Insights from the 2024 H1 Global Marketing Data for DTC Brands.

The 2024 H1 data on global expansion and DTC brand analysis reveals some new trends:

- Brands focused on niche markets are striving to break through product category limitations.

- Emerging markets like India and Malaysia are witnessing intense competition among leading brands.

- Some brands are taking unconventional marketing approaches to significantly improve their return on ad spend (ROAS).

In this article, we’ll explore key findings from the GoodsFox & SHOPLINE 「 2024 H1 DTC Brands Global Marketing Report 」. We’ll cover three main sections:

- Advertising product performance and marketing strategies.

- Case studies of trending products.

- Case studies of SHOPLINE DTC brands.

This analysis aims to help brands understand the current competitive landscape and stay ahead in the global e-commerce market.

1. Advertising Product Performance And Marketing Strategies.

Building upon the insights we shared in our [ Unlocking Growth: Expert Analysis of DTC Marketing Strategies of 2024 ] post, today we're taking a deeper dive.

1.1 Global Advertising Trends

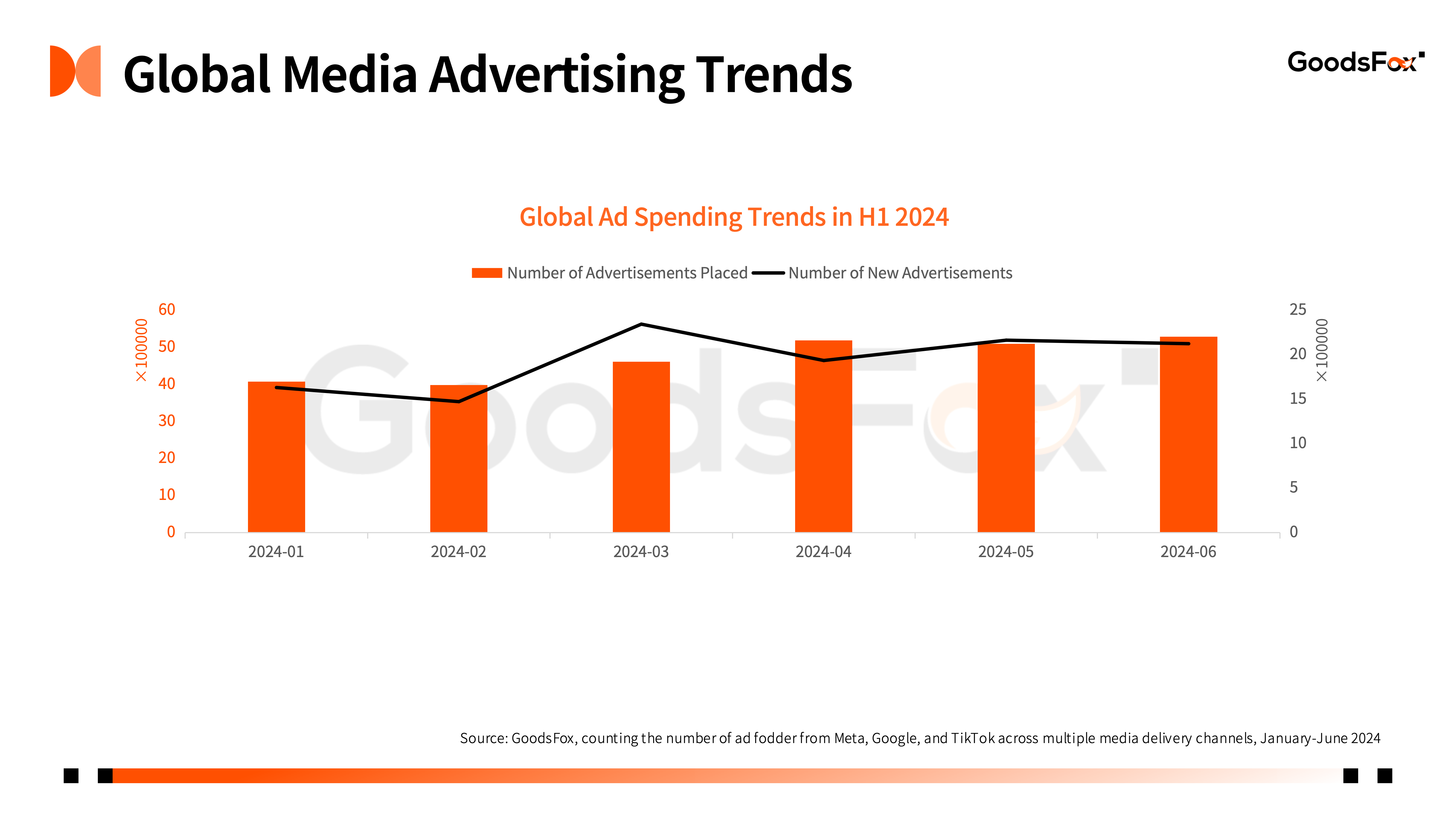

New ad materials in Q2 signal market activity. A clear growth trend in global e-commerce ads marks 2024's first half. March sees a rise in ads with new products and spring promotions. April peaks for Mid-Year Promotion prep.

