To help brands and sellers navigate, we’ve analyzed key data to uncover trending products, marketing strategies, and global approaches. The result? The GoodsFox 2024 Black Friday and Cyber Monday Advertising E-Commerce Report.

This article highlights essential insights from the report, shedding light on key opportunities this season.

Which Industries and Strategies Are Leading?

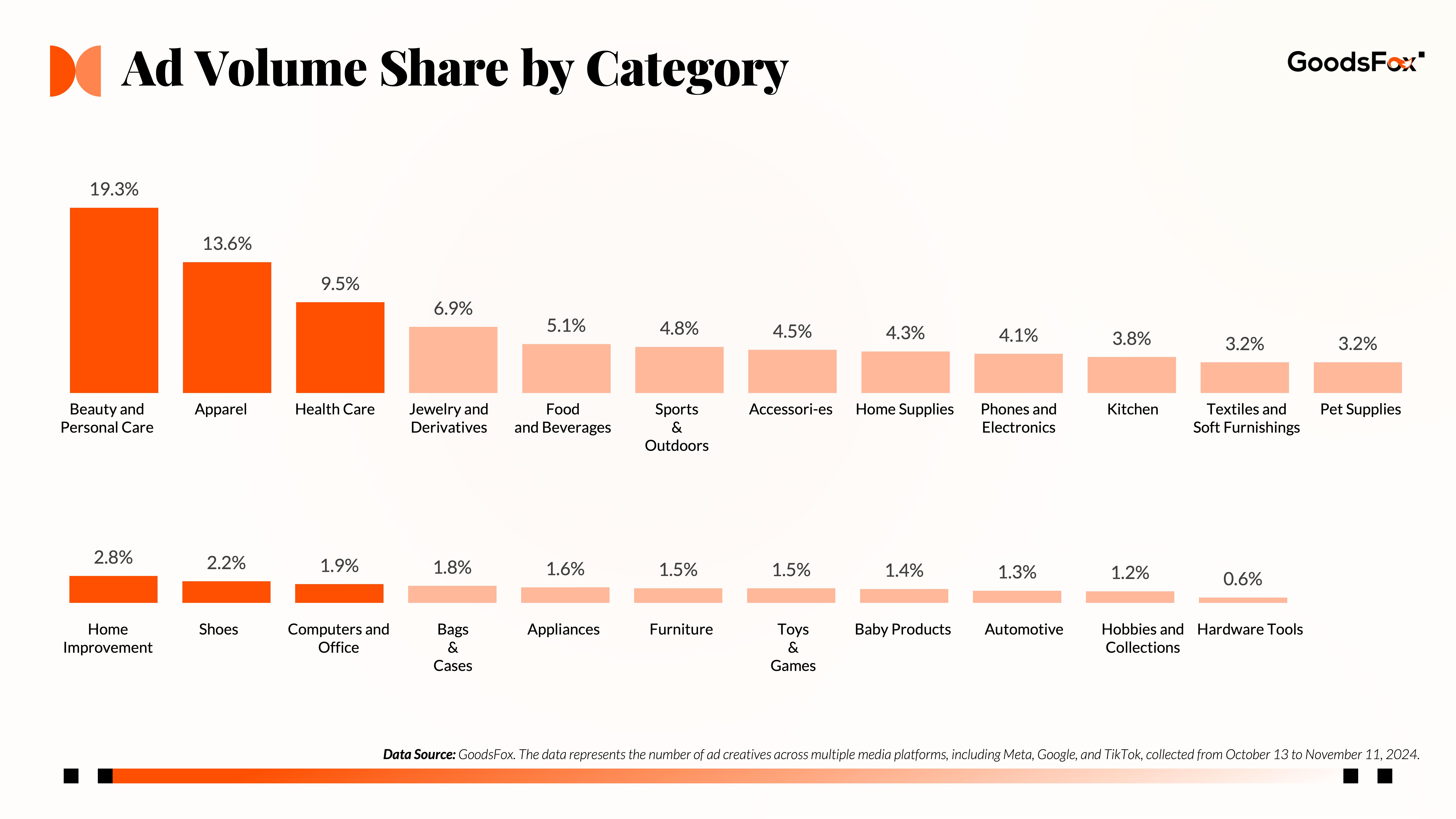

For newcomers to e-commerce, here’s the current landscape:

Beauty & Personal Care, Apparel, and Health are the hottest categories for advertising. High-margin sectors like Jewelry and Sports & Outdoor also stand out. Notably, tech-related industries, including consumer electronics, have enabled many emerging brands to achieve remarkable profitability.

Each of these top categories exhibits distinct trends:

