"CPM has doubled; at this rate, we'll be out of business."

July was a costly month for overseas advertising.

From Amazon Prime Day to TikTok Shop US promotions, TEMU Week, SHEIN Summer Sale, and Walmart Deals, the entire traffic market revolved around major sales events.

As a result, CPM surged across all sectors, including e-commerce, B2B, healthcare, and travel.

Now, with promotions winding down, traffic heat is cooling, but advertising costs remain high.

Key questions arise: How to adjust budgets, what ad creatives to use, and how to manage platform pacing?

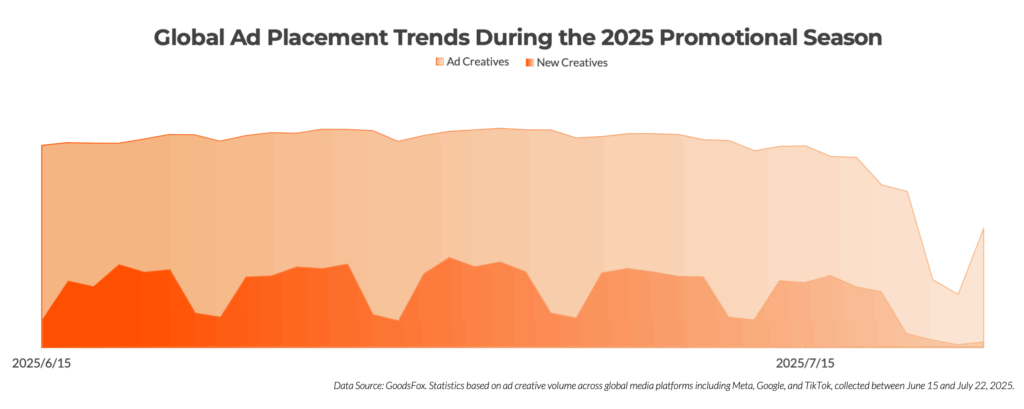

We analyzed ad spend data from June to the present, comparing e-commerce and non-e-commerce trends. The clear conclusion: overall ad volume is down, new ad creative updates are slowing, and top sites are reducing spend.

A strategic re-evaluation is crucial before returning to regular advertising.

Ad Spend Slowdown: More Than Just Cooling

Advertisers are rapidly hitting the brakes on ad creative volume.

GoodsFox data shows that in early July, ad creatives on 10 major platforms (Facebook, Instagram, Google, TikTok, etc.) peaked at over 10 million. By late July, this dropped to 6.66 million, a 33% decline month-over-month.

The proportion of "new ad creatives" also fell. During peak season, new ad creatives made up 32% of total, but recently, it hit a low of 10%.

Extended promotion cycles are a key factor.

Amazon Prime Day, for instance, expanded to four days this year. TikTok, TEMU, and SHEIN also maintained long promotional periods.

To adapt, merchants typically use phased advertising: pre-heating, main promotion, and final push.

Once sales end, these event-specific ad creatives are pulled. Platform differences are also significant.

TikTok's new ad creative share was nearly 30% during the sales, but it fell to 17.5% in late July.

Its fast-paced feed and short creative lifespan demand frequent ad creative updates from advertisers.

In contrast, Meta and Google show more stable trends. Some independent sites choose to reduce frequency and maintain steady campaigns, while others leverage the opportunity for mid-to-late funnel ads (e.g., re-engagement, retargeting).

Who is Gaining Momentum?

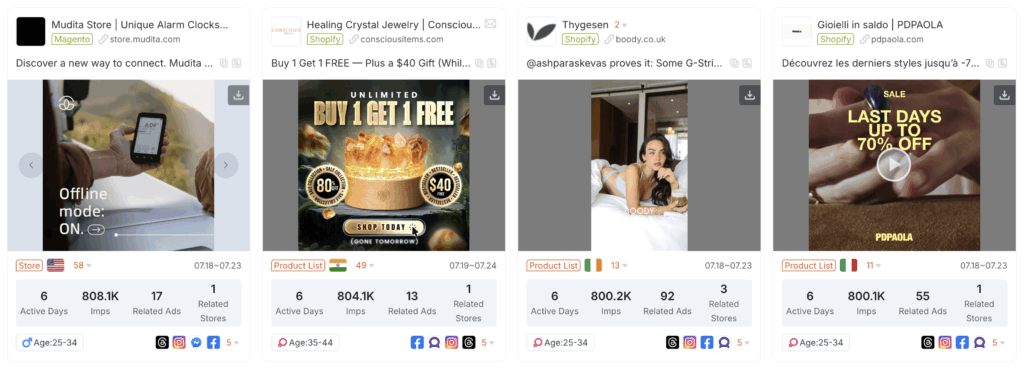

During the sales, e-commerce sites, especially DTC brands, ramped up ad spending the most.