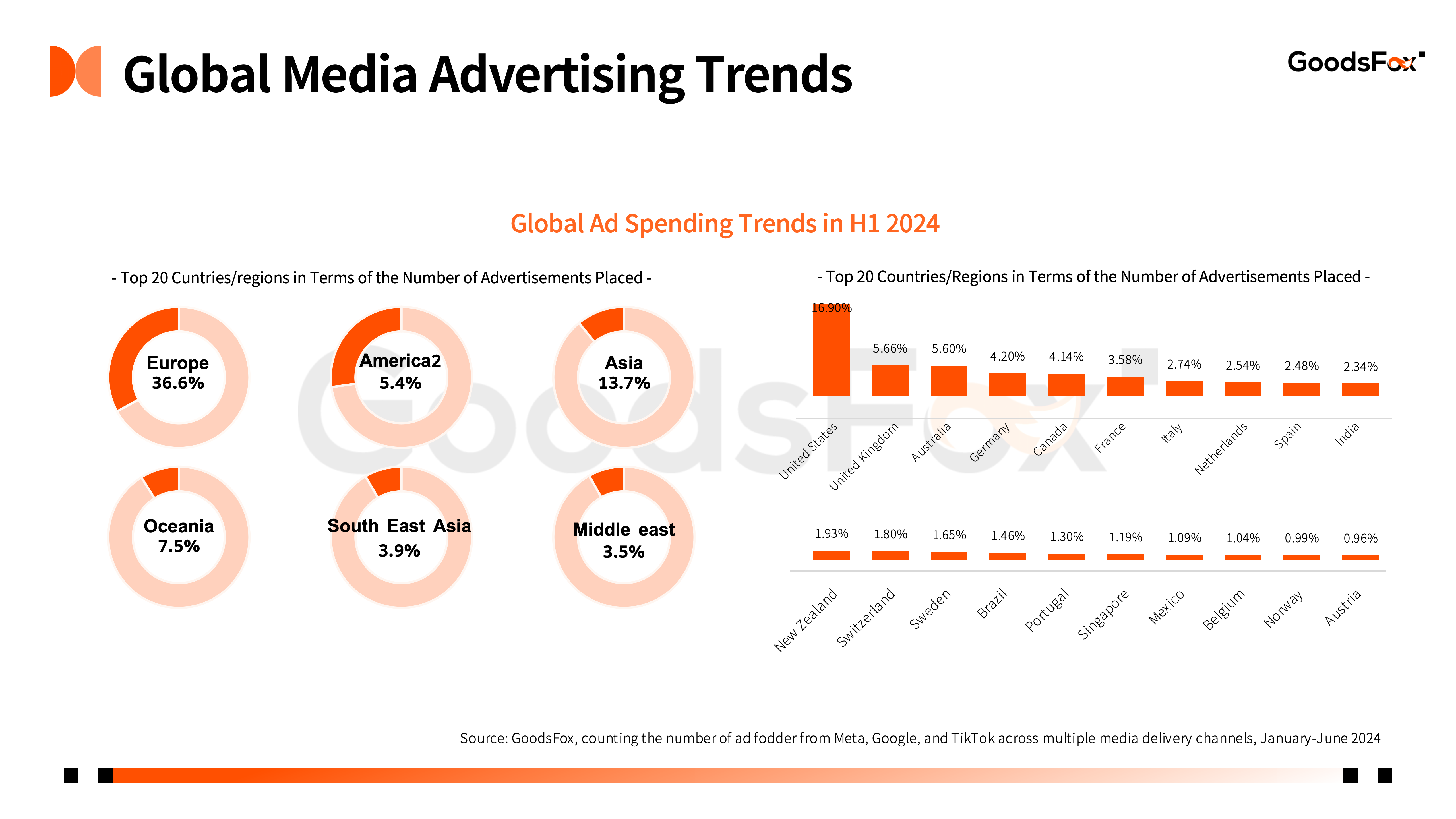

European and American markets lead ad spending. Over 60% of investments target these regions. Southeast Asia emerges, requiring localized strategies.

1.2 Global E-commerce Category Placement Weight

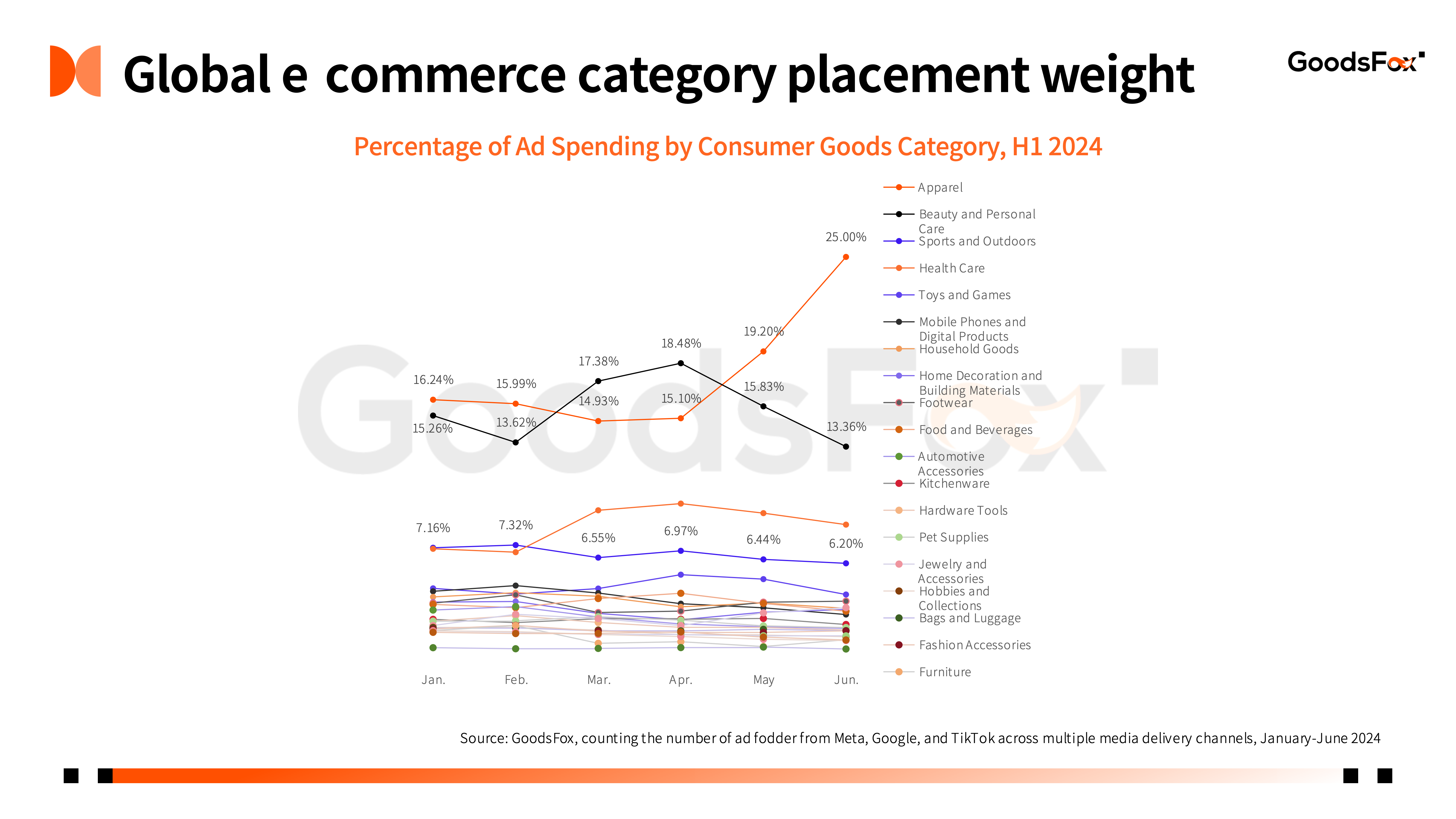

Clothing and beauty ads dominate. Seasonal demand and market competition drive this trend. Independent station sellers must invest in seasonal changes for revenue.