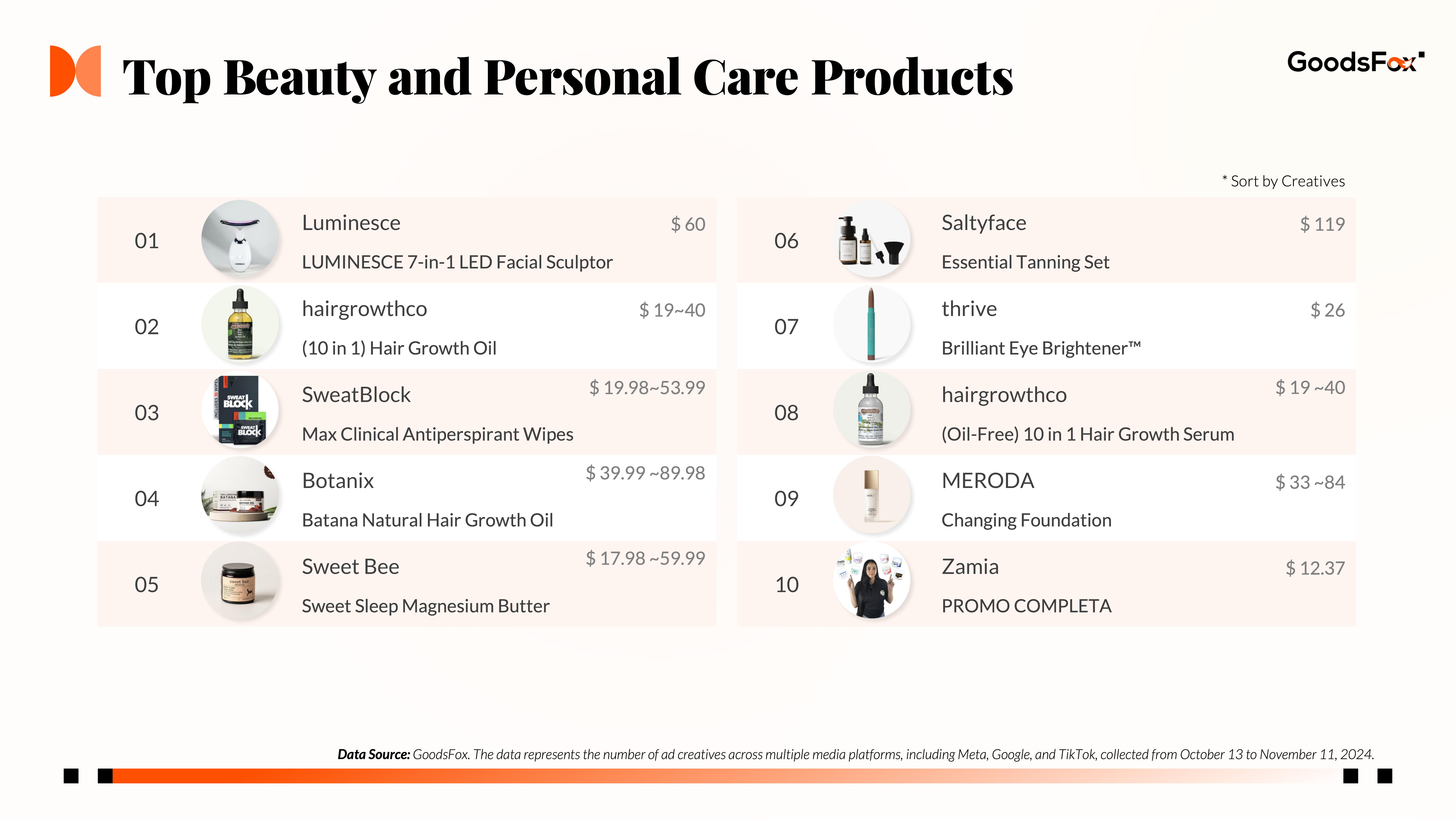

- Beauty & Personal Care: This category remains fiercely competitive, with new brands constantly emerging. Popular products cater to specific needs, offering solutions for slimming, deodorizing, or improving sleep. For example, brands like Botanix and Hairgrowthco target hair growth but differentiate themselves through product design, pricing, and features.