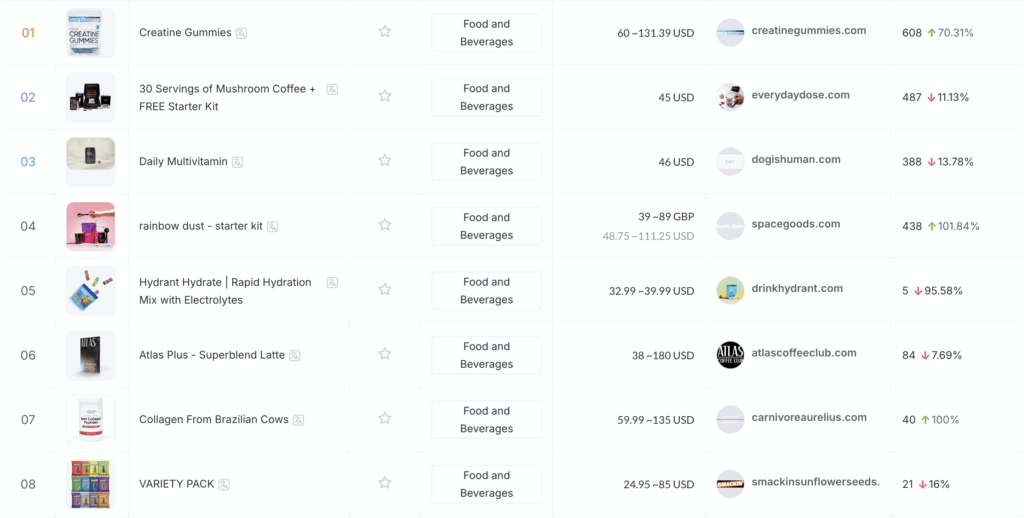

According to GoodsFox, the top five ad-spending categories were: Beauty & Personal Care, Apparel, Health, Jewelry & Derivatives, and Food & Beverages.

Beauty & Personal Care and Apparel consistently lead due to moderate price points, favorable logistics, and strong promotional conversion.

Over recent quarters, Health and Jewelry ad spend has steadily increased (refer to GoodsFox historical reports).

These categories share common traits: high-profit margins, clear demand, and strong content adaptability.

For example, functional products (stress relief, sleep aids, weight loss) easily create "pain point hooks" and resonate with users, leading to shorter conversion paths.

