercado Libre Launches Eco-Friendly Product Series Mercado Libre has recently introduced a brand-new series of eco-friendly products to meet the growing environmental demands of consumers. Over 1600 eco-friendly items can be found on Mercado Libre, spanning various sectors such as fashion, healthy food, beauty, and personal care. Notably, bamboo toothbrushes, cloth shopping bags, and diapers are the most popular. 2.Temu's Repeat Customer Attraction Surpasses eBay According to financial reports, within two years of entering the U.S. market, […]

GoodsFox Daily News June 12, 2024 1.The Magic of the Soap Pen that Went Viral on TikTok 2.eBay's All-Category Seller Recruitment Conference to be Held in Guangzhou on June 13 3.The Philippines Department of Trade and Industry to Strengthen Cooperation with TikTok 4.SHEIN's Semi-Managed Model Officially Launched 5.The Number of Chinese Sellers on the Ozon Platform Exceeds 100,000 1.The Magic of the Soap Pen that Went Viral on TikTok Soapen is an innovative cleaning product designed in the shape of a crayon. Children can use it to draw patterns on their hands and then wash them clean. This product combines children's education with hygiene. Additionally, Soapen has conducted a series of marketing campaigns on TikTok, featuring product usage instructions, brand stories, user feedback, and more. Its account has over 20,000 followers and 3 million likes, with some videos garnering up to 2.1 million views. 2.eBay's All-Category Seller Recruitment Conference to be Held in Guangzhou on June 13 The eBay All-Category Seller Recruitment Conference will be held in Guangzhou on June 13. At this event, eBay will focus on AI technology, integrating innovative AI tools and operational ADS advertising for the first time. The platform's full-category recruitment managers will share the latest platform policies, product selection, and operation guides to help sellers better utilize AI technology and the advantages of a full range of categories. The aim is to recruit more sellers with forward-thinking and innovative spirits to join eBay and help businesses expand their cross-border operations. 3.The Philippines Department of Trade and Industry to Strengthen Cooperation with TikTok Alfred Pascual, the Secretary of the Department of Trade and Industry (DTI) of the Philippines, discussed with TikTok in Singapore on June 5 to strengthen the partnership and explore new ways of cooperation to enhance the digital economy of the Philippines. During the meeting, Pascual pointed out that the cooperation with TikTok is a "key step" in promoting the development of the country's e-commerce industry. He stated, "This cooperation will greatly promote the growth and development of the digital market, benefiting businesses, consumers, and the entire economy." TikTok was launched in the Philippines in May 2017 and launched TikTok Shop in April 2022. The platform currently has about 53 million users in the country, with approximately 2 million sellers on TikTok Shop. 4.SHEIN's Semi-Managed Model Officially Launched On June 3, cross-border e-commerce platform SHEIN officially launched its "semi-managed" model. It is reported that over 20,000 merchants are looking forward to SHEIN's semi-managed model. The platform has no performance threshold requirements for sellers, and there are no additional fees for opening a store. The platform also offers exclusive traffic support for the semi-managed model, which has already opened for the American site. 5.The Number of Chinese Sellers on the Ozon Platform Exceeds 100,000 A responsible person from the Russian e-commerce giant Ozon recently stated that by the end of 2023, the number of sellers on the Ozon platform has reached about 500,000, with more than 100,000 being Chinese sellers, accounting for at least 20%. At the same time, most of these over 100,000 Chinese sellers mainly sell electronic products such as mobile phones, computers, and video cards.