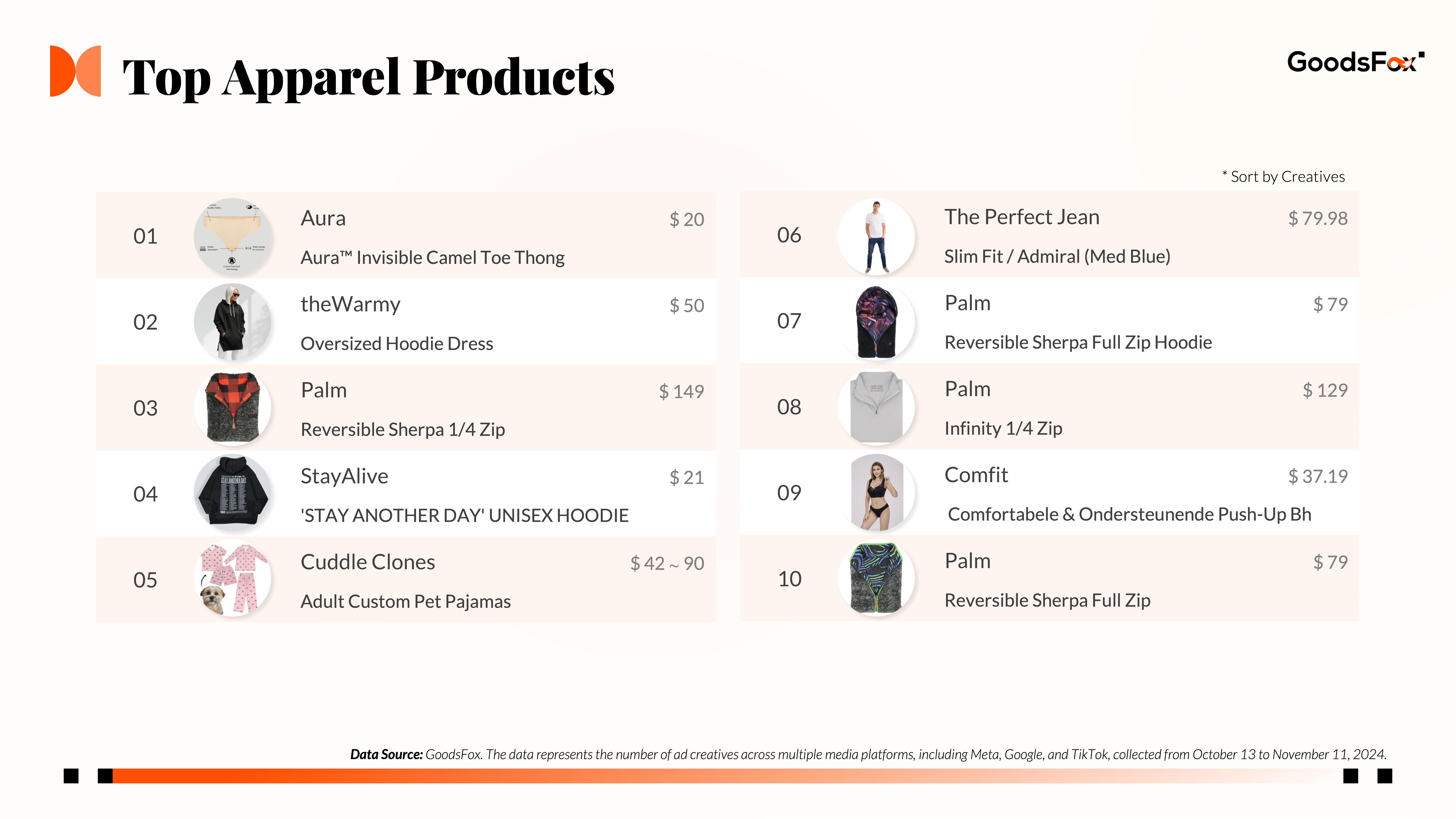

- Apparel: Rapid product cycles dominate this sector. Many brands focus on timeless basics and unisex styles. These staples meet constant demand, avoid falling out of fashion, and help reduce inventory costs.

- Health Products: This category spans dietary supplements, medications, cosmetics, and tools. Health supplements make up 60% of trending products. Tech-enhanced health items, often free from stringent oral supplement regulations, are gaining popularity due to their flexibility and utility.

Ad Formats and Platforms

Despite TikTok and YouTube gaining ground, image-based ads still lead in engagement. According to Emplifi, posts featuring product images generate 30% more interactions.

Two primary types dominate:

- Discount-focused visuals showing price reductions upfront.

- Feature-oriented images emphasizing product benefits before introducing discounts.

SEO-optimized captions often rely on keyword stuffing rather than fluid narratives.

