2025.3.21 GoodsFox Daily E-commerce News: Temu Shifts from Full to Hybrid Logistics Amid T86 Policy Concerns

- Music Festival Earplugs Drive Multi-Million GMV

- Philippines Proposes 12% VAT on E-Commerce Sales

- Temu Shifts from Full to Hybrid Logistics Amid T86 Policy Concerns

- Skincare and Serum Searches Surge on E-Commerce Platforms

- U.S. Customs ACE System Update: $800 Exemption Extension?

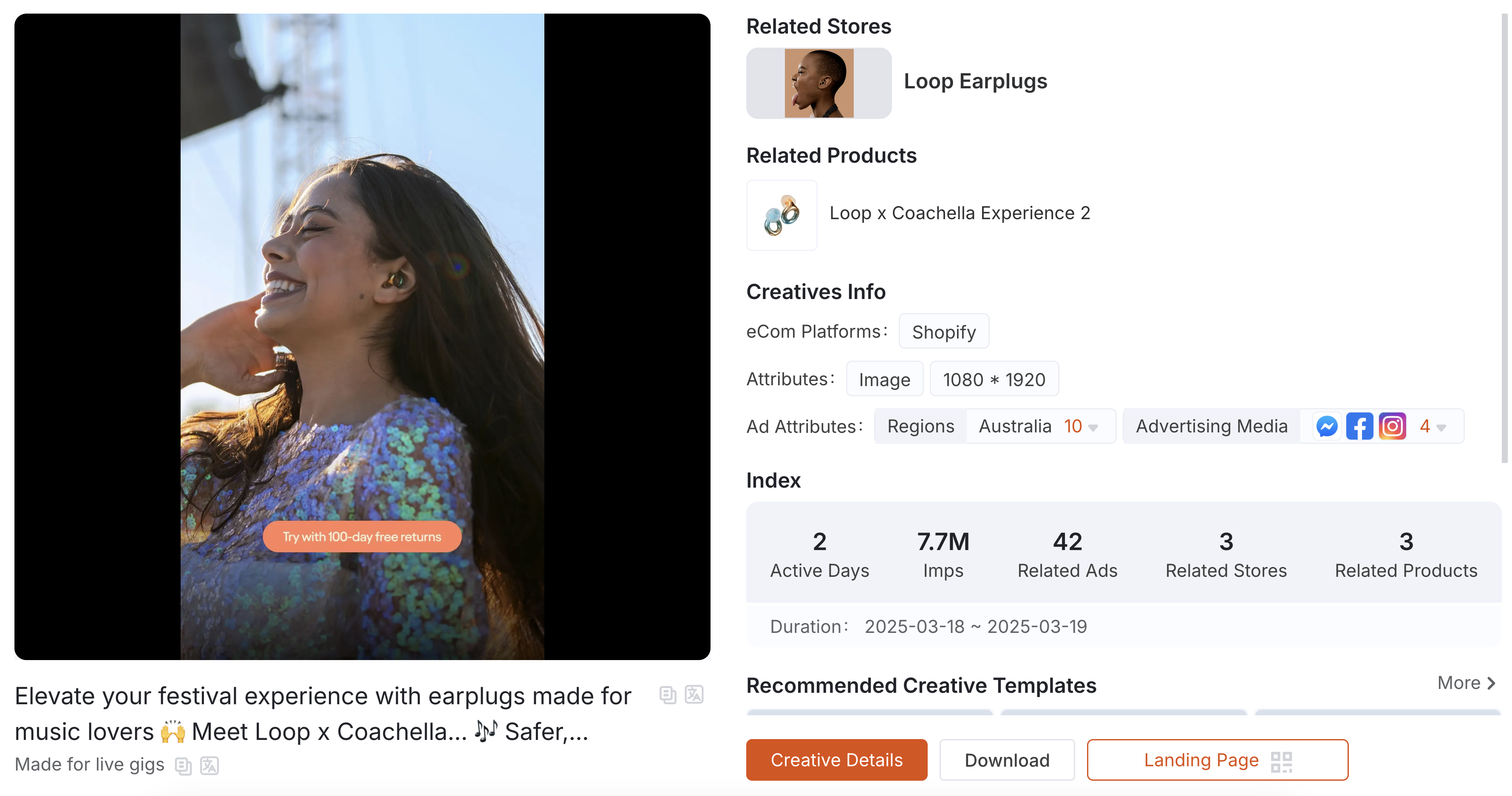

1. Music Festival Earplugs Drive Multi-Million GMV

GoodsFox data shows that Loop Earplugs has launched a Coachella-themed edition, targeting music festival enthusiasts. Over the past week, ad placements surged by more than 100 creatives.

Priced at $37.19, these earplugs filter out background noise while preserving music clarity. Their anti-slip design ensures stability during intense dancing and crowded environments. Women make up nearly 70% of buyers, as the product is tailored for smaller ear canals.

The brand prioritizes advertising in music festival hotspots like the U.S., Canada, the U.K., and Australia. They leverage "aftermovie-style" creatives, showcasing all-day comfort from daytime to night concerts. With the global music festival market exceeding $40 billion, hearing protection wearables may become a new niche in smart accessories.

Source: GoodsFox

2. Philippines Proposes 12% VAT on E-Commerce Sales

The Philippine Retailers Association (PRA) has urged the government to impose a 12% VAT on online goods sold through platforms like TikTok. The move aims to eliminate the tax disparity between e-commerce sellers and brick-and-mortar stores.

Currently, physical retailers must pay VAT, while many online sellers are exempt, creating an uneven playing field. The government is also drafting legislation to ensure that all digital service providers, including e-commerce platforms, comply with local tax regulations.

3. Temu Shifts from Full to Hybrid Logistics Amid T86 Policy Concerns

In response to potential T86 customs clearance adjustments, Temu is accelerating its shift from a fully managed to a semi-managed logistics model. By April, all high-demand products will transition.

Under this model, sellers will handle their own shipping, increasing their financial and logistical responsibilities. To ease the transition, Temu has introduced bundled listings (linking full-managed and semi-managed products) and offers traffic boosts for semi-managed products. However, sellers must carefully manage logistics costs and avoid violations such as using fake shipping labels, which could lead to penalties.

4. Skincare and Serum Searches Surge on E-Commerce Platforms

A study by Front Row reveals Amazon’s growing dominance in skincare sales, with a 26% YoY increase from 2023 to 2024. Meanwhile, the beauty category as a whole grew 17%.

GoodsFox data shows that in the past seven days (March 14-20), "serum" was among the top-searched beauty keywords. The term "skincare" has seen a 339% increase in Amazon searches over two years, reaching 18 million queries in 2024. This trend underscores the rise of the "skincare economy", reshaping global beauty consumption patterns.

5. U.S. Customs ACE System Update: $800 Exemption Extension?

On March 17, the U.S. Customs and Border Protection (CBP) released an update on the ACE system deployment, scheduled for September 2025.

Key changes include:

✅ A new "estimated arrival time" field

✅ Alerts for daily imports exceeding the $800 de minimis threshold

✅ Stricter monitoring of duty-exempt shipments

While some sellers believe this signals a possible extension of the $800 tax exemption until September, others warn that the policy could still be revoked at any time. With ongoing tariff uncertainties, cross-border sellers should proactively plan for regulatory changes.

LinkedIn: https://www.linkedin.com/in/goodsfox-helper-365450282/