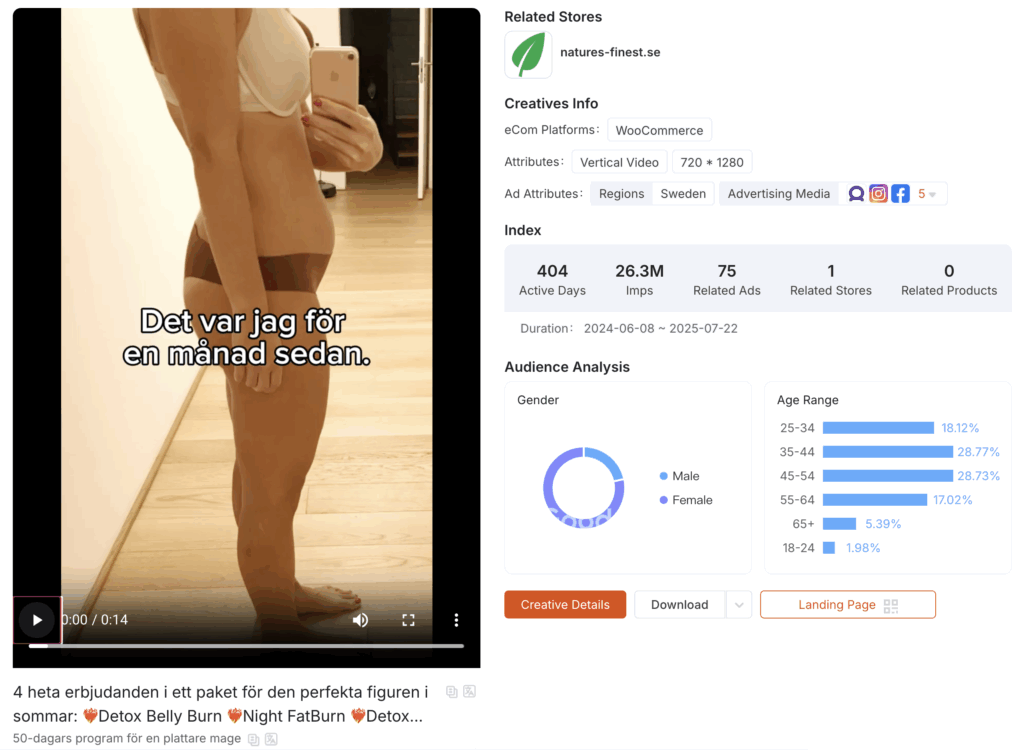

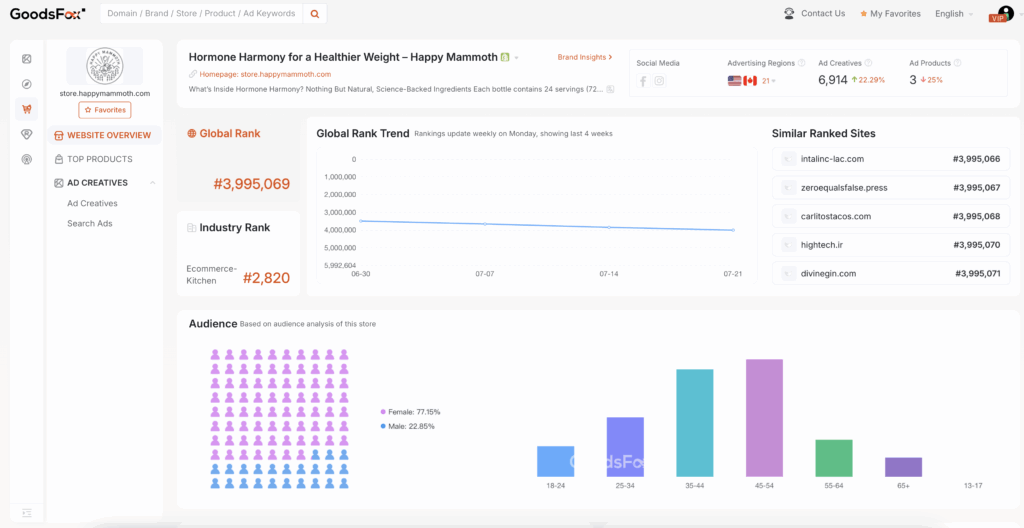

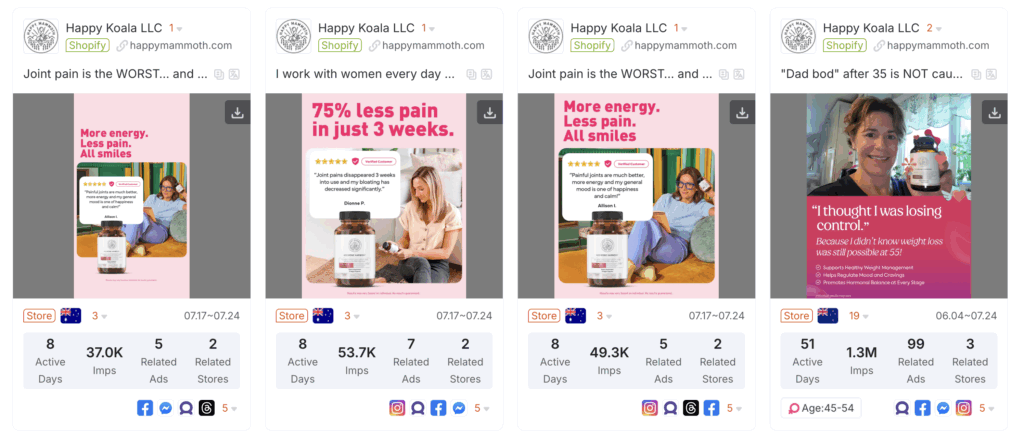

These categories now lead in ad volume. Health brands like Happy Mammoth use established strategies and content templates, with high ad density and rapid ad creative iteration.