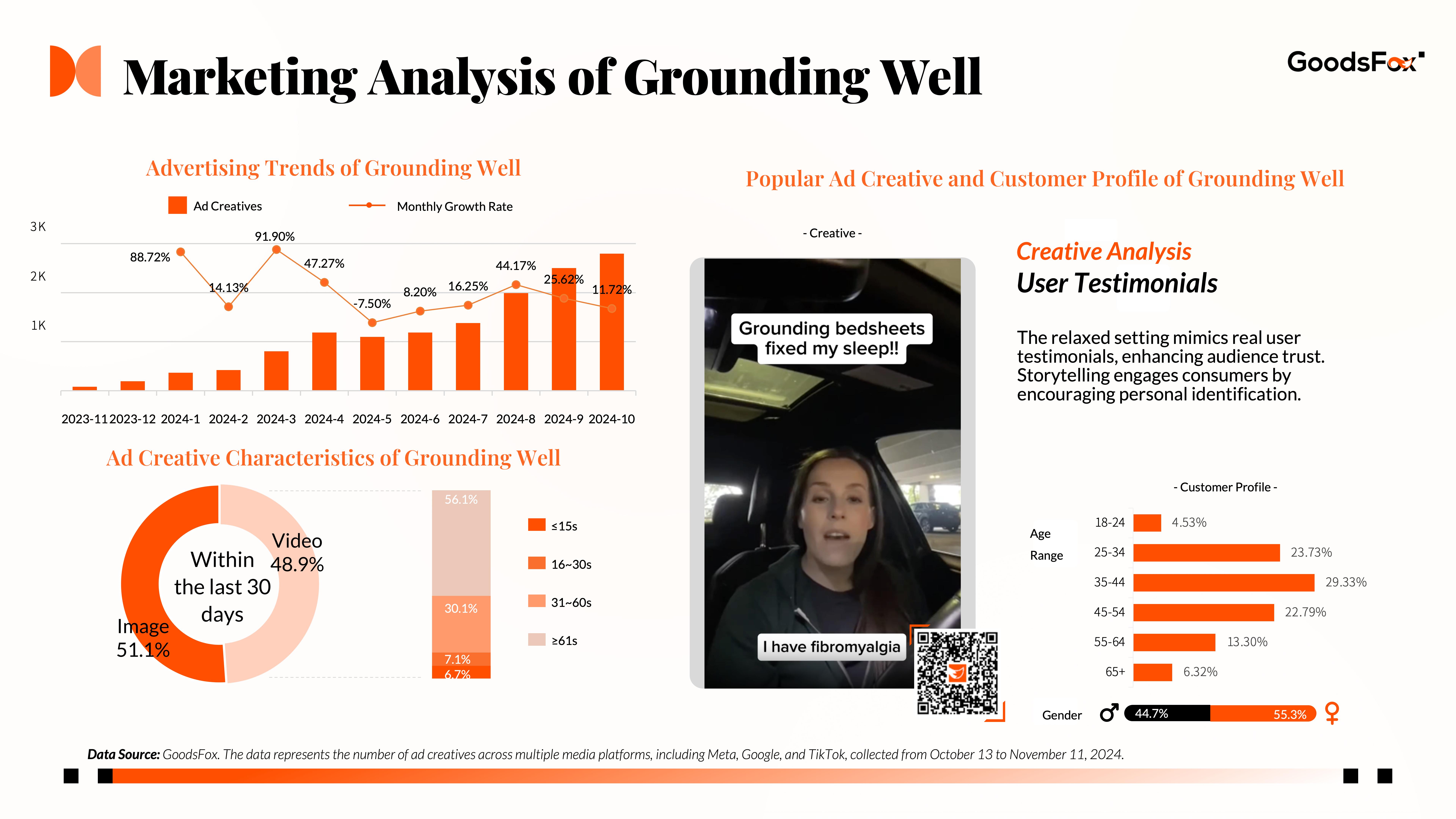

What Makes Top Brands Stand Out?

Common traits of high-performing brands include:

- Focus on specific lifestyles and emotional value.

- Higher price points than competitors.

During Black Friday, consumer motives revolve around self-care and gift shopping. According to impact.com, 77% of shoppers plan to buy for family, prioritizing loved ones over themselves.

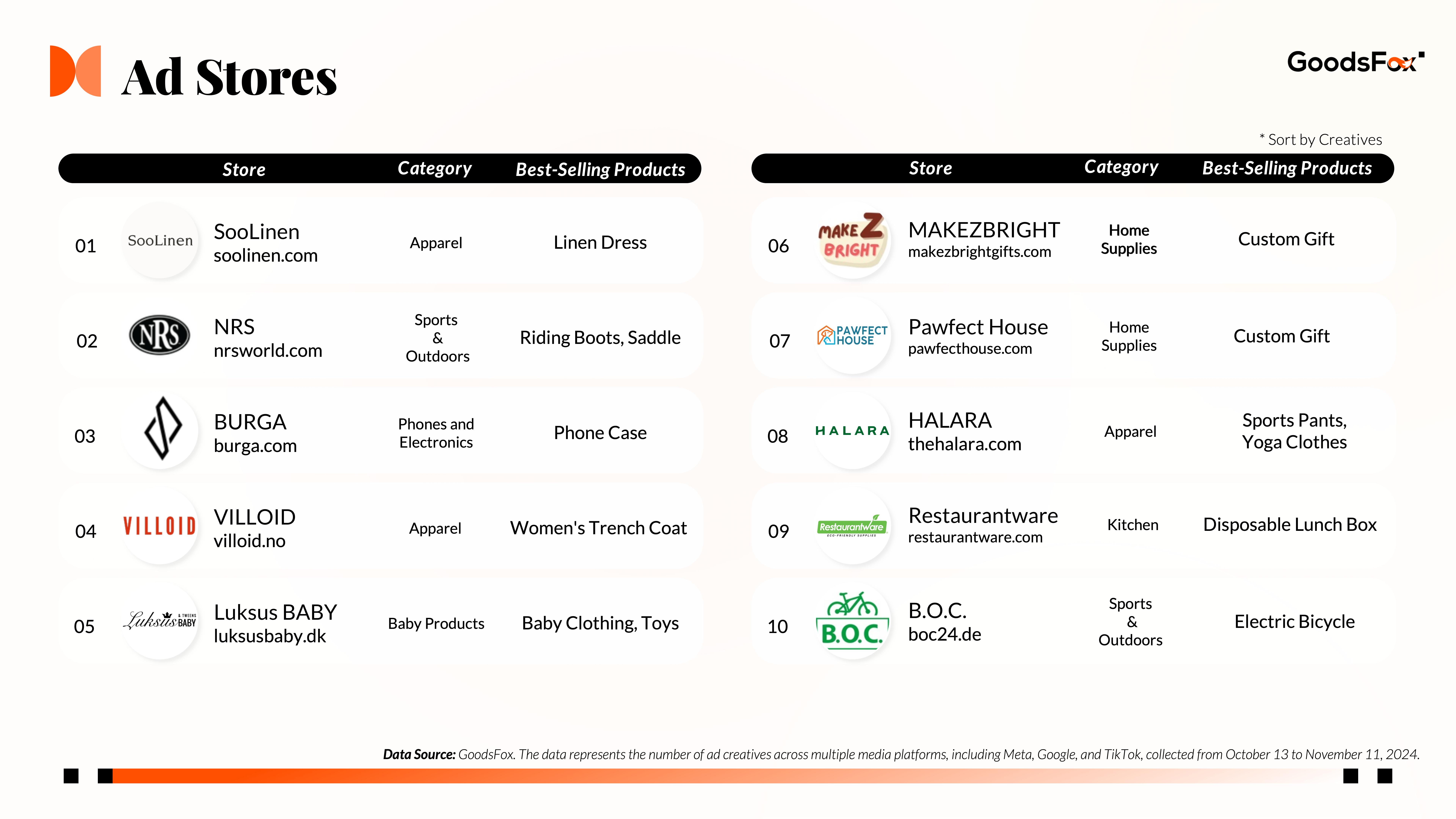

GoodsFox data shows that the top 10 independent stores focus on family-oriented products. Examples include baby brand Luksus BABY, personalized gifts from MAKEZBRIGHT, and home decor by Pawfect House.