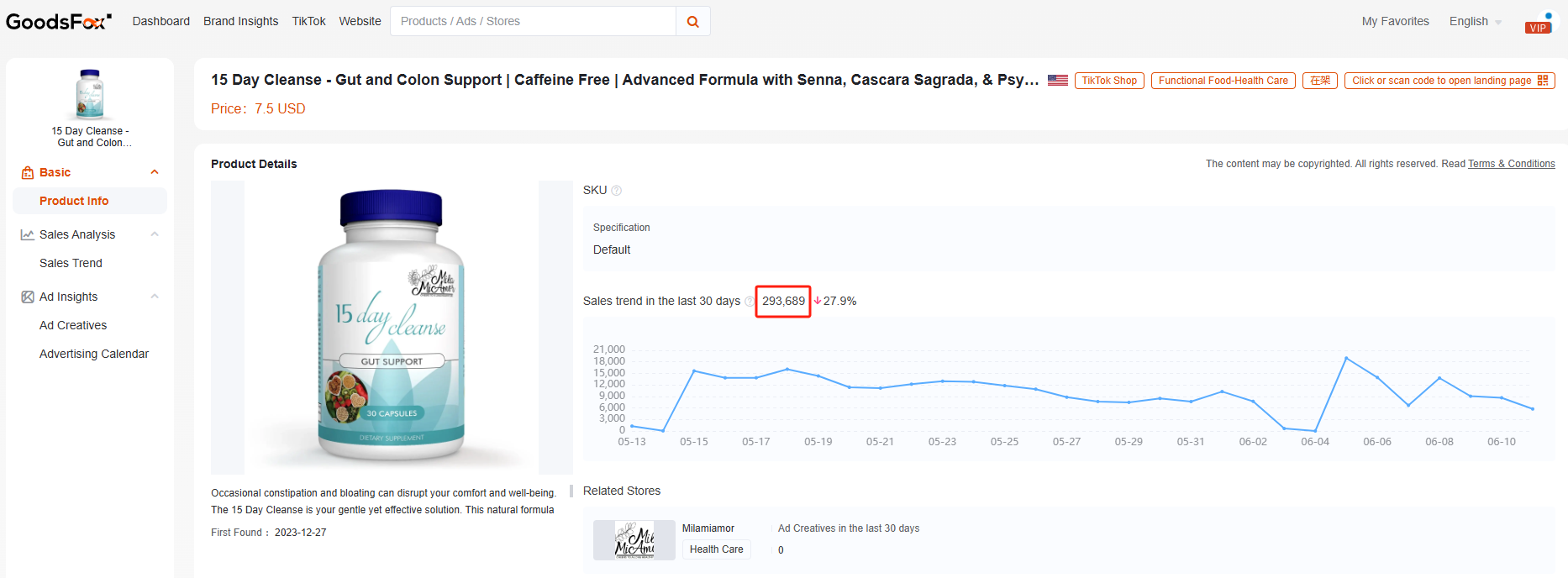

GoodsFox Daily News June 11, 2024 1.TikTok US Region Averages 10,000 Daily Sales, Another New Health Product Takes Off 2.Amazon Plans Further Layoffs for Customer Service Team 3.Mercado Libre Mexico's HOT SALE Promotion Sees 44% Increase in First-Day Sales Compared to Last Year 4.TikTok E-commerce Aims to Increase US Region's GMV by 10 Times in the Second Half of the Year 5.Temu Launches in Brazil 1.TikTok US Region Averages 10,000 Daily Sales, Another New Health Product Takes Off TikTok US Region Averages 10,000 Daily Sales, Another Health Product Takes Off Day Cleanse is a functional health product that helps promote digestion and reduce bloating and constipation. According to GoodsFox, over the past month, it has averaged 10,000 daily […]

With the arrival of summer, the clothing category has entered its peak season for marketing and promotion. According to the data presented by GoodsFox, many brands have experienced significant increases in their advertising investments recently. These include Karakubuy, a brand specializing in Japanese retro men's clothing, as well as Bellabarnett and Loragal, which are fast-fashion brands for women. In addition to adult apparel, Moodytiger, a children's sportswear brand, has also significantly increased its advertising efforts. In the past 30 days, their advertising volume has grown by 95.2% compared to the previous period, and they currently rank 9th on the list of clothing brands expanding into international markets. Children's clothing has often been an overlooked segment, but in recent years, it has maintained stable growth. According to data, the global children's clothing market reached $172.52 billion in 2021, and it is projected to reach $296.85 billion by 2029 (Fortune Business Insight data). In terms of market distribution, a significant portion of global children's clothing revenue comes from the United States, accounting for over 20% of the global market share (Statista data). On the other hand, there is an increasing presence of Chinese brands expanding internationally, and the children's clothing segment is no exception. In recent years, notable brands like PatPat and Hibobi have emerged in the European, American, and Middle Eastern markets. In the case we are analyzing today, Moodytiger focuses on the niche category of children's sportswear to tap into the global market and establish a worldwide presence. 01 Brand Overview Moodytiger is a brand that specializes in providing professional sportswear for children aged 4 to 16. It is owned by Moody Trade (Shenzhen) Co., Ltd., established in 2018. The brand's founder, Zoe, is a mother of three children and a sports enthusiast herself. Prior to establishing the brand, Zoe keenly observed the limited availability of professional children's sportswear brands in the market. To fill this gap, Moodytiger was born. In terms of international expansion, Moodytiger has adopted a sales model that involves establishing independent brand websites, enabling global brand positioning. Currently, the brand's customer base spans 105 countries and regions, including the United States, Canada, Australia, the United Kingdom, Finland, Belgium, France, and more. Based on the traffic to the website, Moodytiger has experienced an upward trend in the past three months, reaching over 106,000 visits in April. In terms of traffic sources, 47.53% of the visits come from the United States, while 25.71% originate from Vietnam. Regarding social media traffic, Moodytiger primarily focuses on Facebook and Instagram, with these two channels accounting for 61.98% and 28.15% of the traffic input, respectively. As a brand that emphasizes "professional performance," Moodytiger's […]