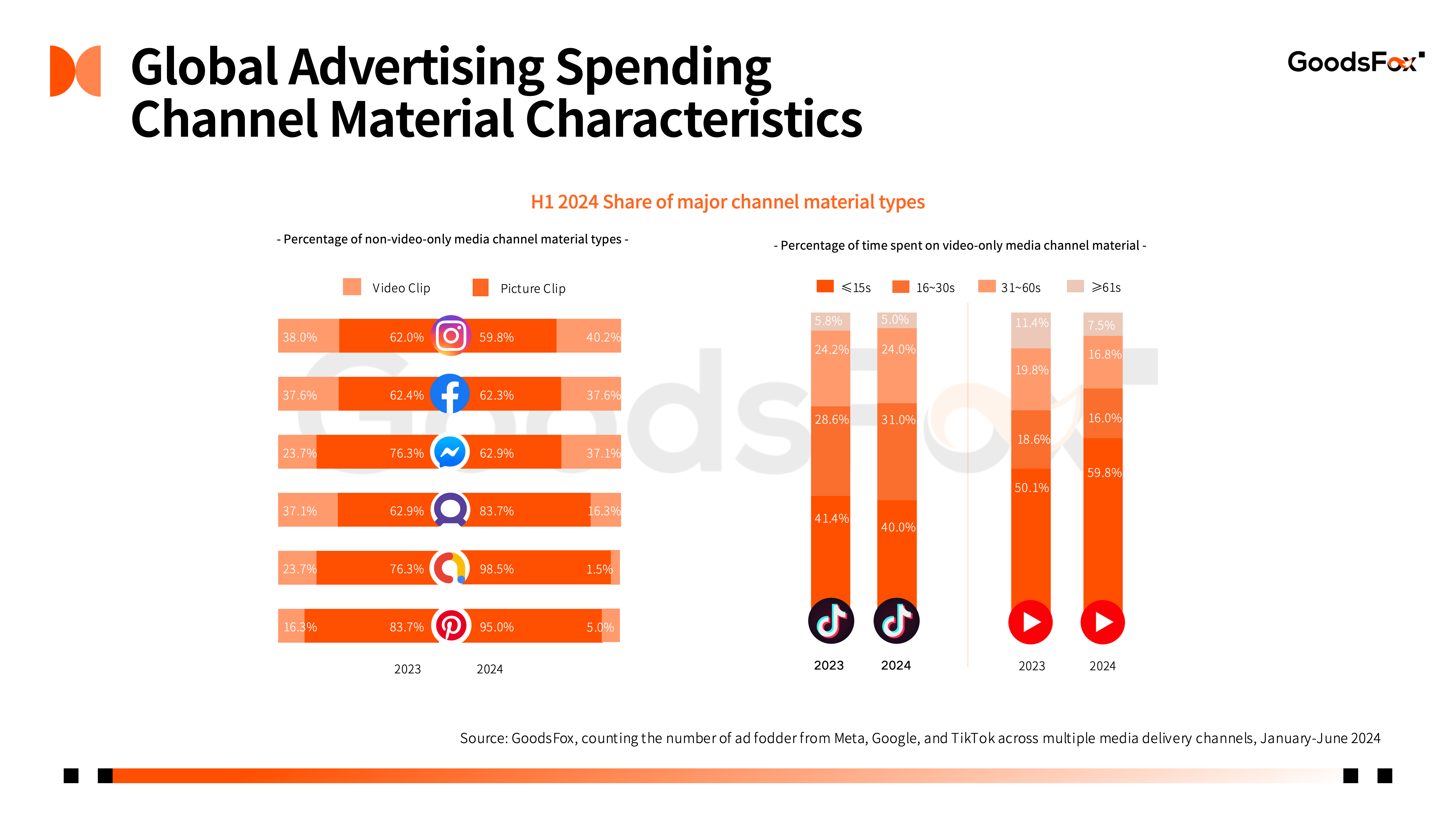

1.3 Global Advertising Spending Channel Material Charateristics

Clothing and beauty ads dominate. Seasonal demand and market competition drive this trend. Independent station sellers must invest in seasonal changes for revenue.