Luxury design-driven brands also perform well, like Lithuania-based BURGA, selling phone cases priced at $35–$65 with a premium, artistic touch.

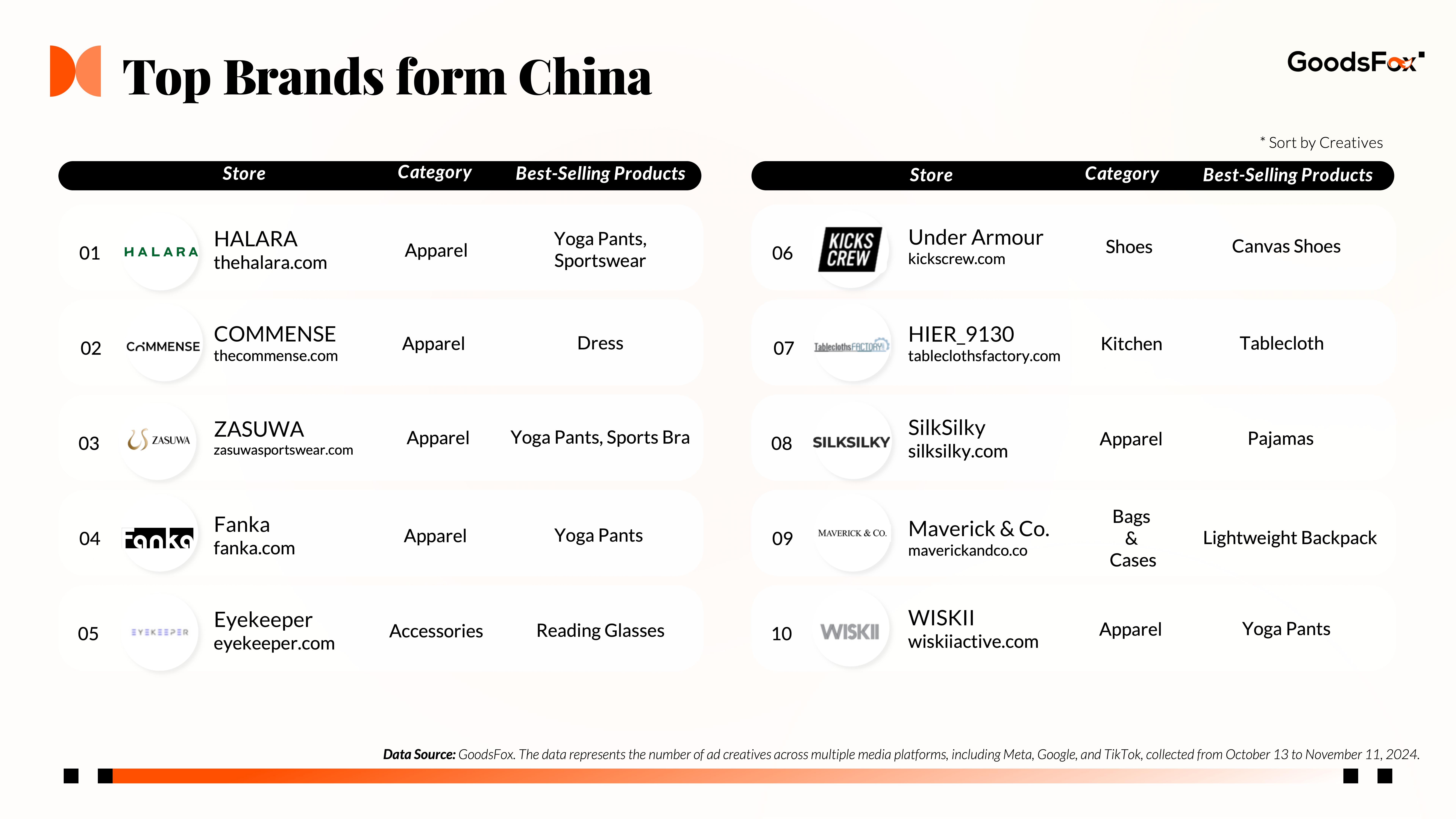

Spotlight on Chinese Brands

Yoga pants are the most popular category among Chinese sellers during Black Friday. In the GoodsFox Chinese brand rankings, six out of the top 10 apparel brands sell yoga pants, targeting the U.S. and Canadian markets. These brands cover all price points:

- High-end: Fanka ($90).

- Affordable: HALARA ($30).

- Mid-range: WISKII and ZASUWA.

This reflects both market segmentation and the universal appeal of yoga pants. ZASUWA leans into bold, sensual designs, while Fanka highlights body-shaping features.