Recent ad creatives of Happy Mammoth. Source: GoodsFox

A validated market and imitable models mean faster consumer education and shorter ad creative fatigue cycles. Brands need stronger differentiation to stand out.

Food and beverages previously had lower ad spend due to short shelf life, fragmented SKUs, and high logistics demands, making large-scale DTC expansion difficult.

However, this category saw increased spending, possibly due to improved overseas local e-commerce capabilities. Cold chain warehouses, pre-warehouses, and logistics networks in Europe and America have accelerated in the past two years, especially amid "tariff wars".

Top Products of food and beverages. Source: GoodsFox

Richard Liu's (JD.com) recent perspective on international business is notable:

"I firmly believe cross-border e-commerce is unsustainable long-term... Moreover, cross-border e-commerce can only sell cheap goods, which severely impacts our national image."

In other words, if users can get same-day delivery locally, why wait three weeks for a cheaper price?

However, Sports & Outdoors is a standout category.

June to August is peak summer travel in Europe and America, with Europeans favoring "low-consumption, long-duration" outdoor activities like camping, hiking, and RVing.

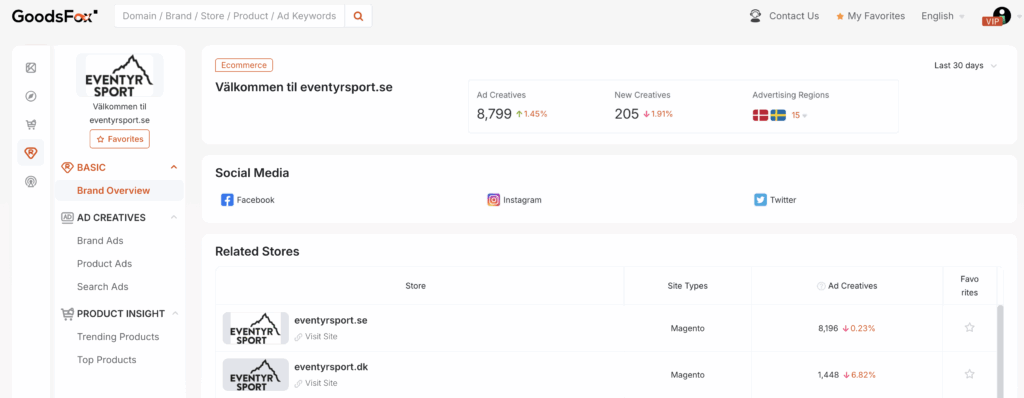

Brands like EVENTYR SPORT and Berger Camping capitalized on this trend, focusing on outdoor gear, apparel, sun protection, and insect repellent products.

Another crucial event: Back-to-School Season.

In the US and Europe, it typically runs from late July to early September (varying by state/school district). Ad campaigns should launch 2-3 weeks prior, covering backpacks, apparel, stationery, and electronics.

The window for launching back-to-school ads is now.

How to Optimize Ad Spend for Profitability?

In periods of high costs and low conversion, how can you adjust your strategy to minimize losses and missteps?

First, prioritize pacing.

After major sales, your rhythm should be content-driven, not budget-driven. During periods without clear promotions, consider controlling frequency and returning to regular ad intensity.

Second, adjust your targeting focus.

After event-specific ad creatives are pulled, re-evaluate audiences and ad creatives. Which retained audiences are worth re-targeting? Which content remains effective? Focus your budget on the lingering effects of the cold start phase, as it's more cost-effective than blindly acquiring new customers.

Third, adapt to platform rhythms.

TikTok's conversion window shortens fastest, and ad creatives are consumed quickly. Consider lowering budgets for content testing. Meta's competition is easing, making it suitable for gradually rebuilding brand exposure. Google search demand is generally cooling, so a defensive ad strategy is suitable for stabilizing your baseline in the short term.

The current focus isn't on ad spend volume, but on allocation and efficiency.