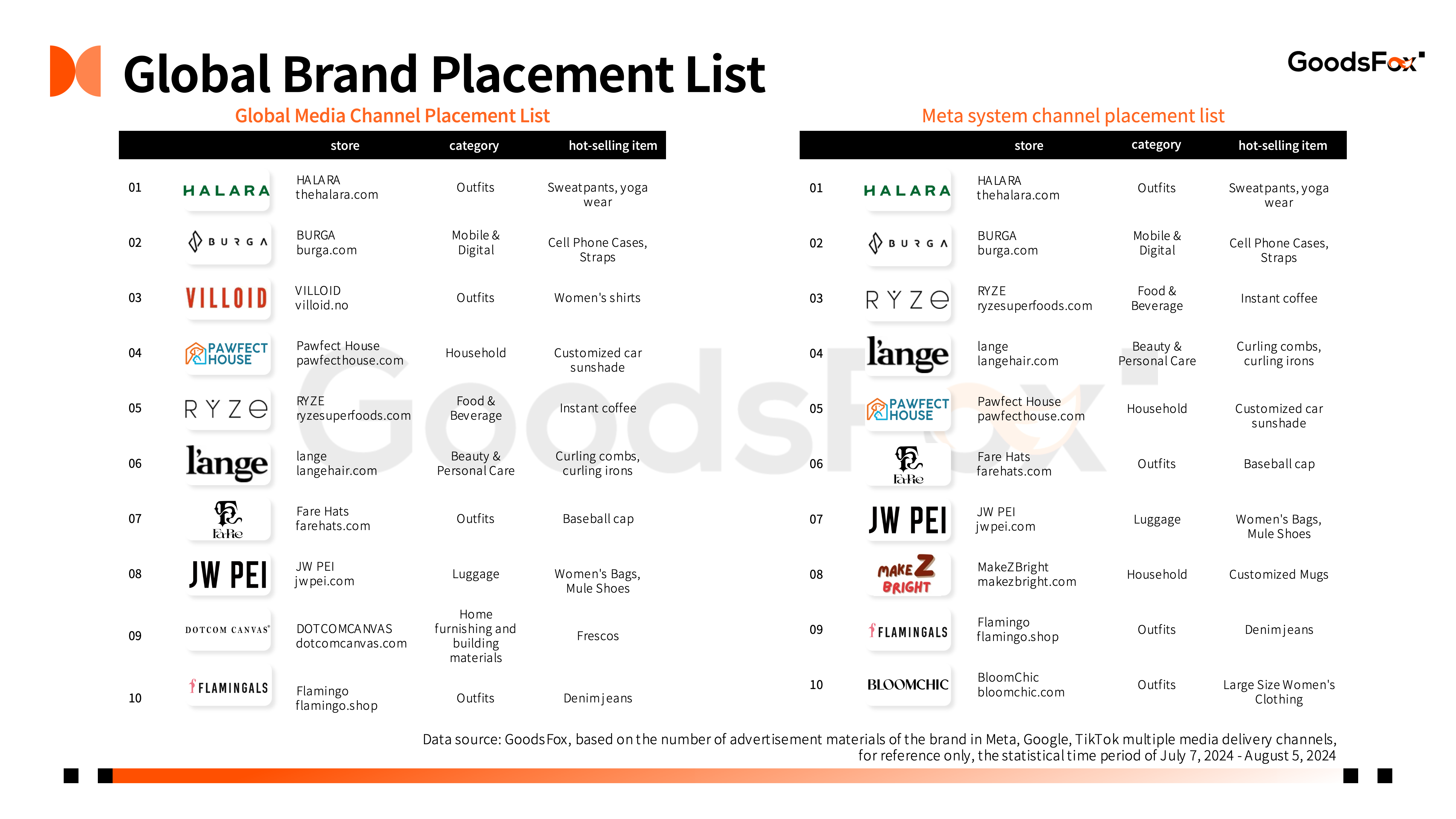

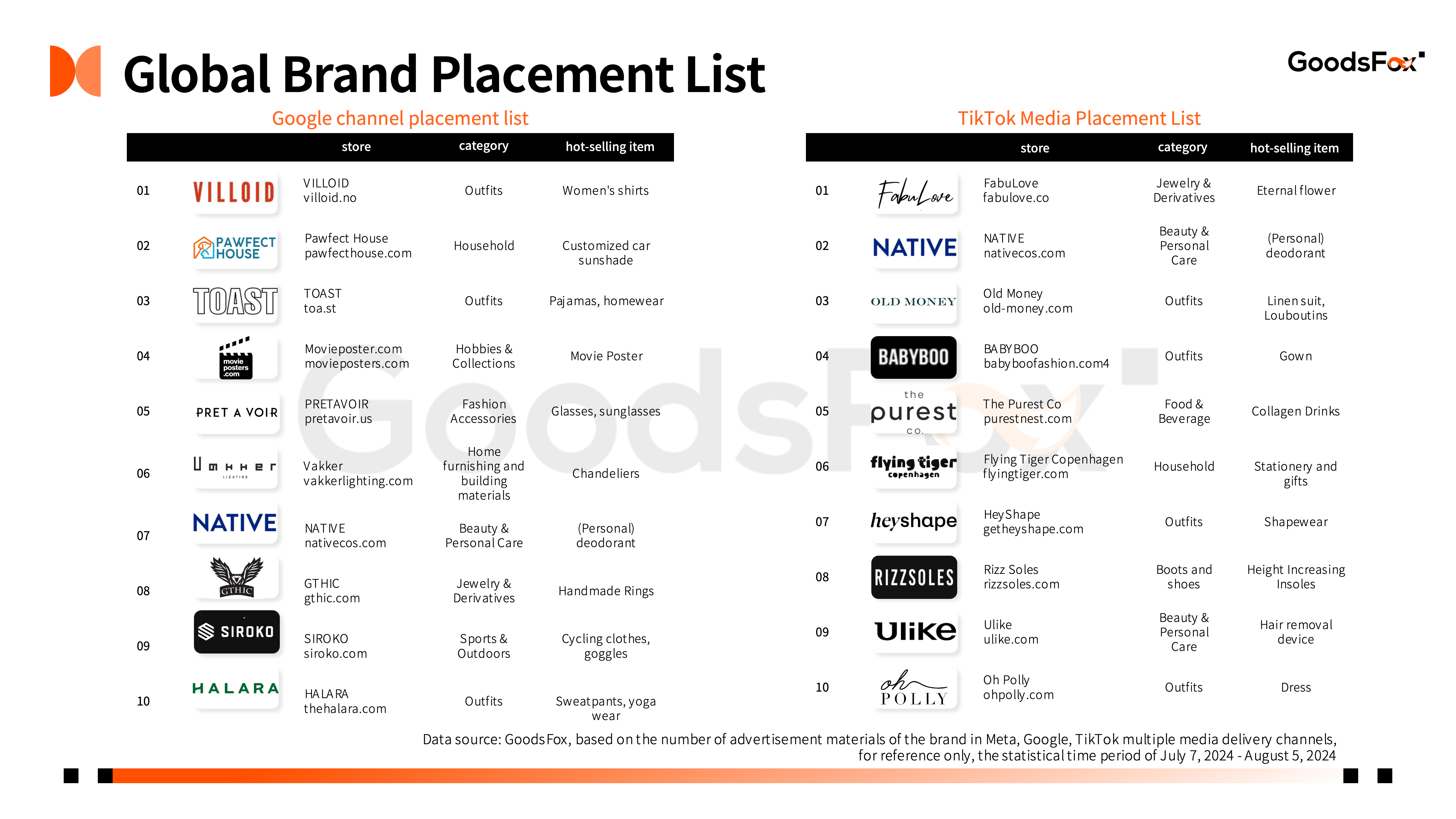

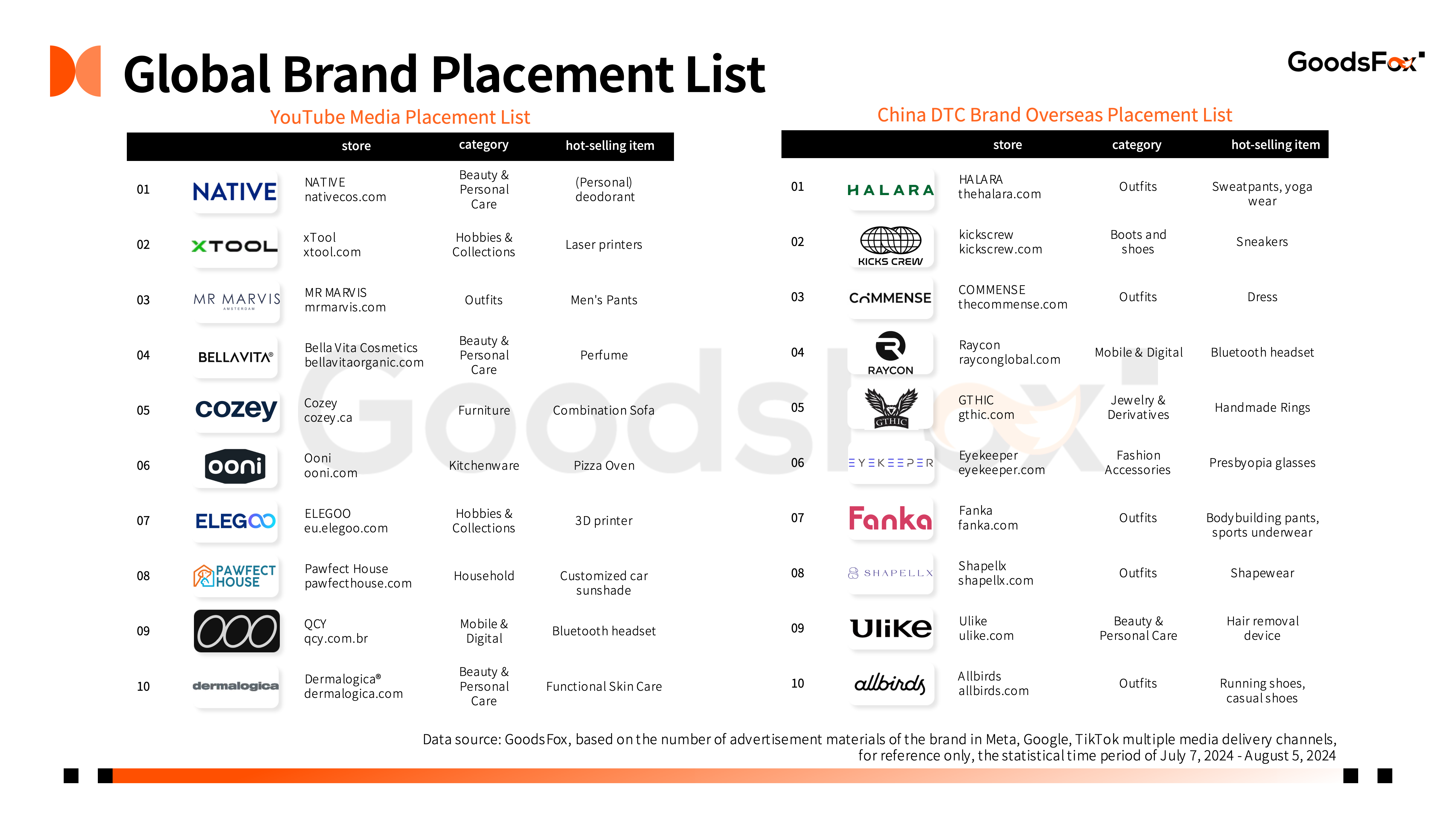

1.4 Global DTC Brands Placement List

Top DTC brands diversify, breaking through segmentation. Cell phones and digital, household, food and beverage, beauty and personal care, etc., showing a diversified consumption trend. Consumer demand for global e-commerce is no longer limited to traditional popular categories, and there are market opportunities in all areas.