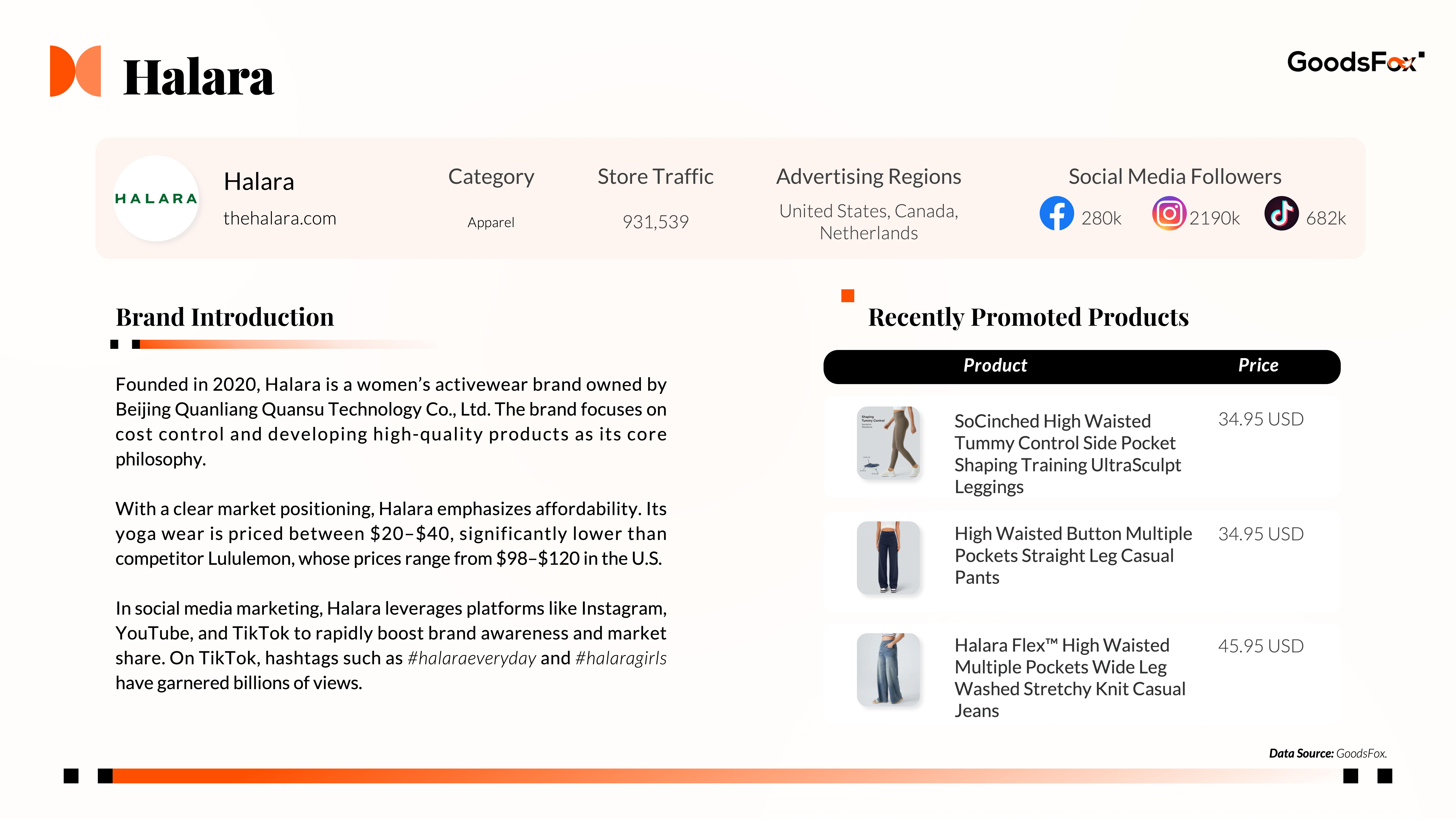

Halara: A Rising Star

Halara made waves with affordable yoga pants, focusing on single-category dominance. This strategy brings inventory challenges during seasonal shifts, especially for summer sweat-wicking products in colder months.

For Black Friday, Halara’s campaigns emphasize versatility and clearance, with the tagline “Comfy & stylish for any occasion.” This narrative ties affordability to freedom of choice, resonating with Western consumers who wear yoga pants daily.