According to the data provided by Accenture, the global beauty market has reached a staggering $600 billion in 2023, and the market growth is still on an upward trend. It is expected that the entire beauty and personal care industry will steadily develop at an average annual growth rate of 10% over the next three years. By 2025, the overall revenue of the industry is projected to reach 694 billion yuan, with the United States and the United Kingdom leading the European and American countries as the main consumer markets.In the new consumption environment, there are emerging trends in the beauty and personal care industry. For instance, an increasing number of new brands are quickly gaining popularity, and there is rapid development in specialized areas such as haircare and teeth whitening. Additionally, there is the rise of "male beauty" economics. To help businesses gain a deeper understanding of the development environment and trends in the beauty and personal care industry, GoodsFox has released the "Global Clothing Industry DTC Brand Marketing Report." 01 Beauty and Personal Care Advertising Market Throughout 2022, global beauty and personal care products (mobile media) maintained a share of over 10% in the overall product category for advertising and promotion, making it the category with the largest advertising and promotion volume, apart from clothing. Looking at the proportion of advertising and promotion in each quarter, the largest investment in beauty and personal care was in Q1 of 2022, accounting for 14.9%. The lowest proportion was in Q3 of 2022, accounting for 11.6%. In terms of the number of stores with advertising and promotion, the beauty and personal care category accounted for over 8% of the overall product category. The number of stores in this category rose by over 40.04% in spring, specifically in March of 2022. This also reflects the fact that the period from March to May is an active season for marketing and promotion of beauty and personal care products, with high market demand. Looking at the global market performance, Europe and the United States are still the main areas for advertising and promotion of beauty and personal care products. For example, the United States, which has the largest advertising investment, accounts for 19.2% of the global advertising share, followed by Australia and the UK, accounting for 6.6% each. In addition to Europe and the United States, there are also many emerging markets that sellers should pay attention to, such as India, which is ranked second with a rapidly increasing advertising share of 7.3%. There are also Brazil (3.6%) and Singapore (2.1%), among others, which indicates that the demand for beauty and personal care products in these new markets is constantly increasing, attracting more and more sellers to join. Looking at the sub-categories of beauty and personal care, the advertising and promotion share of facial and body care products is the highest, reaching 48.2%. Hair care products come second, accounting for 23.2%. In terms of the fastest-growing product categories in each quarter of 2022, facial and body care products had the fastest growth in Q1-Q2, hair care in Q3, and oral care products in Q4. Looking at the global top brands in advertising and promotion for beauty and personal care, Lange, a brand specializing in hair care products, had the highest advertising investment and promotion volume, followed by two brands specializing in teeth whitening products, Hismile and Snow. Overall, there are relatively few Chinese brands in the global top advertising list, reflecting the intense competition among the leading brands in the beauty and personal care category. 02 Key Market and Marketing Analysis of Beauty and Personal Care. In the European and American markets, the top 3 popular beauty and personal care subcategories are facial and body care products (42.1%), hair care products (24.6%), and makeup products (13.9%). In terms of price, the median price of the top 1,000 beauty and personal care advertisements in Europe and America is $59.9, with 25.7% of the products priced between $20-40. The top 3 brands in the beauty and personal care advertising list are Lange for hair care products, Hismile and Snow for teeth whitening products. In the Asian market, facial and body care products are heavily promoted, accounting for 59.1%. The second is hair care products, accounting for 20.3%. The lowest proportion is hand, foot and nail care products, accounting for only 1.8%. In terms of price, the Asian market is lower than Europe and America. The median price of the top 1,000 promoted products is 48.24%, with 33.0% of the products priced below $40. In the brand advertising list, the top 3 brands are Futurelab, Hismile and The Digital Media Hub. In the Southeast Asian market, the top 3 popular beauty and personal care subcategories are facial and body care products (57.1%), hair care products (19.2%), and makeup products (10.6%). In terms of price, the median price of the top 1,000 beauty and personal care advertisements in Southeast Asia is $38.51. Among them, 37.5% of the products are priced below $40. The top 3 brands in the brand advertising list are Sandandsky, Scalpa and Bangn Body. 03 Case Study of a DTC Beauty and Personal Care Brand - HiSmile HiSmile, founded in 2014, is a brand that specializes in teeth whitening products. It has grown to become a top brand in the teeth whitening market, with over 100,000 customers worldwide and annual sales of over $25 million. HiSmile's products are especially popular among younger consumers. In terms of product offerings, HiSmile's product line is not extensive, primarily consisting of teeth whitening strips, LED light kits, mouthwash, teeth whitening serums, and toothpaste. The brand operates as […]

GoodsFox-Expend global marketing solutions and drive your e-commerce brand growth as always.

The global e-commerce business is rapidly expanding. Data shows that in 2022, the US e-commerce market reached $1.09 trillion, surpassing the trillion-dollar mark for the first time. At the same time, there is significant growth in new markets such as Southeast Asia, the Middle East, and Latin America, with new platforms and merchants such as TikTok and Temu joining the competition. As both new and established players continue to expand, the cost of competition is also rising. In the new economic cycle, branding has become a necessary long-term development option for merchants to constantly improve their competitiveness and gain consumer trust and loyalty.How can merchants stand firm in the fierce competition and achieve global brand marketing growth? YOUMI Cloud has launched a new Global E-commerce Brand Marketing Data Analysis Platform called GoodsFox […]