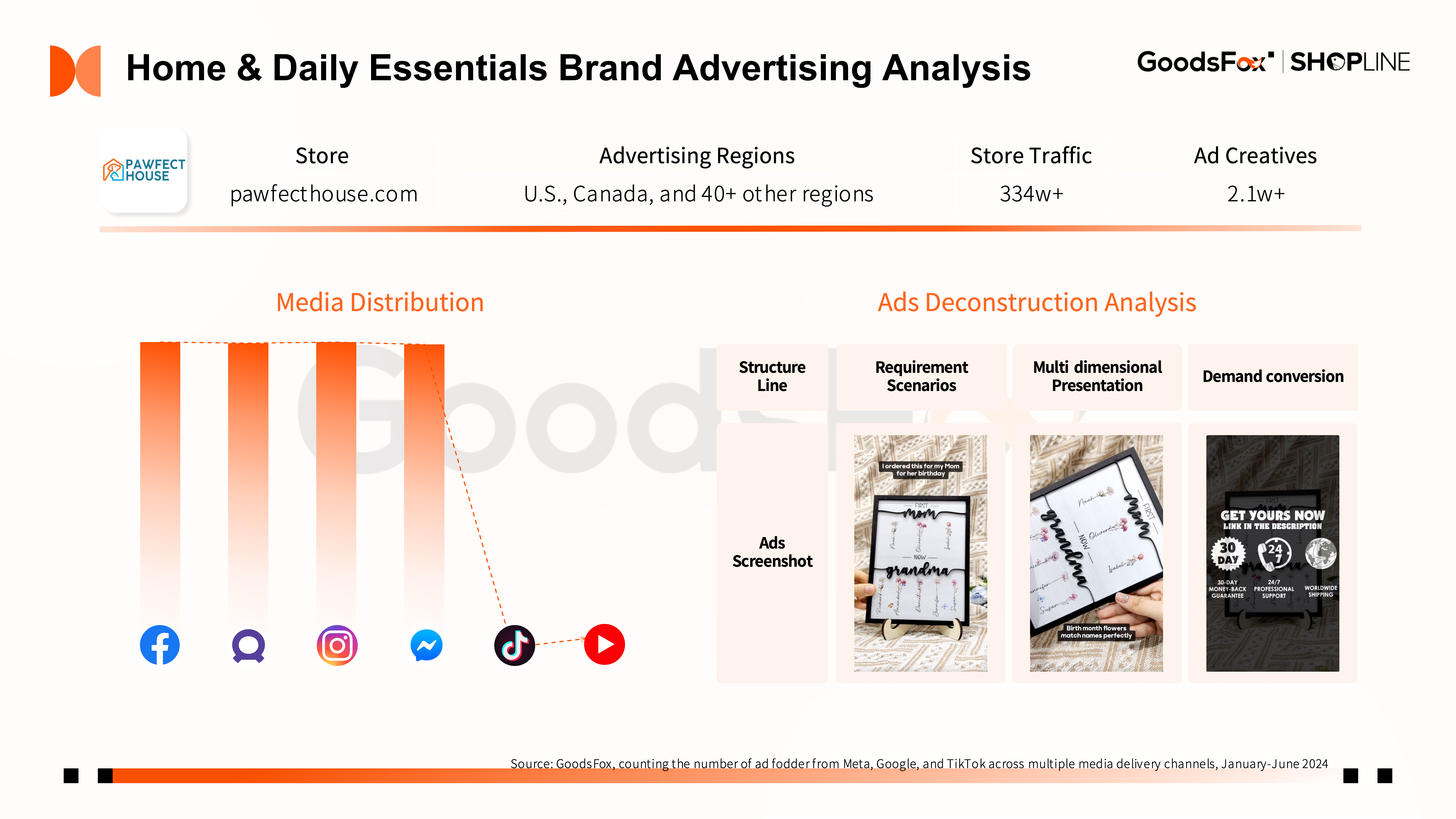

The apparel category continues to dominate the advertising landscape, with a growing trend towards segmentation. This segmentation strategy is not only applicable to the apparel category, but DTC brands in other sectors have also demonstrated similar market positioning, such as Pawfect House, which focuses on customized products, lange, which is dedicated to curly hair care, and DOTCOMCANVAS, which focuses on the decorative mural market. These brands have found a way to differentiate themselves from the competition by pinpointing their market segments.

Focusing on market segments helps build brand image, but for brands to realize long-term development, they need to break through category limitations and expand broader market space through brand influence.

The apparel and footwear category has a strong performance in overseas placement, occupying the top 3 positions of the head placement brands.

From the perspective of category focus, the "beauty economy" is particularly prominent, with products such as bodybuilding pants, shapewear, and hair removal devices.

At the same time, new categories are also emerging in the international market. More and more domestic FMCG brands are going to the sea to explore the gold and have achieved remarkable results.

"Made in China" expands globally.

The data presented above is sourced from GoodsFox, which tracks the number of advertising materials across various media channels including Meta, Google, and TikTok from January to June 2024.

2. Case Studies Of Trending Product

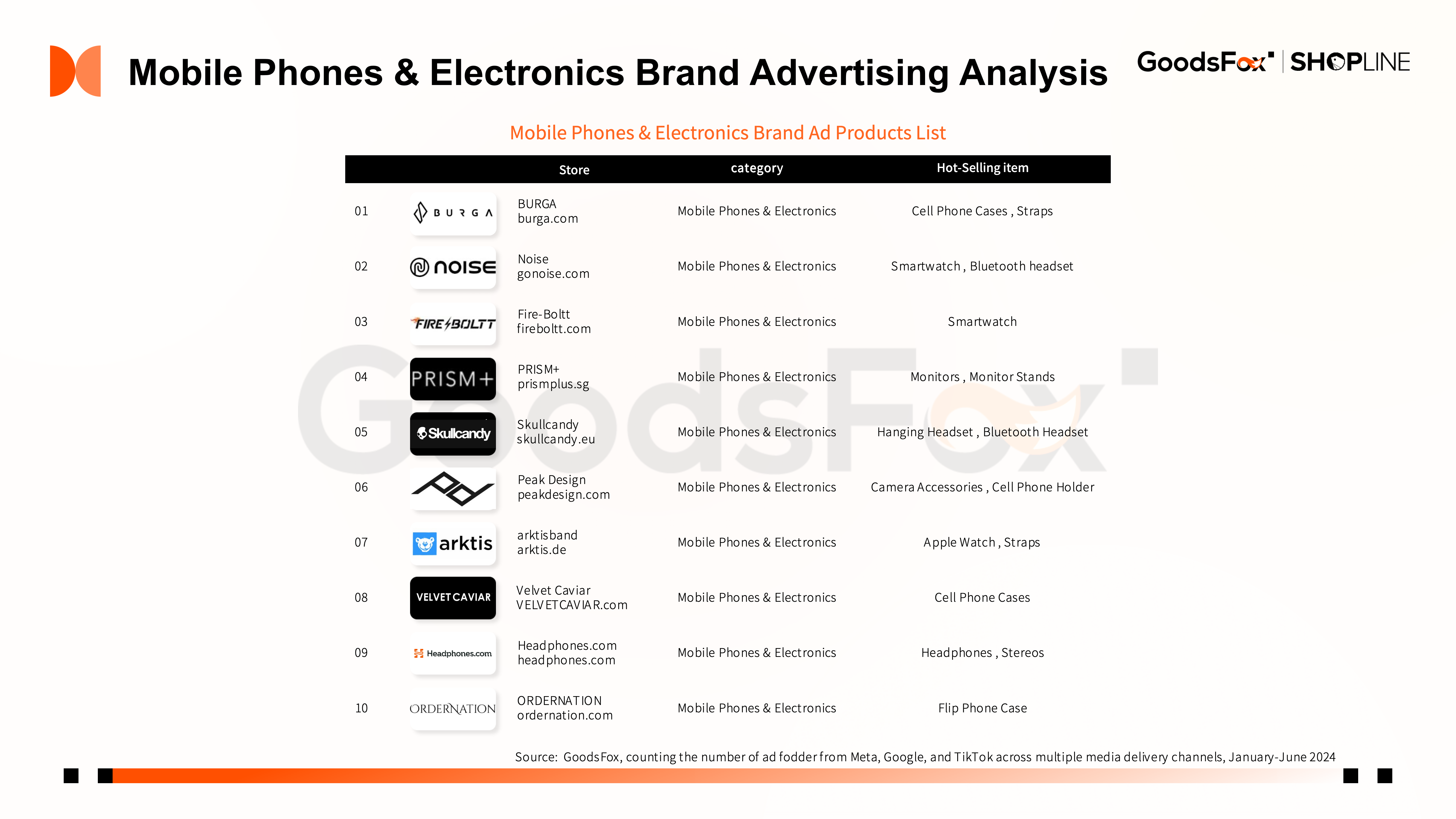

2.1 Mobile Phones & Electronics Brand Advertising Analysis

Mobile phone and electronics brands are striving to balance aesthetics with functionality. For instance, brands like BURGA and Velvet Caviar have transformed phone cases into fashion accessories while maintaining durability and protection. On the other hand, OrderNation, more functionally focused, is beginning to address the aesthetic preferences of its customers.

Brands with global expansion strategies typically target high-end markets, aiming for fashion-forward consumers and professionals. Skullcandy and Peak Design serve these niches with precision. Meanwhile, brands like Noise, Fire-Boltt, and OrderNation dominate the budget segment, offering affordable alternatives. Effective market positioning helps brands meet diverse consumer needs, ensuring a strong presence in the competitive landscape.

In today’s competitive environment, strong production capabilities alone aren’t enough. Building brand recognition and achieving cultural relevance requires time and strategic effort. Brands entering high-end markets such as Europe and North America must understand local design standards and consumer preferences. Proper localization is essential for success. In emerging markets like Pakistan and India, targeting accessories for popular brands like Samsung and OPPO—similar to OrderNation’s approach—can lead to market dominance.