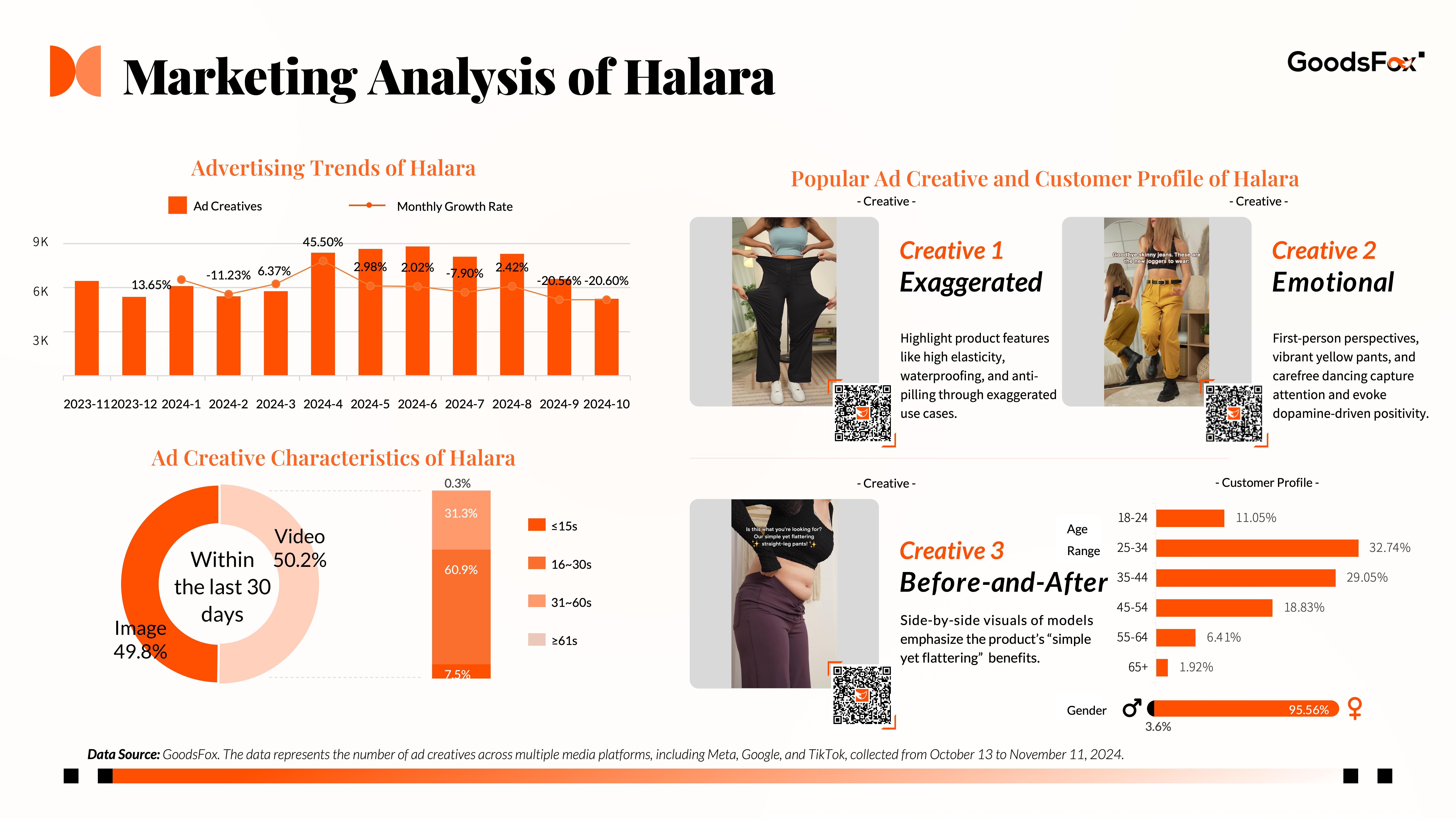

Halara’s ads leverage techniques like exaggerated demonstrations, emotional appeals, and before-and-after comparisons—similar to TikTok trends for yoga pants in China.

TikTok Trends

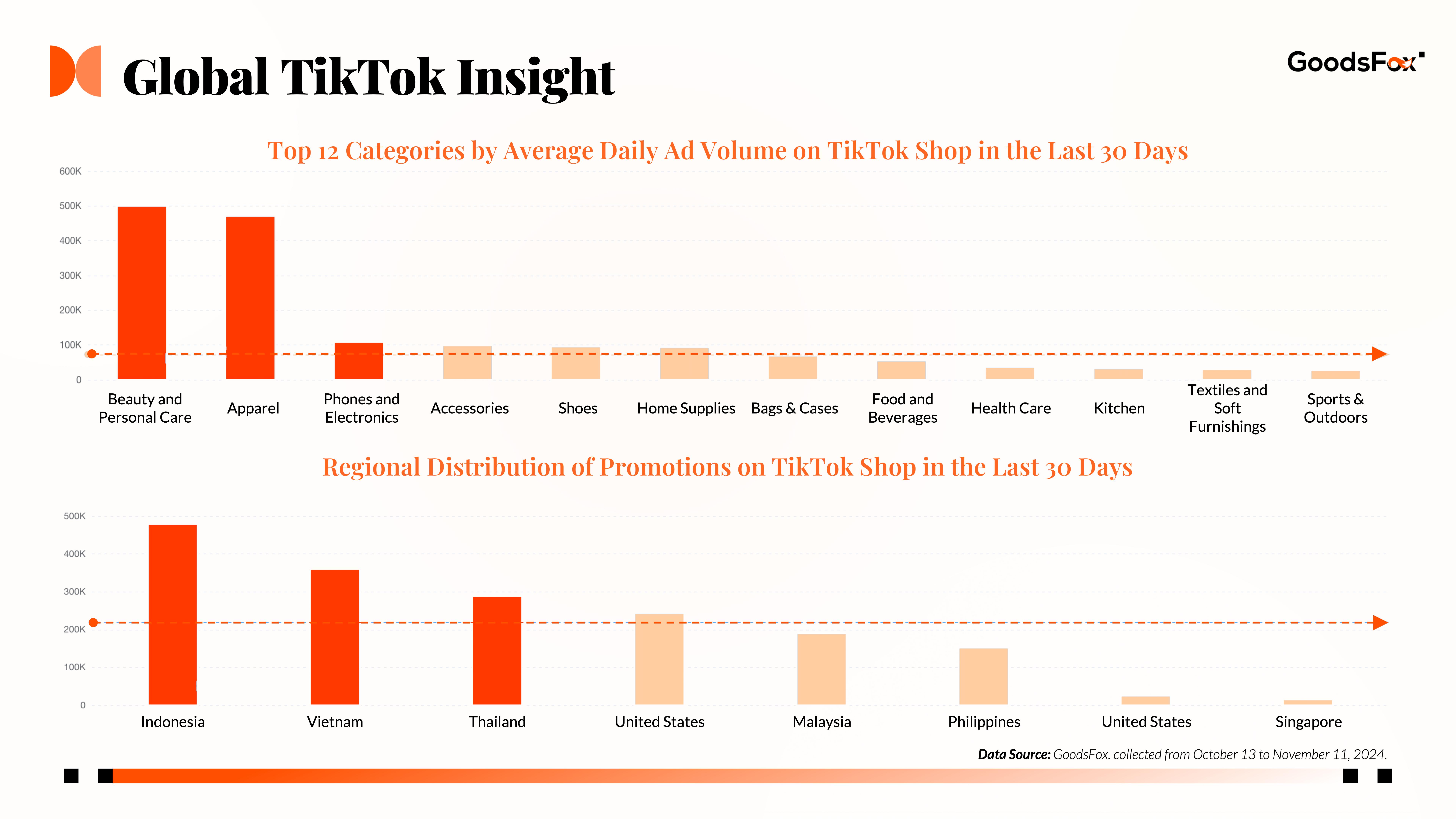

TikTok Shop’s 2024 Black Friday promotions run from November 14 to December 2. GoodsFox data reveals Beauty & Personal Care and Apparel dominate ad spend on TikTok Shop.

Young users on TikTok make quick buying decisions, favoring short videos for their flexibility and high-frequency updates.

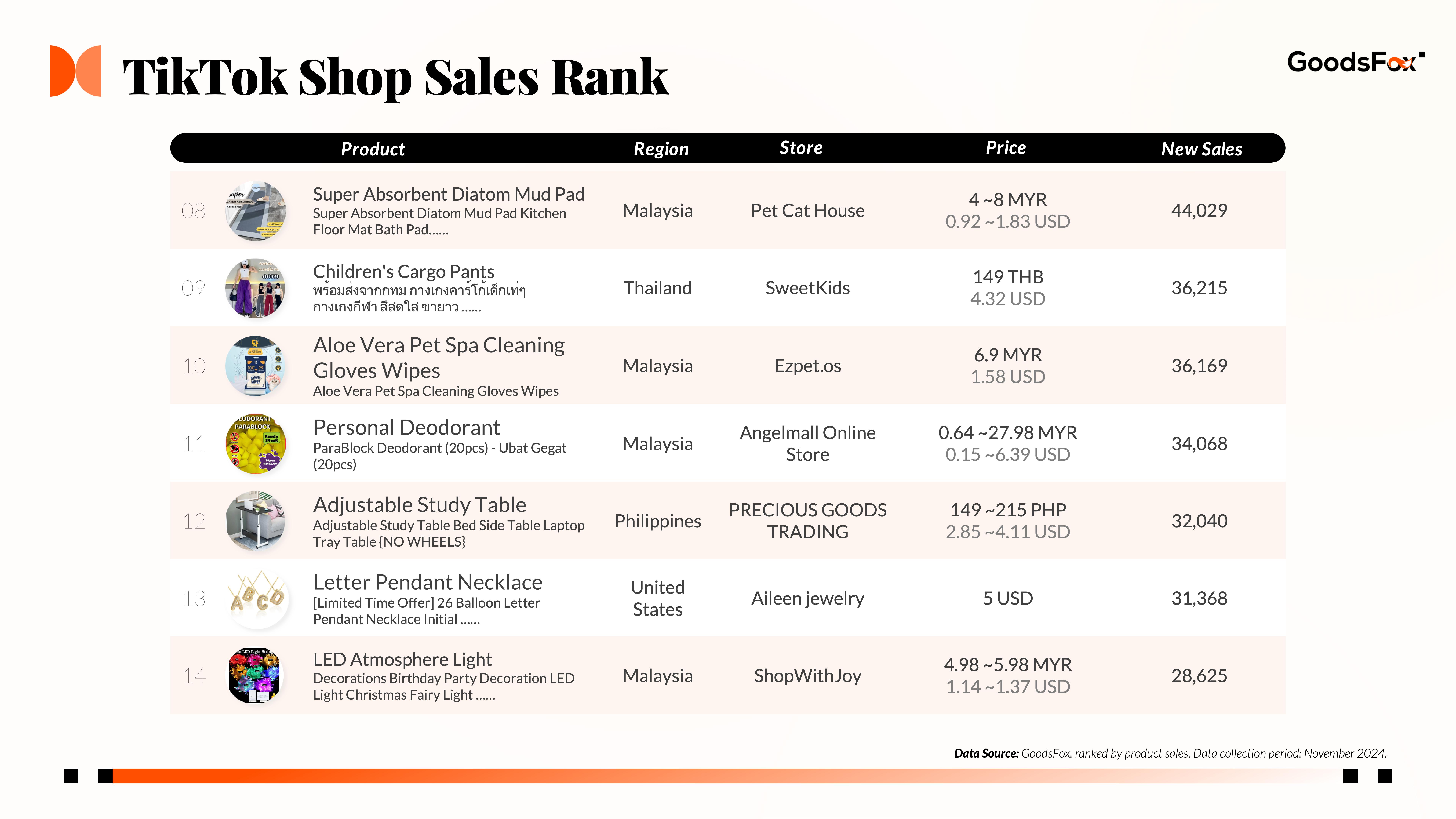

During the pre-sale period, ad volume in Indonesia, Vietnam, and Thailand led globally, showcasing Southeast Asia’s potential. However, the region’s hot-selling products are low-priced, requiring higher ad efficiency to optimize ROI.

Join our Discord community to connect with fellow TikTok and DTC brands for insights and discussions!