In the Mobile Phones & Electronics category, the contrast between global and localized marketing strategies is clear. Some brands, like India’s Noise and Fire-Boltt or Pakistan’s OrderNation, focus on local markets. Others, such as BURGA, Skullcandy, and Peak Design, have a broader global reach. These market differences heavily influence their marketing strategies.

Global brands like BURGA and Velvet Caviar concentrate on the high-end phone case market, sharing similar advertising product trends. They intensify their campaigns in March, April, and June, capitalizing on international holidays like Easter and regional events such as Spain’s Constitution Day and Sweden’s National Day. Velvet Caviar, for example, launched a limited-edition series in June, significantly boosting its ad visibility.

In contrast, local competitors like Noise and Fire-Boltt, which dominate India’s smartwatch market, display different advertising patterns. Data from GoodsFox shows that Noise reduced its advertising SKUs by over 50% in March and April, shifting focus from headphones to smartwatches. This strategic move likely aimed to test market reactions or reallocate resources in response to competitive pressures. By May, Noise resumed a more balanced strategy, promoting a range of trending products like Bluetooth earphones, smartwatches, and smart rings.

In a highly competitive market, instead of directly competing, it’s often more effective to shift focus. BURGA, for example, targets fashion-conscious markets like the U.S., Australia, France, and Germany, where consumers are willing to pay a premium for unique designs and high-quality products.

While phone cases are BURGA’s primary offering, its top-selling items in-store are the exclusive 8 Apple Watch bands. By targeting the overlapping customer base of Apple Watch and iPhone users, BURGA creates cross-selling opportunities. This strategic product expansion aligns with Apple’s design philosophy, allowing for more precise ad targeting and brand positioning.

After building brand recognition for its core products, BURGA shifts its marketing efforts to accessories and complementary items that enhance the value of the core product. This approach avoids direct competition and uncovers new demands, attracting different customer segments.

In India’s competitive smartwatch market, Noise and Fire-Boltt both offer affordable, feature-rich products, frequently alternating as market leaders. However, their strategies differ in focus. Noise invests in proprietary technology, prioritizing product depth, while Fire-Boltt emphasizes breadth with an aggressive pricing strategy.

Fire-Boltt rapidly introduces new models and leverages TikTok for an engaging ad strategy, making swift inroads into the market with low-cost, diverse options. Its focus is on reaching consumers in non-tier-one cities with a more entertaining and relatable approach.

Both Noise and Fire-Boltt extensively use influencer marketing in their campaigns, collaborating with key opinion leaders (KOLs) to drive brand awareness. However, their strategies differ in partner selection, content direction, and creativity.

Noise, with a focus on fashion and core features like health monitoring and fitness tracking, collaborates with trendy influencers and fitness experts. Their ad scripts emphasize product performance with data-driven insights, targeting urban consumers interested in style and wellness.

Fire-Boltt, targeting more practical consumers in rural India, partners with tech influencers like Nabeel Nawab, a YouTuber with over a million followers. Their ads highlight practicality and durability, often featuring scenario-based or extreme product demonstrations. To enhance its national presence, Fire-Boltt has also partnered with cricket legend Virat Kohli, tapping into the popularity of cricket and the IPL to build a strong cultural connection with consumers.

Despite intense competition, the growing smartphone market in emerging regions indicates significant potential for wearable products. Noise and Fire-Boltt’s distinct strategies offer valuable insights for Chinese DTC brands in the Mobile Phones & Electronics sector looking to expand globally.

In one product review video, renowned Indian tech YouTuber Nabeel Nawab endorses Fire-Boltt's smartwatch. The video demonstrates product usage scenarios, including hands-free calling in the car, highlighting its communication features. It also includes an extreme demonstration of the watch being rinsed with water, showcasing its waterproof capabilities.

2.2 Wellness Brand Advertising Analysis

The wellness industry is evolving, moving from elective demand to an essential need, especially in certain health demographics. This sector now covers a wide range, from preventive care to ongoing maintenance and improvement. Brands like The Hearing Co., known for affordable, basic hearing aids, have made these products accessible to those previously priced out of the market. Rising Indian brands such as The Good Bug and ZeroHarm are capitalizing on this shift, particularly as wellness products become more critical. However, challenges such as high R&D costs and market entry barriers remain significant hurdles.

The “Golden 3 Seconds” strategy in video ads—featuring 9 distinct user scenarios—immediately grabs attention by leveraging the visual impact and “social proof” from a crowd. By directly addressing consumers' pain points and emotionally connecting with them, these ads showcase product value in a way that resonates, fostering a sense of trust and anticipation in the brand's offerings.

Founded in 2022, The Good Bug has quickly established itself as a key player in the probiotic market. Previously dominated by Western brands, the wellness sector is now witnessing the rise of emerging competitors, signaling new market potential.

The Good Bug breaks away from traditional wellness market norms by educating consumers with simple, clear product names like "Weight Management" and "Gut Health." This strategy helps consumers easily understand the benefits, making the products more accessible.

In addition to standard probiotic supplements, The Good Bug tailors its offerings to specific consumer needs. Its product line targets areas such as women's health, children's health, and immune support. By focusing on personalization and customization, the brand positions itself uniquely in the market, quickly drawing in target consumers and distinguishing itself from competitors.

The Good Bug employs a two-pronged marketing approach that enhances both brand credibility and consumer trust. The brand collaborates with wellness KOLs (Key Opinion Leaders) for authoritative endorsements, while also featuring real user experiences to build emotional connections with its audience.

This dual strategy not only boosts ad authenticity but also sparks word-of-mouth recommendations. The combination of expert endorsements and user testimonials generates organic growth, encouraging user referrals and enhancing the brand’s reputation across both local and global markets.

2.3 Home & Daily Essentials Brand Advertising Analysis

In the Home & Daily Essentials category, five key brands are leading the way by offering personalized products that focus on emotional expression and home decor. As marketing events increase, the ad volume for customized products surges, highlighting their popularity as socially meaningful gifts.

DTC sellers are expanding their product lines by selecting multiple items that cater to various scenarios. This trend reflects the evolving demand in the home essentials market, where personalization and situational relevance play a key role in attracting consumers. Brands that follow these trends can offer products that align with consumer tastes and lifestyles, driving greater engagement and sales.

Ads for customized products often feature spoken-word videos that focus on emotion, usage scenarios, and the personal touch. These ads are cost-effective, easy to replicate, and typically rolled out during major marketing events for maximum return on investment (ROI). By tapping into the emotional connection of personalization, brands can enhance their appeal and strengthen customer loyalty.

The data presented above is sourced from GoodsFox, which tracks the number of advertising materials across various media channels including Meta, Google, and TikTok from January to June 2024.

3.Case studies of SHOPLINE DTC brands.

3.1 Apparel Brand Case: Peter Jackson

Peter Jackson is a renowned Australian men’s apparel brand that recently underwent a personalized store reboot (2.0), resulting in a 16% increase in website conversions and a 52% surge in revenue. This transformation has significantly enhanced its business performance, digital operations, and overall market competitiveness.

Founded in Melbourne in 1948, Peter Jackson has over 70 years of experience in high-end custom men’s apparel. Known for its commitment to quality and innovative design, the brand has been a trailblazer in Australia’s men’s fashion market, continually revolutionizing the retail experience for men's clothing.

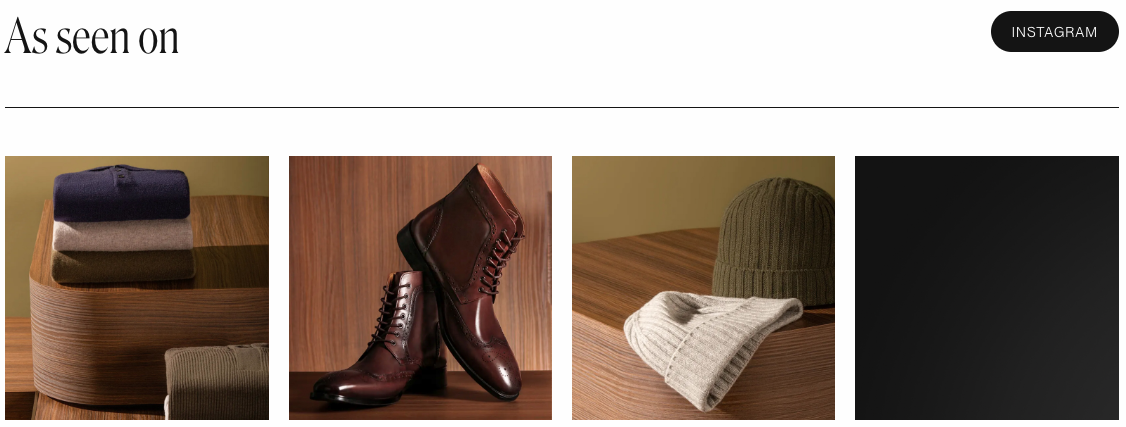

With 1 in 7 Australians shopping online daily, Peter Jackson recognized the need to upgrade its digital storefront. The brand chose SHOPLINE’s advanced product plugins, which align perfectly with its luxurious and stylish identity. These tools support a seamless product selection process, offering various themes and sizes, all of which contribute to an enhanced shopping experience and improved brand image online.

Peter Jackson primarily uses Facebook and Instagram for advertising, capturing attention with both videos and images. The brand prioritizes user-generated content platforms, which require minimal effort but effectively engage users.

By showcasing its clothing in a variety of scenarios—business casual, vacations, red carpets, outdoor events, sports occasions, and weddings—the brand uses hashtags to increase visibility. Regular updates of new styles keep the brand top-of-mind for consumers, driving direct traffic to the site and increasing purchase opportunities.

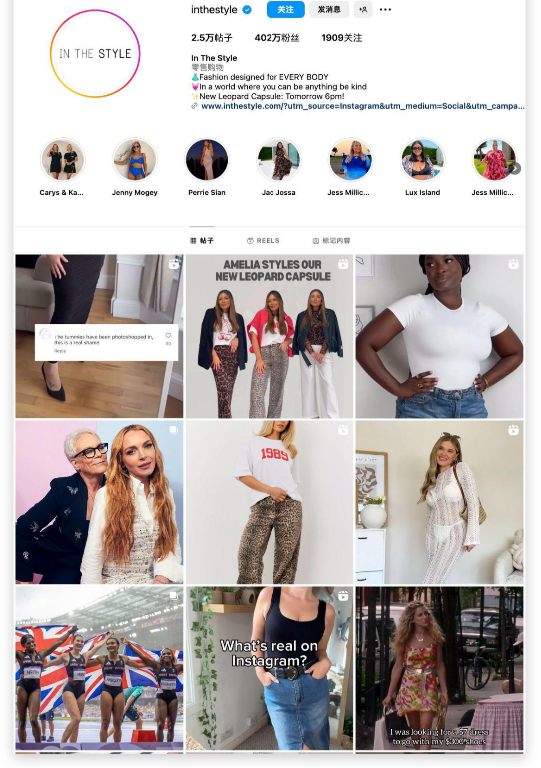

3.2 Apparel Brand Case: In The Style

In The Style, a global women’s fashion brand, advocates for inclusive fashion that allows everyone to express their unique style. After relocating its independent site, the brand saw its gross margin increase from 42% to 56%, expanding its global market share and boosting revenue.

In The Style is an online fashion brand known for making fashion accessible to everyone as a form of self-expression. With diverse options and a modern shopping experience on its independent site, the brand empowers consumers to embrace their personal style.

Unlike other platforms, Magento’s customization can be less intuitive and time-consuming. However, for a fast-fashion brand like In The Style, it’s crucial to stay on top of trends while delivering a modern, intuitive shopping experience. The brand’s independent site offers seamless customization, ensuring that every customer can confidently explore their fashion journey with ease.

This strategy has paid off: In The Style has seen a significant increase in profitability, with a 14% year-over-year growth in gross margin. Marketing performance has been stellar, with transaction revenue increasing by 138%, ROAS improving by 146%, and high-profit product revenue growing by 263%.

In The Style leverages platforms popular with young, overseas audiences, such as Instagram, Facebook, Twitter, and YouTube.

By partnering with influencers and celebrities, In The Style creates co-branded design collections that generate viral effects. For instance, collaborations with Molly-Mae Hague and Jacqueline Jossa have attracted fans and boosted sales.

With 4.02 million followers, Instagram serves as In The Style’s main platform for building brand communities. The brand regularly posts style inspiration from influencers, interactive videos, and diverse styling advice. Instagram Stories feature new product previews, behind-the-scenes content, and Q&A sessions with influencers, further engaging its audience.

In this open community, users share their outfits, provide product feedback, and offer suggestions, making Instagram a powerful tool for engagement and brand growth.